[ad_1]

Japan’s central bank, the Bank of Japan, or BoJ, is beginning to lose control of its financial system.

The BoJ is the grandfather of monetary insanity. The U.S.’s Federal Reserve (the Fed) first introduced Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE) in 2008.

The BoJ introduced them in 1999 and 2001, respectively.

Since that time, the BoJ has NEVER been able to normalize monetary policy. The longest it managed to tighten financial conditions without having to reverse and start easing again was a measly 14 months.

So we’re talking about 20+ years of loose monetary policy or a slow-motion nationalization of Japan’s financial system. The BoJ has bought so many assets during this time that today it:

1) Owns more than half (50%) of all Japan Government Bonds outstanding.

2) Owns more Japanese stocks than any other entity (country or institution) in the world.

3) Is a top 10 shareholder in 40% of Japan’s publicly listed companies.

4) Has a balance sheet that is equal to 92% of Japan’s GDP.

Having spent 17 odd years printing money and buying assets with little success in creating economic growth, in 2016, the BoJ attempted a new kind of policy: Yield Curve Control (YCC).

In its simplest rendering, the BoJ stated that anytime the yields on Japanese Government Bonds rose above a certain level (0% for the 10-Year Government Bonds), the BoJ would print new money and use it to buy bonds until the yields fell back to the desired range.

This was an open-ended, unlimited form of QE. And the BoJ maintained it for six years straight until inflation finally appeared in the financial system.

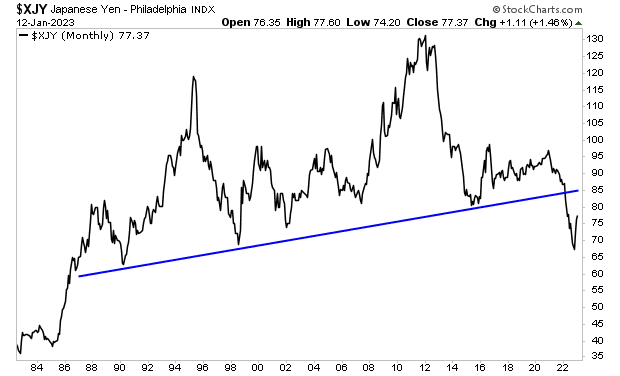

And that’s when things started to break: the Yen collapsed to a 35 year low.

At this point, the BoJ had a choice: defend its currency or continue defending its bonds.

The BoJ chose to defend the currency by RAISING the target yield for 10-Year Japanese Government Bonds from 0% to 0.5%. This was an implicit admission that it would print less money defending bonds. And it’s why the Yen began to rally in late 2022 (see the large bounce in the chart above).

Unfortunately, that’s the end of the good news. The bond market has begun testing the BoJ’s resolve, with the yields on Japanese Government Bonds rising above the BoJ’s target repeatedly. Things have begun to spiral out of control to the point that the BoJ is being forced to intervene on a near daily basis to try and stop the bond yields from soaring higher.

The BoJ is now in a corner. If it keeps printing money to defend bonds the Yen collapses making inflation worse. And if it doesn’t print money to defend bonds the bond yields soar and Japan becomes insolvent (unable to make debt payments).

As I keep stating, the Great Crisis… the one to which 2008 was a warm-up, has finally arrived. In 2008 entire banks went bust. In 2022, entire countries will do so.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.