[ad_1]

The yen’s summer revival entered a fourth day as one of the biggest macro trades of the year continues to unwind.

Article content

(Bloomberg) — The yen’s summer revival entered a fourth day as one of the biggest macro trades of the year continues to unwind.

Article content

The Japanese currency climbed as much as 0.9% to just above 132 per dollar in a fourth day of gains Monday. Hedge funds are selling down dollar positions and increasingly buying the yen as a haven play, according to Asia-based currency traders who asked not to be named as they are not authorized to discuss client activity publicly.

Lowered expectations for Federal Reserve rate hikes have led to a rally in Treasuries, narrowing the yield gap that had opened up between the US and Japan that helped drive the yen to a 24-year low. That has weakened the argument behind one of the most prominent trades of the year — short the Japanese currency — and resulted in a more than 5% rebound from the yen’s mid-July low.

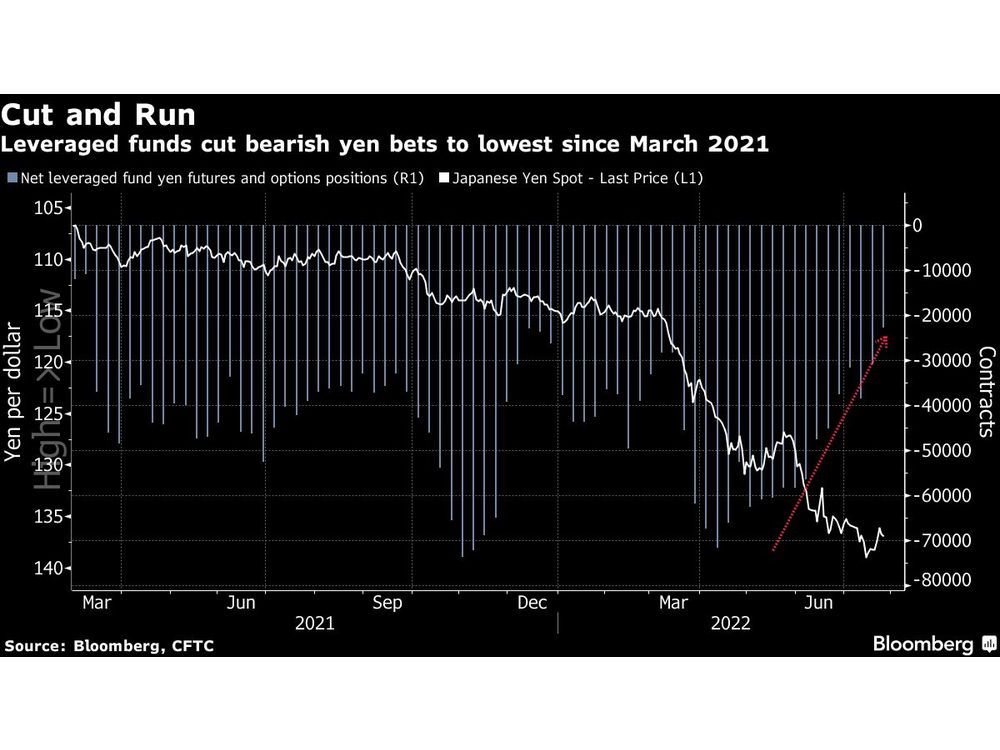

Leveraged funds have slashed net-short futures and options positions on the Japanese currency to the lowest since March 2021, according to the latest data from the Commodity Futures Trading Commission. Net bearish bets of around 23,000 contracts are now less than a third of their April peak.

Article content

“Clients have been heavy buyers of yen of late and continue to hold a positive yen stance,” wrote Pepperstone Group head of research Chris Weston in a note Monday.

Still, the currency remains the worst among Group-of-10 peers, down around 13% this year as the Bank of Japan keeps interest rates pinned to the floor even as the Fed hikes aggressively. Higher oil prices in energy-import heavy Japan and a blowout in the country’s trade deficit continue to weigh.

While the yen’s decline may be nearing its end, until markets get clarity on the view of the Fed, “there will be some turbulence,” said Maki Ogawa, head of financial market research at Sony Financial Group. “It’s still too early to say that the 140 yen exchange rate will no longer happen.”

(Updates throughout.)

[ad_2]

Image and article originally from financialpost.com. Read the original article here.