[ad_1]

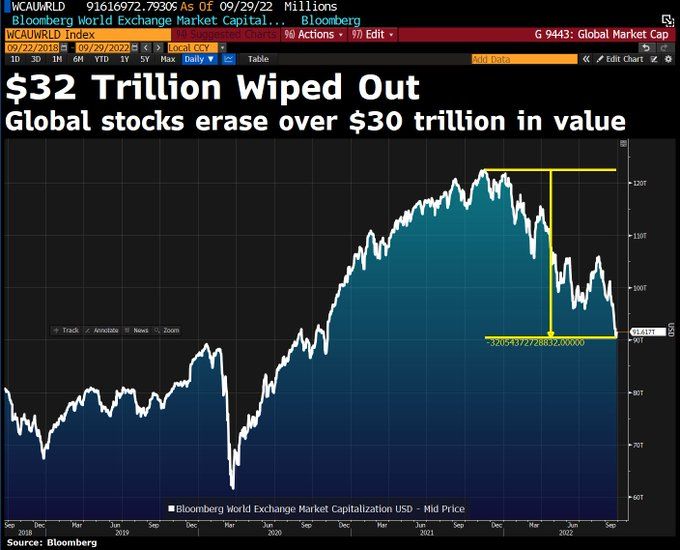

$32 TRILLION of global stock value has been wiped out since December 2021.

Today’s core PCE deflator reading of 4.9% YoY shows that the inflation surge is not over. With a core PCE deflator of 4.9%, the Taylor Rule suggests that The Fed Funds Target Rate should be at 9.65%, far below its current level of 3.25%. So, IFF The Fed is following any sort of rule, rates should continue to soar.

And if we use headline inflation of 8.30% YoY, the Taylor Rule suggests hiking the target rate to 14.75%.

After yesterday’s dismal Q2 report of -0.6%, I fully anticipate a recession. Ain’t this a kick in the … head.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.