[ad_1]

Detroit-based Benzinga sent its team to New Orleans for Xerocon, Aug. 24-25.

While there, Benzinga sought to recognize the innovation in accounting technology and spoke with founders, investors and other interested parties.

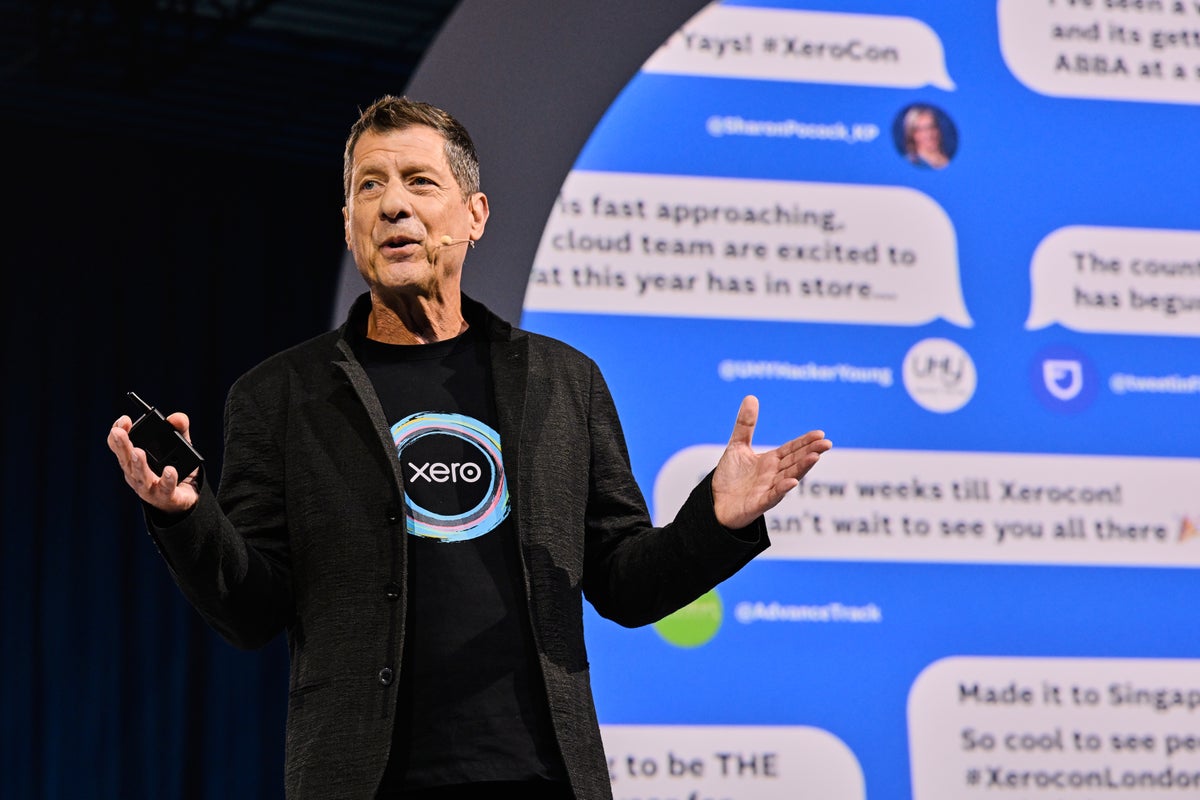

The following is a chat with Xero Limited XROLF CEO Steve Vamos and Chief Growth Officer Chris O’Neill.

The following text is edited for clarity and concision.

Q: Nice to meet you, both! Care to start off with an introduction?

Vamos: I’ve been in the industry since when the big new thing was mini computers, working at IBM IBM.

The reason I’m here today is that one of my experiences was in the birth of digital advertising and the change journey that involved.

So, all the while many experts thought digital media was never going to work, I became a CEO of a joint venture between Microsoft Corporation MSFT and a media company to try and drive the growth of the online media industry. This happened when Intel Corporation INTC was one of the early experimenters of digital advertising in 1997 or 1998.

I spent four to five years just trying to convince advertising agencies and media companies that the internet was going to change the face of online advertising.

Fast forward to today, I’ve learned that leading technology companies is about leading change, and that’s our journey here at Xero. We are here to lead the change in the way small business operates. And, the most interesting thing about our business is that it is not just about us.

It’s about the ecosystem and transformation of financial services. We’re on a change journey here, too. Small business is the last frontier, and we’re one of the very few companies that understand small business.

O’Neill: Around 1998 I was applying to graduate school.

I was curious about California and I took a couple of months for an assignment there. Fast forward, I stayed for 25 years after I was bitten by the tech bug during the first wave of craziness in the Valley.

I was fortunate to find my to way Alphabet Inc GOOGL GOOG and the highest watermark for that was my experience in Canada.

About 63% of Canadian businesses didn’t even have a website. And, more disturbingly, they didn’t even know why they would need one. So we went on this journey, with a bunch of people, including the government, to get people online.

