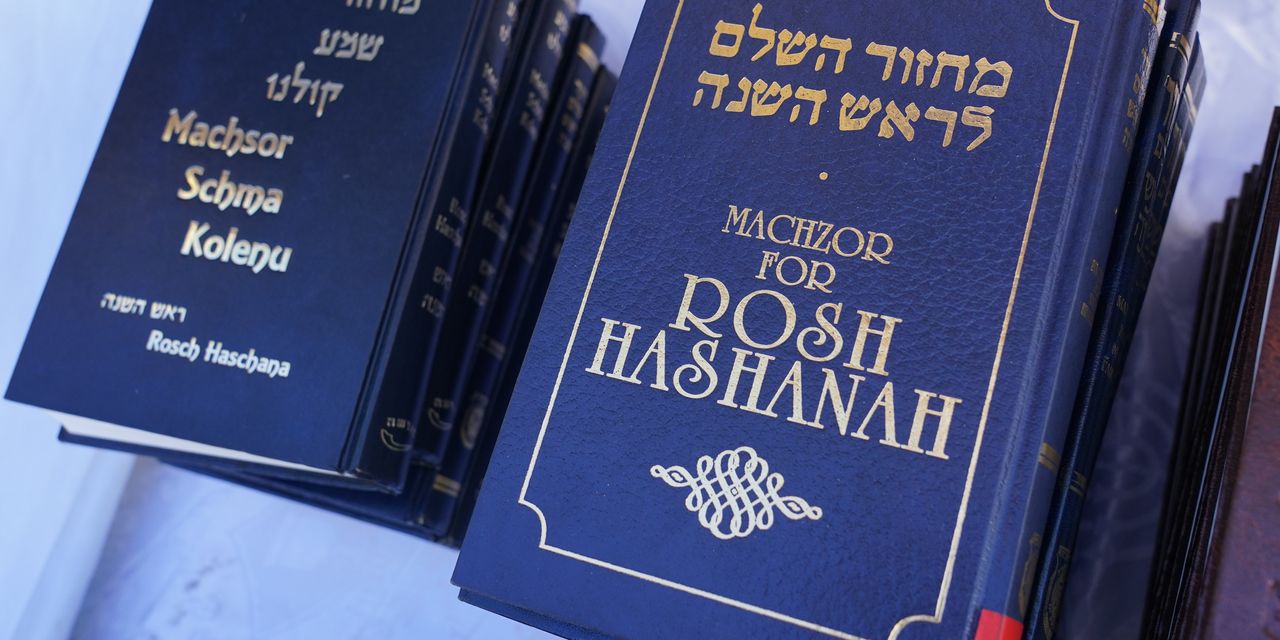

It might seem arbitrary to take investing advice from old market adages, but there is one market strategy commonly mentioned ahead of the Jewish holidays – “Sell Rosh Hashanah, Buy Yom Kippur.”

This year, Rosh Hashanah, which is the beginning of the year according to the traditional Jewish calendar, begins at sunset on Sunday, Sept. 25. It will run through nightfall on Tuesday, Sept. 27. Meanwhile, Yom Kippur, or the Day of Atonement, begins 10 days later on Tuesday, Oct. 4.

“The thesis is that folks sell positions on Rosh Hashanah the first of the Days of Awe to rid themselves of financial commitments and then return to the market after Yom Kippur, the Day of Atonement,” wrote Jeff Hirsch, editor of the Stock Trader’s Almanac, in a note on Friday. “It is no coincidence that this coincides with the seasonal September/October weakness.”

The U.S. stock market extended its losses on Friday with both the S&P 500

SPX,

and the Dow Jones Industrial Average

DJIA,

trading below their 2022 intraday lows reached in June. According to Hirsch, it might be a bit late this year for traders to follow the traditional market strategy to sell at Rosh Hashanah, but the chance to buy at Yom Kippur is already set up.

According to the Stock Trader’s Almanac, the Dow Jones Industrial Average has fallen 29 out of 52 Rosh Hashanah holiday periods with an average decline of 0.5%.

See: S&P 500 falls below June closing low, with Dow on track to enter bear market

“A host of fears from inflation, a hawkish Fed, bellicose Russia, global upheaval, US midterm politics is exacerbating the usual seasonal and 4-year cycle carnage,” Hirsch wrote.

In a follow-up phone interview with MarketWatch, Hirsch explained that it is the seasonal movements and the quarterly movements of the large institutions, which tend to make September the worst month for stocks and the week after the “triple witching” expiry of futures and options “notoriously bad”, while October is “this bear killer as we stay in the almanac.”

“Triple witching” is a quarterly phenomenon referring to the simultaneous expiration of three different types of derivative contracts – stock index futures, stock index options and stock options. It happens on the third Friday of the third month of each quarter.

The Federal Reserve on Wednesday announced its third large rate hike of 75 basis point in hope of cooling the inflation, while warning again that its job is not done.

U.S. stocks finished the week sharply lower with the Dow ended nearly 500 points lower and narrowly avoided the lowest close of the year. The S&P 500 finished 1.7% lower, while the Nasdaq was down 1.8%. For the week, the large-cap index shed 4.7%, the Dow lost 4% and the Nasdaq booked a 5.1% weekly decline, according to Dow Jones Market Data.