[ad_1]

EPS revisions are moving down. And fast. In the context of a macroeconomic slowdown – one that appears to be accelerating – this is hardly surprising. But what does it mean for stocks, if anything? If you are in the technical analysis camp, this may not really be on your radar screen. However, evidence suggests it should be.

The chart below shows how current revisions are tracking for the forward year 2023 relative to a typical revision cycle. Quite clearly, this revision cycle is more aggressive than the usual experience.

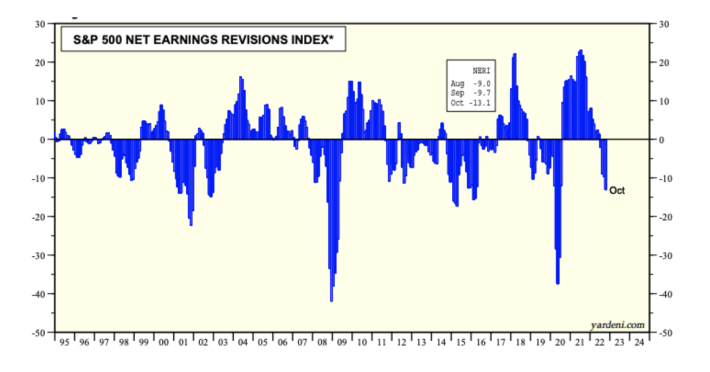

Another way to look at it is by simply comparing upgrades vs. downgrades. Here, too the cycle is well on the way to match the horrid 2015/16 experience, possibly worse.

Yardeni research

The reason for this is likely two-fold.

One, the pandemic caused a large behavioral change globally and analysts were forced to decide how permanent or temporary the implications were, stock by stock. In some cases, the good times – think Netflix, Peloton etc. – were extrapolated too far into the future. Some of the current revisions are a payback for earlier, misplaced optimism.

Two, the economy is indeed cooling quite rapidly. Housing is the most obvious indicator where rising mortgages are bringing previously hot housing markets off the boil. But more broadly, activity is slowing.

Still, why should we care?

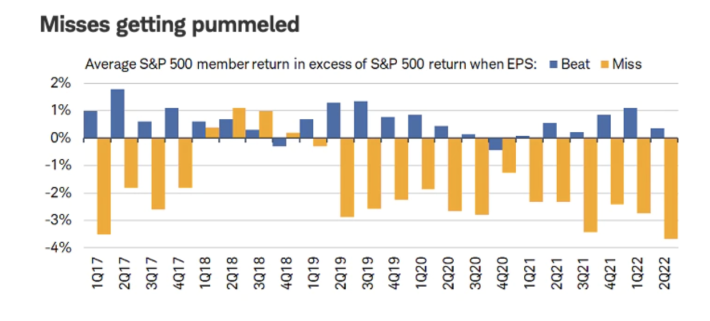

Earnings disappointments are getting punished a lot more than they have done in some time. As shown in the chart below (courtesy of Charles Schwab analysis), stocks that beat estimates were rewarded on the day of their earnings’ release but less than the prior two quarters. In contrast, stocks of companies missing estimates were punished to a more significant degree than anything seen over the past five years.

Charles Schwab

Idea Spotlight: Fisker (FSR)

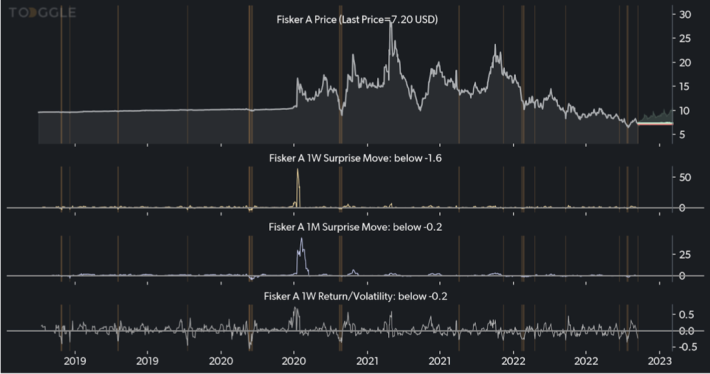

TOGGLE analyzed 13 similar occasions in the past where entry point indicators for Fisker were oversold and historically, this led to a median increase in price. This insight received 6 out of 8 stars in our quality assessment.

Last Wednesday, Fisker reported a loss of 49 cents a share, versus Wall Street’s expectation of 42 cents. However, the company is on track to start production of its first EV, the Ocean SUV.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.