[ad_1]

Midterm elections may not be top of mind right now between the bear market, Russian invasion and skyrocketing inflation. But with less than a month to go it’s good to think about the implications for equities. Some of the findings are surprising (and encouraging). Read on.

The usual pattern, politically speaking, is that the President’s party loses seats. That’s widely expected to happen this year, too. According to the FiveThirtyEight, a popular election forecasting site, Democrats are likely to hold on to the Senate but lose the House.

FiveThirtyEight

How about stocks?

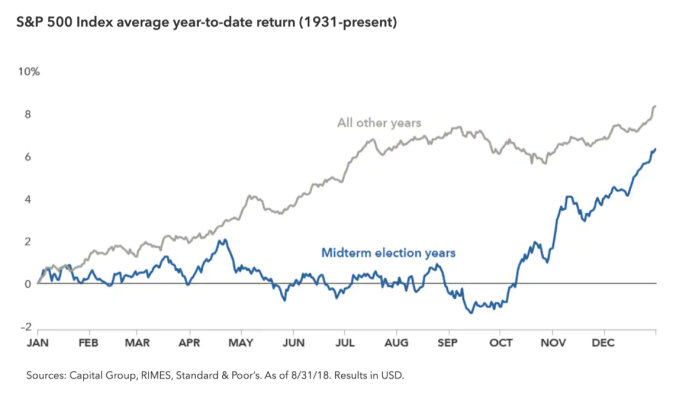

A well-researched article from the Capital Group (chart from the article below) highlights that across 85 years of history, there is a persistent seasonality pattern in midterm election years. In particular, market performance tends to be “blah” right up until the election, and prices quickly catch up with the usual annual returns.

Why?

Markets hate uncertainty and elections are no different. With both the House and Senate majority potentially up for grabs, possible policy outcomes vary widely.

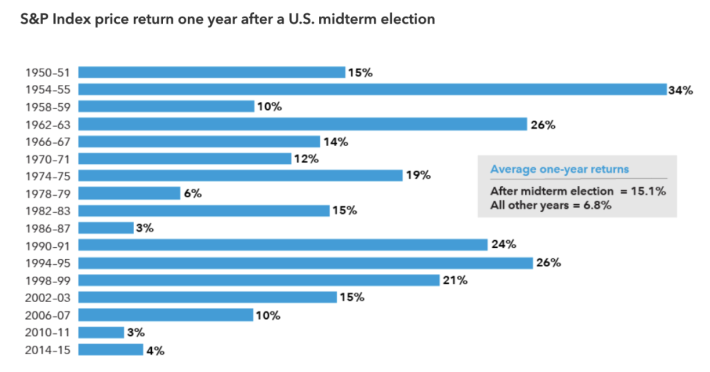

The relief is palpable: across every midterm election year going back to 1950s, S&P 500 has never recorded a negative return in the 12- month period following it.

In fact, the average 15% return is more than double the typical 12-month rolling return for the index across all other periods.

Capital Group

It’s been a tough year for equity investors but the timing of midterm elections coincides with a few other timelines that suggest a market bottom. It’ll have been almost 12 months since major indexes peaked, a common bear market experience, and the decline may well match the usual -30% drop. Assuming the Fed will be near the end of its tightening cycle and a recession set to begin in 2023, the stage could be set for a dramatic relief rally, just as everything looks hopeless (The despair, too, is a solid foundation for a major low).

Idea Spotlight: Pfizer (PFE)

Price level indicators for PFE:NYSE dropped abruptly to and historically, this led to a median increase in price of 10.77% over the following 3M. TOGGLE analyzed 16 similar occasions in the past to produce the median projection and this insight received 5 out of 8 stars in our quality assessment.

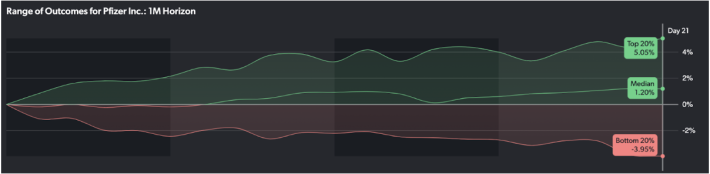

Catalyst incoming! Pfizer is set to announce Q3 2022 corporate performance on November 1st at 10:00 AM ET. Historically, after beating EPS expectations, the stock has typically risen 1.20% over the subsequent 1M horizon.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.