[ad_1]

The U.S. 10-year Treasury yield is trading moderately lower this week on fresh concerns over a new COVID-19 strain which boosted demand for government bonds.

Fundamental analysis: Risk sentiment volatile

Reports about a new and a more transmissible coronavirus variant in the United Kingdom spooked investors earlier this week. The U.K. PM Boris Johnson said that the better part of the country is set to face stricter lockdown measures during Christmas holidays, while a number of other nations have immediately closed their borders to Britain.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

Investors were concerned that risks of new lockdowns and business shutdowns could curb the economic recovery in Europe, leading them to invest in safe-haven assets like U.S. Treasurys.

“Presumably the flight-to-quality would have been even more significant had it not been for Congress’s $900 bn pandemic relief bill which is set for a Monday vote by both the House and the Senate,” said Ian Lyngen, rates strategist at BMO Capital Markets.

“There is little question that the current price action represents the market’s kneejerk response to the actualization of a key pandemic risk on the path to the new normal – i.e. new strain of the pathogen,” he added.

On the other hand, the risk sentiment was boosted by news that Congress lawmakers finally came to an agreement over a new coronavirus aid package after months of negotiations.

The lawmakers had agreed over a $900 billion aid package which is expected to be voted on Monday, according to Senate Majority Leader Mitch McConnell and Minority Leader Chuck Schumer.

Technical analysis: Yields fall

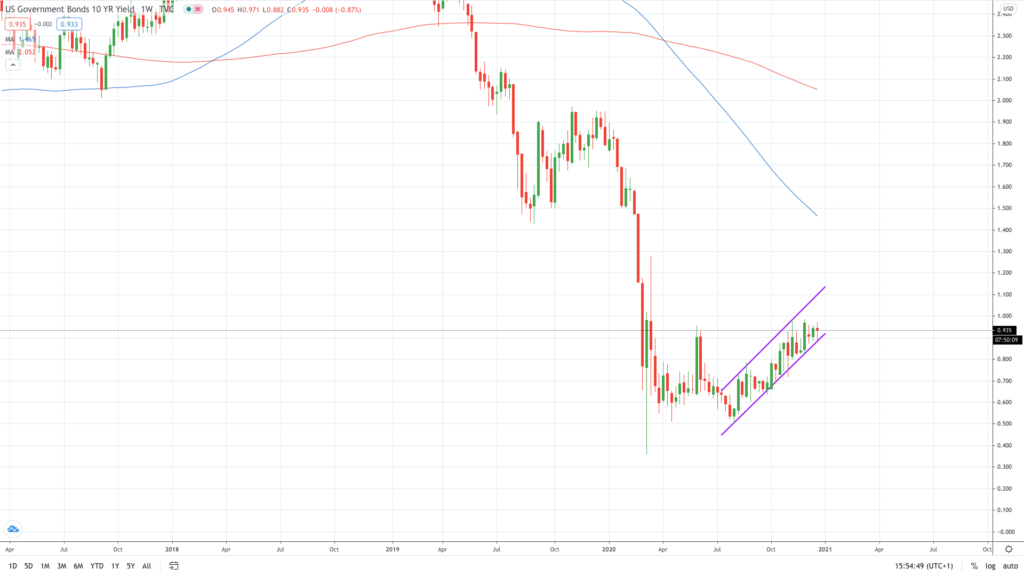

US10Y is trading 0.7% lower today or 0.87% in the red on a weekly basis. Overall, the price action has continued to trade mostly sideways after coming close to trading at 1% for the first time since March.

In theory, the 10-year Treasury yield is closely watched as an indicator of broader investor confidence.

Summary

U.S. Treasuries fell on Monday on the news about a new, more transmissible coronavirus variant in the United Kingdom, driving investors to buy safe-haven assets.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- Capital.com, simple, easy to use and regulated. Register here >

*Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

[ad_2]

Image and article originally from invezz.com. Read the original article here.