[ad_1]

TLDR

The two news snippets below show investors are forecasting the end of the hiking cycle. This will help prop markets.

Why is the hiking cycle about to end?

For two good reasons: growth is falling and inflation is falling too.

Leading indicators worldwide are pointing to a fall in both inflation (thankfully) and growth (less thankfully).

Central Banks make a habit of watching these indicators – as investors know. So it is not impossible to assume that equities and long treasury bonds will begin to look for a bottom in prices soon

So what does that mean for investing?

The simplest strategy to invest your money is risk parity: mix together equities and bonds in equal risk-adjusted proportions, let it rest for a few decades, then retire.

Risk parity has worked like a charm for centuries, but has recently sold off HARD. Looks like a great entry point to us.

In conclusion

In conclusion, many investors are living with a mindset that sounds more or less like “Inflation is so high! I need to invest, but where?” The answer might be to stay in cash and get ready to enter the market in Q4 or Q1.

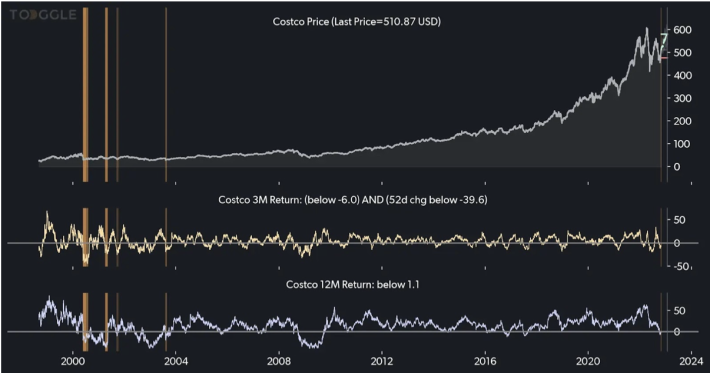

Idea Spotlight: Costco (COST)

TOGGLE analyzed 7 similar occasions in the past where momentum indicators for Costco decelerated and historically, this led to a median increase in Costco price. This insight received 5 out of 8 stars in our quality assessment.

Costco’s dividend yield is currently at a historical low and the stock has bullish seasonality over the next month. They will announce earnings on Dec. 8, 2022.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Image and article originally from www.nasdaq.com. Read the original article here.