[ad_1]

by BoatSurfer600

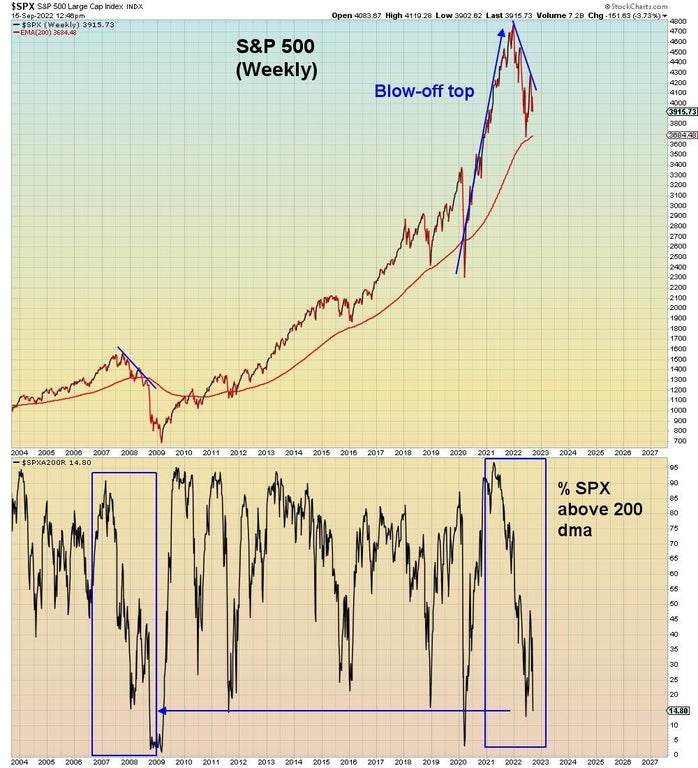

It’s clear now in hindsight with all of the late cycle indicators flashing red, that the pandemic was not a true bear market. It was merely the pullback prior to the final melt-up of the post-Lehman rally. A massive sugar rally fueled by unprecedented stimulus

If you think everyone is buying puts just look at $VIX. This is a very complacent environment still pic.twitter.com/kXLDUrPE36

— Reformed Tr🅰️der (@Reformed_Trader) September 15, 2022

Main indicators suggest trader keep buying call options despite the drawdown.. literally no fear

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) September 16, 2022

$3.2 trillion in options are to expire today, per Bloomberg.

— unusual_whales (@unusual_whales) September 16, 2022

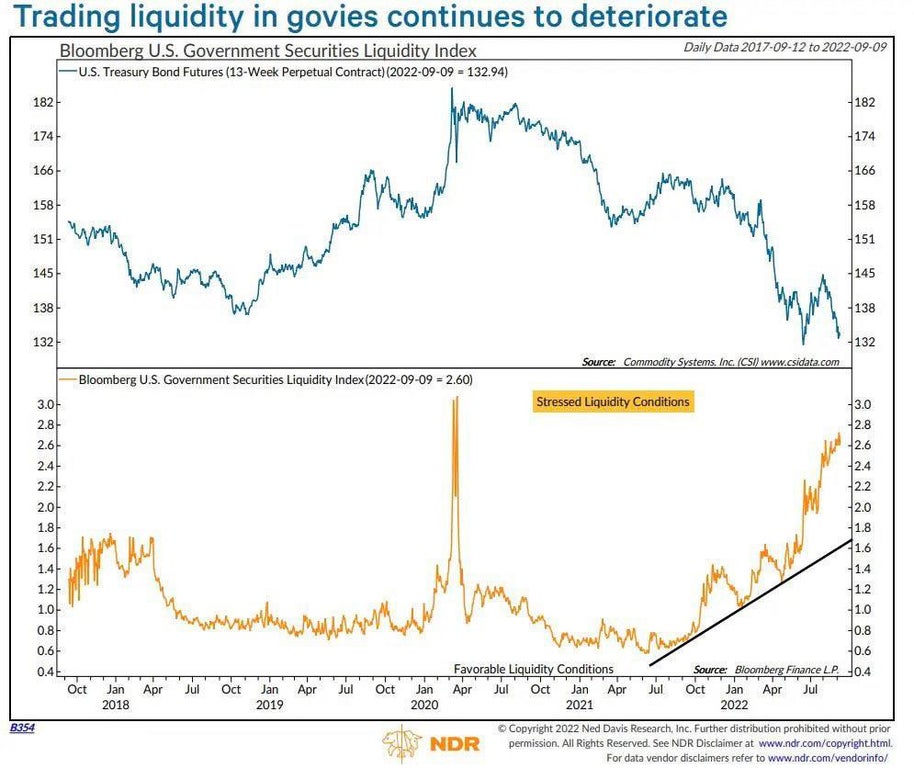

Repo market is becoming illiquid due to the Feds QT. Last time the Fed tried to taper at half the rate the repo market completely froze over

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.