Decentralized Exchanges (DEXs) are starting to slowly replace Centralized Exchanges (CEXs), as Uniswap (UNI/USD) overtook Coinbase when it came to the ETH/USD trading volume.

Uniswap is one of the world’s largest Decentralized Exchanges (DEXs), which is automated and allows users to swap different cryptocurrencies through peer-to-peer (P2P) market making.

Are you looking for fast-news, hot-tips and market analysis? Sign-up for the Invezz newsletter, today.

UNI is the native cryptocurrency that serves the role of a governance token.

ETH/USD increased trading on Uniswap as a catalyst for growth

In the latest crypto news, Ethereum (ETH/USD) became more traded on top of Uniswap than on Coinbase.

On November 14, 2022, Uniswap inventor Hayden Adams shared the news on Twitter, citing the analysis conducted by Nansen Chief Executive Officer Alex Svanevik.

In the report, it is clearUniswap had more volume than Coinbase.

At the time, Hayden Adams reported Binance was the leader, at $1.9 billion in volume, with Uniswap second with $1.1 billion and Coinbase third with $0.6 billion.

The FTX implosion and overall collapse have shifted traders’ perspectives and motivated them to move to decentralized alternatives.

The main goal of cryptocurrencies such as Bitcoin (BTC/USD) was to decentralize everything and provide user freedom when making transactions, whereas DEXs live up to these expectations more than CEXs.

Should you buy Uniswap (UNI)?

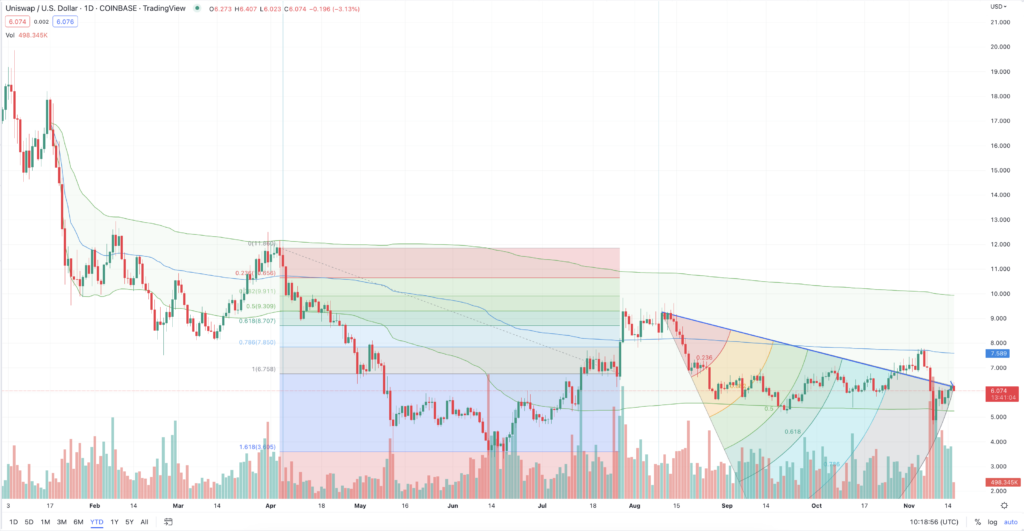

On November 16, 2022, Uniswap (UNI) had a value of $6.074.

The all-time high value of the Uniswap (UNI) cryptocurrency was on May 3, 2021, when it reached a value of $44.92. Here we can see at its ATH the cryptocurrency was $38.846 higher in value, or by 640%.

Going over the 7-day performance of the cryptocurrency, Uniswap (UNI) saw its low point at $4.80, while its high point of value was at $6.42. Here we can see an increase in value of $1.62 or by 33%.

However, when we look at the 24-hour performance, Uniswap (UNI) saw its low point at $6.05, while its high point was at $6.48. Here we can see a difference in the value of 7% or by $0.43.

Investors might gain interest in buying UNI, as it can climb to $8 by the end of November 2022.

Invest in crypto, stocks, ETFs & more in minutes with our preferred broker, eToro.

10/10

68% of retail CFD accounts lose money

[ad_2]

Image and article originally from invezz.com. Read the original article here.