Article content

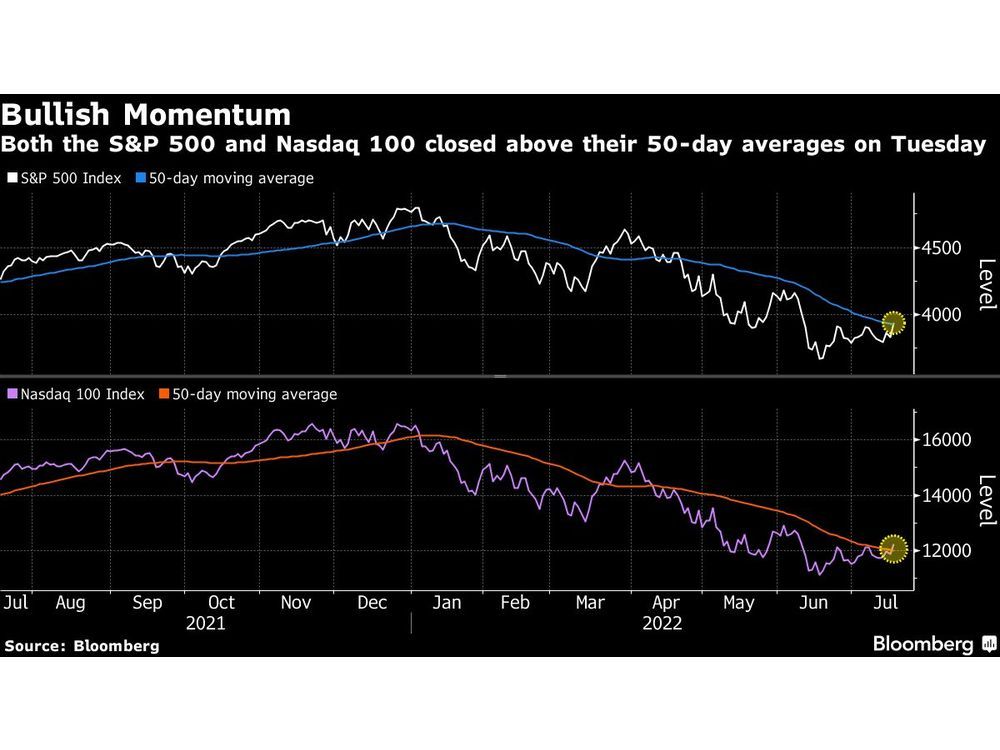

(Bloomberg) — Stocks extended a rally Wednesday amid a retreat in the dollar and speculation that the worst of this year’s equity rout may be over.

[ad_1]

(Bloomberg) — Stocks extended a rally Wednesday amid a retreat in the dollar and speculation that the worst of this year’s equity rout may be over.

Author of the article:

Bloomberg News

Andreea Papuc

![f2ysz4b)ycj0qektaxs)va]4_media_dl_1.png](https://wealthstreetinvestor.com/wp-content/uploads/2022/07/US-Futures-Up-Stocks-Extend-Rally-as-Dollar-Dips-Markets.jpg)

(Bloomberg) — Stocks extended a rally Wednesday amid a retreat in the dollar and speculation that the worst of this year’s equity rout may be over.

This advertisement has not loaded yet, but your article continues below.

Technology shares fueled a climb of more than 1.5% in a gauge of Asian equities after the S&P 500’s biggest jump since June. European futures pushed higher and US contracts were in the green too, encouraged by a Netflix Inc. surge in extended trading on a smaller-than-expected subscriber loss.

The tech climb swept along Chinese firms following a report that regulators are wrapping up an investigation into ride-hailing giant Didi Global Inc. with a hefty fine — stoking hopes of an end to Beijing’s crackdown on the sector.

A dollar gauge has shed about 1% this week, underscoring waning haven demand for the greenback and a brighter mood in markets. Treasuries held a decline that’s taken the 10-year yield back above 3%.

This advertisement has not loaded yet, but your article continues below.

The euro hovered around a two-week high against the dollar on the possibility of a bigger-than-expected European Central Bank interest-rate hike Thursday.

Speculation that company earnings will hold up and that the Federal Reserve will avoid very aggressive monetary tightening is giving investors some hope. Worries about a global downturn due to rising interest rates, Europe’s energy challenges and China’s Covid and property-sector woes are taking a back seat.

“Stocks have been beaten down,” Kristina Hooper, chief global market strategist at Invesco, wrote in a note. “That doesn’t mean we won’t see more downside for some stock markets around the world, especially given that earnings expectations are likely to be adjusted downward. But I believe we are far closer to the bottom than the top.”

This advertisement has not loaded yet, but your article continues below.

In Europe, Gazprom PJSC is poised to restart gas exports through its Nord Stream pipeline to Europe on Thursday at reduced capacity, as the continent braces for shortages amid Russia’s war in Ukraine.

Elsewhere, crude oil slipped below $104 a barrel. Bitcoin hovered above $23,000 after climbing out of a one-month-old trading range.

How far will the Fed go in this hiking cycle? It takes one minute to participate in the confidential MLIV Pulse survey, so please click here to get involved.

Key events to watch this week:

This advertisement has not loaded yet, but your article continues below.

Some of the main moves in markets:

Stocks

Currencies

Bonds

Commodities

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.