After that, I ran Evernote for a while, a category-creating company that catalyzed the vision that you can write in one place and it shows up everywhere else.

On that last note, you’re starting to see quite a few Evernote knock-offs, right?

O’Neill: It is a bit of a cautionary tale.

You have to keep innovating or someone else will come along and, you know, maybe take what you do and put their own spin on it.

In terms of Xero, small business is the last frontier in many ways. The conversations that we have, as a group, remind me of the conversations in 2010 about the web and cloud.

Simply put, people are far more successful when they have accounting software, when they are connected to their different apps, and they throw an accountant into the mix.

So, Chris, what is your role at Xero?

O’Neill: Steve is asking me to do two things here.

It’s to manage this region and take what we’ve learned in the Southern Hemisphere, and apply it in the Northern Hemisphere.

Talk to me a little bit about the purpose of this Xerocon event. Talk to me about this theme of making accounting cool.

Vamos: Accountants are people. I think we’ve just exposed the humanity of the profession by connecting with them in a way where they genuinely say that we have helped change their lives.

And if you talk to our partners, they’ll say Xero changed my life and enabled me to work more efficiently from places that I couldn’t work before.

Tell me about the launch of Xero Small Business Insights (XSBI). What’s the impact?

Vamos: We created this report and the governments loved it because you’re getting information on a regular basis about how small business is trending.

So, through the [COVID-19] pandemic, we were regularly providing that information. What is happening to sales? What’s happening to employment and other factors?

North American leaders have been very keen to see that coming to this part of the world. And that is why Chris announced we’re now extending XSBI.

O’Neill: It’s a huge sample, too. More than 2.6 million employees are paid through Xero payroll per month in our markets with a Xero Payroll Solution.

Additionally, all the data aggregated is anonymized and we have an economist who then weights the data to make sure it’s representative of the sample.

The Organization for Economic Co-operation (OECD) uses our data, for example, as do world governments so they can adapt to actual data. When they dig into some of this stuff, you see inflation having a big impact and make decisions based on that.

I mean the uses for such insights are probably unlimited, right?

Vamos: We’re not just here building cloud products for small businesses. As Chris said, we’re collaborating with governments financial services institutions.

Cloud compliance is very big in the Commonwealth countries — Australia, New Zealand, UK — and starting to be talked about more seriously in Canada. Essentially in Australia, all your sales, tax reporting, payments and payroll are connected to the government.

When we went through the pandemic, the government knew how many employees you had and were able to target their programs to support the maintenance of those jobs.

So, what types of things are you measuring for?

O’Neill: Sales is the big one.

We measure days to get paid, too. It’s how long from when you send an invoice to when you actually collect the cash.

The other one is late payments. If I issue an invoice for today, and it is due today, and then you take a week, that would be seven days. We measure that time late.

What are you most excited to be working on over the next year and how does that impact the key stakeholders?

O’Neill: It’s about continuing to invest in our team and products.

We’re focused on expanding our market and improving our product with regard to a lot of the non-sexy stuff like plumbing, bank feeds and reconciliation.

The three categories we talk about are how do you manage your money? How do you manage your people? How do you manage your goods?

On the money side, we’ve announced some stuff in the past with Stripe. We’re extending sales tax compliance capabilities with a company called Avalara Inc AVLR and, we acquired a company called Planday, as well as LOCATE.

Inventory goods-based businesses have become surprisingly complex in this country. You know, think of the Supreme Court ruling that made it really important for small businesses to file taxes in all the 50 states if they’re shipping goods there. That’s an unfair fight, right?

Small businesses need our help.

When you penetrate some of these new markets, what are some of the big barriers?

O’Neill: Regulation is definitely a tailwind.

Vamos: We can show the government that there’s a better way. The level of non-compliance in the way people and taxes are paid can be pretty scary.

There’s also the guidance component. Operators generally get less coaching than a kid playing football or a musical instrument. Yet, arguably, small business is a more challenging pursuit.

What are those insights telling you about the market right now?

Vamos: There are some interesting things happening.

For example, the data we showed today reflects an acceleration in digitization, which obviously is the overdue payments number coming down. Businesses are taking advantage of being paid digitally, which reduces that time significantly.

We’re also seeing revenue growth. That’s interesting, particularly when we’re assessing whether the economy is in recession or not. The effect of inflation on sales figures is positive but volume isn’t going up.

That means the economy is not growing. It’s just benefiting from this kind of short-term inflation.

In Canada, sales, adjusted for inflation, are down. If volumes are not going up or declining, too, then that’s sort of giving an indication that maybe we are seeing some slowdown.

But there is some good insight into the number of people being hired and what’s happening at job levels in terms of reflecting on the labor market and the availability of talent. So, we’re talking about a potential recession, but then you say the unemployment levels are falling.

If everyone has a job, how does that translate into recessionary pressure? I think the data reflects the times and the effect that those have on small businesses.

You get real evidence through data.

Photo: Xero CEO Steve Vamos

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.