[ad_1]

The entire crypto market is in a state of indecision which indirectly affects price analysis. Bitcoin and many of the other assets in the market have remained in consolidation for weeks but saw a major breakout on Oct 26.

Even though Bitcoin, Ethereum and most of the altcoins saw major price upticks. There are a few important resistance levels the bulls have to overcome to keep up the bullish momentum. Doing this is important, especially in the wake of the crypto winter that continues to ravage the market.

Below are some of the cryptocurrencies you should know about: What they’ve done, what they’re doing, and what they might do in the near future.

Bitcoin (BTC) – Price Analysis

This week on October 17th and 18th, the bulls were unable to push the price above the upper trendline of bitcoin’s triangle formation on the 4-hour timeframe (around $19,600), as illustrated below.

Chart showing price analysis of bitcoin | Source: Tradingview

This inability of the bulls to push the price above this trendline gave the bears permission to open short positions and therefore push bitcoin below its 20, 50 and 100 period moving averages.

These short positions pushed the price of bitcoin into a retest of the support around the $19,000 zone where it now sits. So far, bitcoin has gone below this level and now trades at $18,975 at the time of writing.

As it stands, the sellers will try to challenge this support level again, and push the price of bitcoin lower. If the bulls prove themselves once again unable to defend this zone, the price of the cryptocurrency may fall further and retest the $18,200 zone as it has several times in past weeks.

The bulls are expected to defend this level because a break below $18,000 could spell disaster and further continuation of the downtrend bitcoin is currently in.

Ethereum (ETH) – Price Analysis

Chart showing price analysis of Ethereum | Source: Tradingview

Like bitcoin, Ethereum has been trading inside a descending channel since q4 of 2021.

Chart showing symmetrical triangle on Ethereum | Source: Tradingview

Earlier this week, the price analysis of Ethereum hit the resistance (around $1,343) of the symmetrical triangle formation it started in early October this year, as illustrated above. However, the bulls were unable to initiate a breakout, causing a downturn in the prices and a retest of the lower support of around $1,279.

The RSI signal line being below the neutral position may indicate that the bears are in control of the Ethereum chart. A breakout of the symmetrical triangle on Ethereum is imminent at this point and may occur to the downside or the upside depending on market conditions.

A breakdown of support may push the price of Ethereum below the $1,200 support and further extend the Ethereum downtrend. However, a break above this level may push Ethereum further upwards to a retest of the $1,400 zone and possibly to the $1,500 zone.

Binance Coin (BNB) – Price Analysis

The price of BNB has been in a range since late August and has been bouncing between the $300 resistance and the $258 support.

Chart showing price analysis of Binance Coin | Source: Tradingview

This week on October 13th, the price of BNB fell and hit the $258 support. The bulls swung into action immediately, pushing the price of the cryptocurrency upwards.

However, the bulls lost their strength fairly quickly, after managing to push the price of BNB toward the $277 zone.

BNB has ranged at this level ever since then and now appears to be aiming for another retest of the support. The RSI, on the other hand, is starting to show oversold conditions. This suggests that BNB may indeed retest support but is likely to bounce again. Another bounce like this may give the bulls a second chance to push back against the bears and possibly take the price of BNB toward the $300 zone.

Ripple Coin (XRP) – Price Analysis

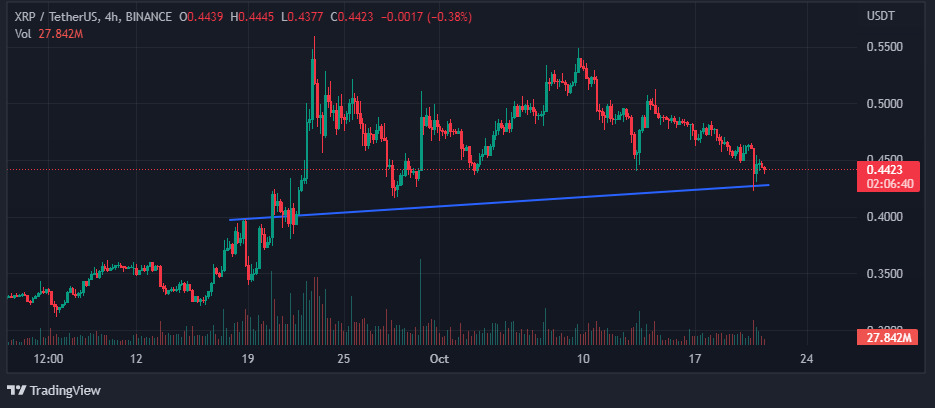

Chart showing price analysis of XRP | Source: Tradingview

The price of Ripple Coin has been in an ascending channel since late September and has been doing fine ever since.

However, the bullish strength of XRP appears to be weakening as the price analysis of the cryptocurrency continues to linger at the $0.45 support. The bulls so far, are doing a good job of holding the price of XRP steady at this support level. However, fears continue to mount that this support may not hold after all.

