[ad_1]

The cryptocurrency market has jumped out to a hot start this year, with coins across the board throwing it back to 2020 by jumping sharply upward.

The moves have come off the back of optimism that inflation is cooling. We saw European inflation come in below expectations last week, landing at 9.2% against expectations of 9.5%, and down from 10.1% the previous month.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

The renewed hope comes off the back of a 50 bps hike in interest rates last month in the UK, Europe and the US, following previous hikes of 75 bps. The slower increase reflects that while inflation remains high, the numbers are suggesting that perhaps it has peaked – and with two months of positive readings, things are at least looking brighter than they did last year.

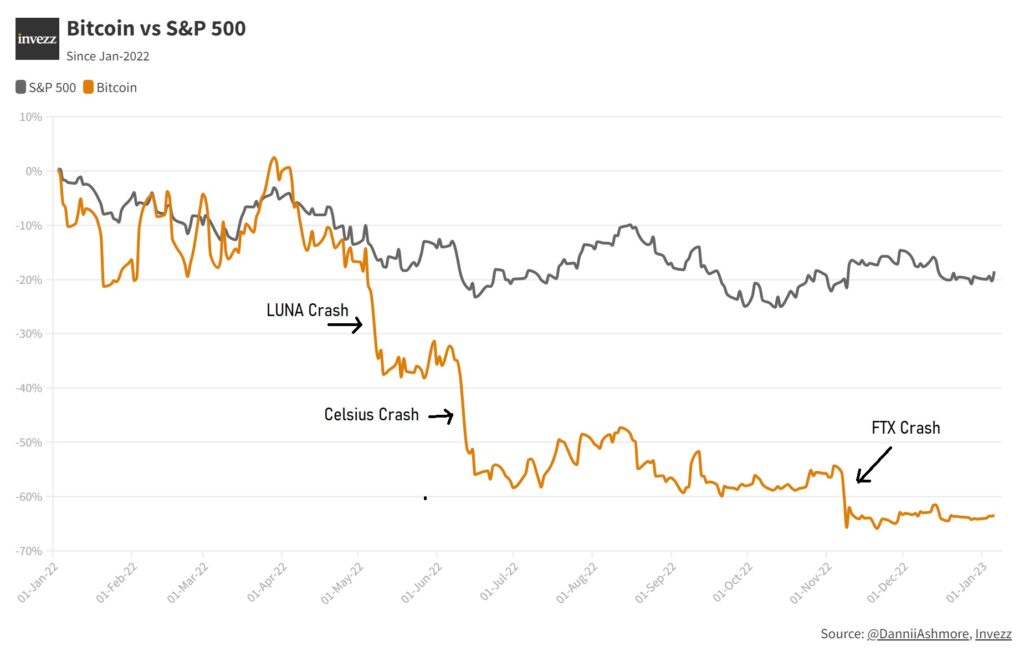

That has been all crypto needed to hear, as prices have jumped up. While the new year is only nine days ago, crypto investors are basking in a little bit of respite after the Armageddon that was 2022.

What will happen to crypto this week?

But the big one is Thursday, with US CPI data set to be announced. As has become the monthly ritual over the last year or so, eyes will be glued to screens to get that all-important number. A reading softer than expected would likely send the market jumping again.

On the flip side, a disappointing reading could spell even worse price action than it normally does, such is the momentum garnered after two consecutive months of placid inflation data. Markets also rose last week off the back of the nonfarm payrolls report, with investors reading the data as potentially leading to a Fed pivot earlier than anticipated.

Nonetheless, inflation does remain very elevated and the labour market still shows resilience. We likely need to see a little more weakness in the latter and a tangible fall-off in demand before the Fed will ease up on its promise that it will do everything in its power to hike into oblivion and nuke inflation.

Expect volatility in week ahead

Either way, there could be volatility in the market in the week ahead. Ever since the FTX collapse in early November, the crypto markets have actually been relatively serene. I charted the volatility going back to before Bankman-Fried revealed to the world his true colours, and it clearly shows the pickup in volatility and subsequent dropoff in mid-December.

Crypto has therefore returned to what it has been doing for most of the last year, with a few isolated episodes aside – and that is following the stock market.

After Thursday’s CPI reading, the next key date is then February 1st. This is when the next FOMC meeting will take place, or in other words, when the Fed announces its latest plans regarding interest rate hikes.

Ears will be hanging on the every word of the most important person in the markets right now, Federal Reserve chairman Jerome Powell, as he gives his thoughts and guidance on what is about to happen next.

Last year, the Fed hiked seven times, as it became abundantly clear that inflation was a problem that could no longer be ignored.

Final thoughts

In wrapping up, it is clear that this is a big week, with the economy at a crossroads. Can optimism continue to abound that inflation has peaked? Or will the market be pulled back down with a gut punch of higher-than-anticipated numbers?

The core inflation number could arguably be even more important than the headline number. Core inflation strips out the more volatile food and energy prices, with the thinking being that these are less affected by monetary policy. Typically, it is the figure that policymakers often focus on.

With gas prices having come way down since last year, the CPI figure will be boosted by the fact that these higher figures will drop out of the index with an extra month’s data. Hence, the core figure could take on an even greater importance.

Whatever the number, however, crypto markets will be staring right at it to decide whether to continue this 2023 rally or not.

[ad_2]

Image and article originally from invezz.com. Read the original article here.