[ad_1]

NVIDIA Corp NVDA shares are trading higher in Tuesday’s after-hours session in sympathy with Advanced Micro Devices Inc AMD, which reported financial results showing strong data center growth.

- AMD Q3 Revenue: $5.57 billion misses estimate of $5.62 billion

- AMD Q3 EPS: $0.67 misses estimate of $0.68

“Third quarter results came in below our expectations due to the softening PC market and substantial inventory reduction actions across the PC supply chain,” said Lisa Su, CEO of AMD.

“Despite the challenging macro environment, we grew revenue 29% year-over-year driven by increased sales of our data center, embedded, and game console products.”

Related Link: AMD Q3 Earnings Highlights: Revenue And EPS Miss, Data Center Growth, Q4 Guidance And More

AMD said data center revenue jumped 45% year-over-year to $1.6 billion.

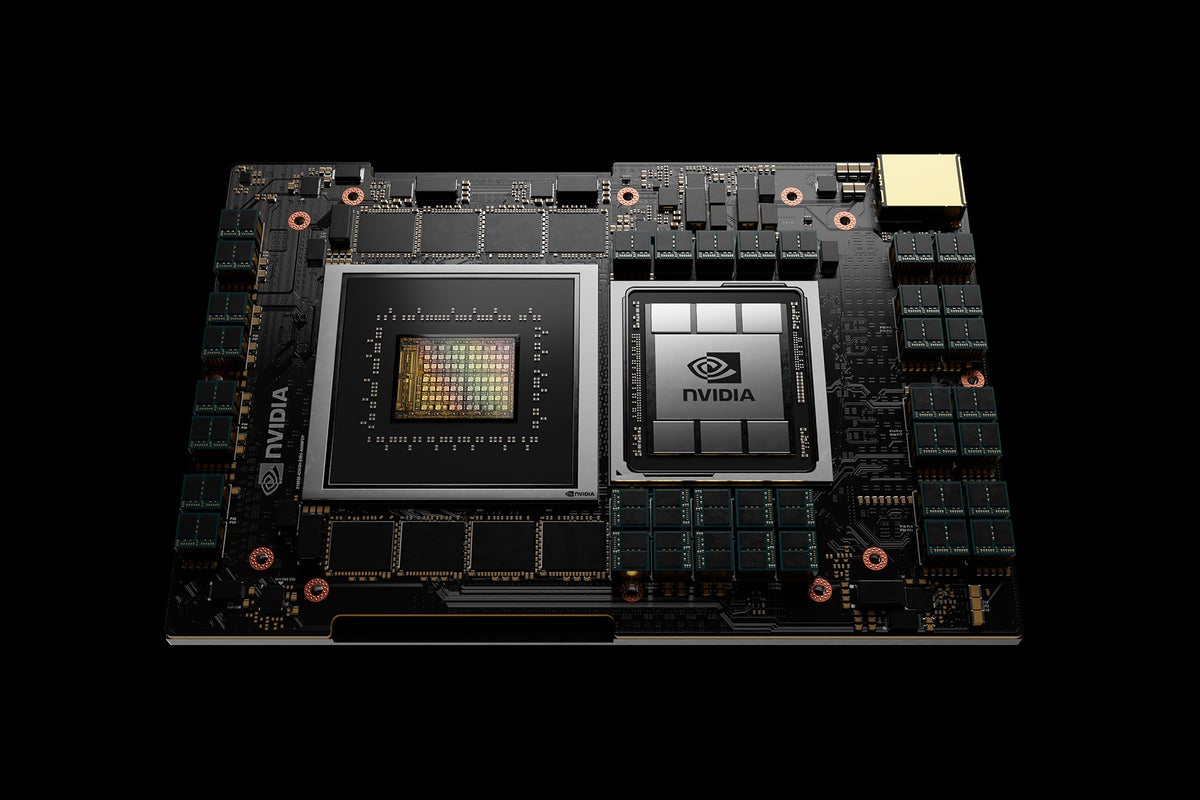

Nvidia is a data center powerhouse. In the company’s most recent quarter, Nvidia reported data center revenue of $3.81 billion, which was up 61% year-over-year, according to Benzinga Pro.

Last week, Nvidia shares surged after hours after Meta Platforms Inc META raised its capital expenditures outlook, citing increased data center spending.

Nvidia’s chips are used in a variety of end markets, including data centers and high-end PCs for gaming and automotive infotainment systems.

NVDA Price Action: Nvidia has a 52-week high of $307.11 and a 52-week low of $108.13.

The stock was up 1.16% in after-hours at $137.01 at the time of publication.

Photo: courtesy of Nvidia.

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.