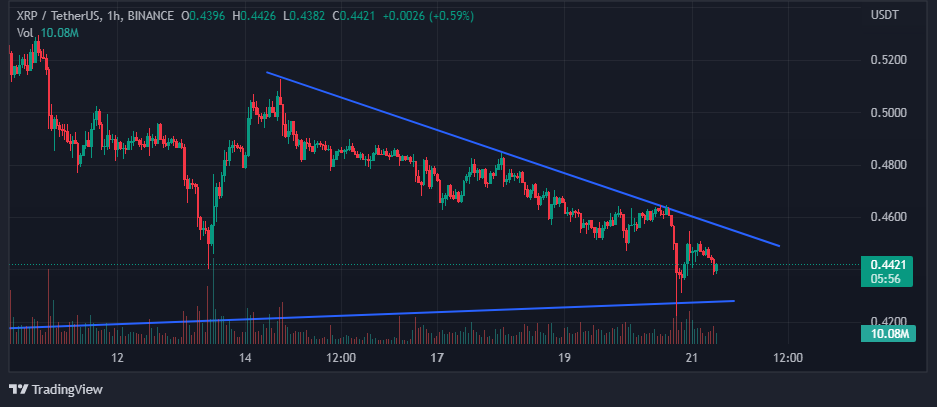

Chart showing wedge on XRP | Source: Tradingview

Zooming in to take a closer look, the price of XRP hit the top support of the triangle formation on its 1-hour timeframe and started to trend downwards.

All attempts of the bulls to push the price of XRP above the upper resistance of this formation have proved abortive, and XRP now appears to be aiming for a retest of support.

Cardano (ADA) – Price Analysis

Cardano’s chart conditions appear interesting from a long-term perspective.

Chart showing price analysis of Cardano | Source: Tradingview

As illustrated above, the long-term price condition of Cardano appears bearish. That much is clear from the performance of the entire crypto market throughout 2022.

However, despite the bearishness, ADA appears to be aiming for a medium to short-term uptrend and a retest of its upper trendline.

What Cardano does next depends entirely on the strength of the bulls. The cryptocurrency is currently testing the lower support of its channel. If the bulls are able to initiate a bounce, the price of ADA may move upwards to the $0.55 zone.

However, if a break below the lower support happens, the price of ADA may dip even lower than expected in an uncharted dip.

Solana (SOL) – Price Analysis

Solana’s price analysis since June this year appears interesting as well. Looking closely, we can see a falling wedge in the cryptocurrency’s price analysis.

Chart showing falling wedge formation on Solana | Source: Tradingview

Solana is currently testing the lower support of the falling wedge around the $27.64 mark.

The gains on Solana may prove to be highly profitable if the bulls manage to take control. If the bulls manage to start a bounce from the lower support of this falling wedge, Solana is bound to retest the upper support around $30.

If a breakout from this level happens as well, Solana may soar with massive bullish momentum and even hit the $48 mark in a 70% rise.

On the other hand, if the bears manage to push Solana below this lower support, the price dip that follows may be nothing short of a disaster.

Dogecoin (DOGE)

Dogecoin appears to have been in a triangle formation since mid-August and is now moving in for a support retest around the $0.056 zone.

Chart showing Triangle on Dogecoin | Source: Tradingview

As Dogecoin continues to trade inside this triangle, a breakout at some point, to the upside or downside is imminent.

After testing support around this $0.056 zone, Dogecoin is bound to enter a bounce and a retest of the upper support. However, if the bulls apply enough pressure to break this upper trendline, Dogecoin’s price may explode to the upside and even target the $0.09 resistance again over the long term.

Polygon (MATIC)

The week has been good for MATIC. After hitting a low of $0.71 on the 13th of October, MATIC soared to a high of $0.88. However, Polygon has begun to trend downwards and is now testing support around $0.78.

Chart showing price analysis of Polygon | Source: Tradingview

What MATIC does next depends on its bulls and bears. The cryptocurrency may bounce off this level and trend further upwards to the $1 resistance, or break below this level and retest the resistance around the $0.72 zone.

Shiba Inu (SHIB)

Shiba Inu appears to be in a symmetrical triangle and is long overdue for a breakout to the upside or downside.

As it is with the other altcoins on this list, what Shiba Inu does next depends entirely on its market participants.

Chart showing Symmetrical triangle on Shiba Inu | Source: Tradingview

The only thing certain about SHIB is that a breakout in either direction is set to happen this week or early in the next.

On the RSI, we see that the signal line is slightly below the neutral levels. This may mean that the bears are currently in control of the market. However, the bulls may take this as a buying opportunity, pushing the SHIB market into a breakout to the upside.

Disclaimer: Voice of crypto aims to deliver accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Featured Image

https://www.freepik.com/free-vector/popular-cryptocurrency-logos-set_23678052.htm#query=crypto&position=1&from_view=search&track=sph

Crypto Writer

Jim Haastrup is a freelance blockchain and metaverse writer. He helps founders, investors, startups, crypto, and blockchain enthusiasts connect with their audience and win investment through the written word.

[ad_2]

Image and article originally from voiceofcrypto.online. Read the original article here.