[ad_1]

Aren’t They Risky?

Many financial pundits assume so, and in terms of volatility and the risk of permanent principal impairment, they’re right. But contrary to popular perception, equities are not necessarily more risky than such supposedly “safe” assets as US Treasuries.

Let me explain.

The US 10-year Treasury bond yielded 2.46% in March. So, the US government could borrow for a decade at a rate of 2.46% a year, and we could buy T-bills and lend to the US government for 10 years at 2.46% interest.

This is considered a “safe” investment since the US government has virtually zero default risk. So, we are more or less guaranteed that 2.46% annual return over 10 years if we hold the investment until maturity.

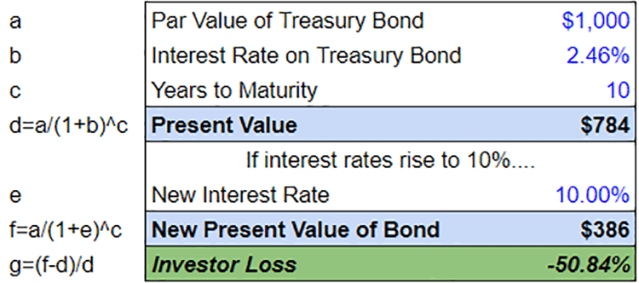

But what if interest rates suddenly skyrocket upwards to 10%? It hasn’t happened in decades, but a 10% interest rate is by no means unprecedented for US government bonds. Moreover, measured variously at ~6% or 8.3%, depending on the metric used, inflation like today’s hasn’t been seen in decades either. A return to that 10% interest rate would cut the value of our “safe” Treasury bond in half.

But let’s assume US inflation holds at 6% over the next decade and we lend our money to the government at 2.46% over that time. After taking the cost of inflation into account — a 2.46% interest rate minus 6% inflation — we would be effectively lending at –3.54% annually. If we did nothing at all and kept our money in cash or stuffed under the proverbial mattress, then in real, after-inflation terms, our money would depreciate in value by 6% a year.

10-Year Treasury Bond Performance: A Hypothetical

While stocks are much more volatile than bonds, this does not preclude bonds from producing awful real (and even nominal) returns for investors over short- and long-term time periods.

Of course, companies can be adversely affected by inflation and other macro events, too, and there’s no guarantee that stocks will outperform inflation — certainly not over the short-term, at least. Nevertheless, businesses can theoretically evolve and adapt. (“Theoretically” because US nonfinancial corporate returns on equity have been remarkably stable, at around 11%, since World War II.) They can raise prices to pass the costs of inflation on to customers, cut costs elsewhere in the business, sell off real estate at inflated prices, etc. Thus, as assets, equities are better equipped to weather the inflationary storms.

A bond, on the other hand, is simply a locked-in contract with no facility to adjust to inflation or any other outside influence or development. A Treasury bond, “risk-free” as it is over time, likewise cannot adapt to changing circumstances.

As Jeremy Siegel and Richard Thaler observe:

“[Financial disasters] that destroy stock values have been associated with hyperinflation or financial wealth confiscation where investors are often worse off in bonds than in stocks.”

Long-Term Returns for Equities Are Higher Than for Other Asset Classes

Equity markets outperform cash and bonds over time by a wide margin, albeit with much greater short-term volatility. Over any brief investment horizon, we may be better off in cash or bonds. But if we’re investing for the long run — seven years or more — then stocks are probably the better bet.

Our “risk,” therefore, is inversely related to our time horizon. The stock market may be chaotic over the short term, but it’s the most consistent wealth generator over the long term. Indeed, the y-axis in the chart above is on a logarithmic scale, so stocks have outperformed bonds by approximately three orders of magnitude since 1801.

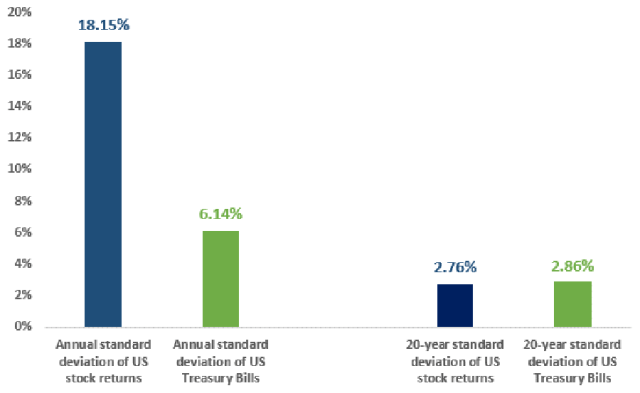

For Long-Term Investors, Stocks Are Less Volatile Than Meets the Eye

The annual standard deviation of US stock returns between 1801 and 1995 is 18.15%, vs. 6.14% for T-Bills, according to research by Siegel and Thaler. Over 20-year intervals, however, the standard deviation of US stock returns is actually lower than T-Bills: 2.76% vs. 2.86%. This is despite stocks returning 10.1% CAGR compared with 3.7% for T-Bills.

US Stock Returns vs. US Treasury Bonds: Standard Deviation

The riskiness of stocks can’t be discounted, especially given the turbulence we’ve seen in recent weeks and months. But this analysis demonstrates that over extended periods of time, they may be both higher-returning and less risky than bonds. And that makes them worth holding for the long run.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Nick Dolding

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.