[ad_1]

Financial regulations are becoming more far-reaching and restrictive. At the same time, employees are working from home and trading at higher volumes across more platforms than ever before.

Yet compliance teams have limited budgets and staffing resources, and many are struggling to implement effective risk-mitigation measures across financial services firms with hundreds or even thousands of employees.

It’s increasingly clear that to minimize risk, firms need the help of dedicated compliance software.

But purchasing and implementing that software among teams and workflows is only the first step in a much larger process. It’s convincing employees to use compliance software that will really make the difference.

Driving Software Adoption

Why might employees be slow to adopt or hesitant to use compliance software? The answer is fairly obvious. To most employees in the financial services industry, compliance can seem like a tedious administrative task that offers them no direct benefit. Although compliance teams might understand that broad organizational compliance depends on everyone’s participation, employees may have a more difficult time seeing how their own compliance roles are integral to the organization’s overall mission.

What’s more, financial services firms often cobble together several in-house or third-party technology solutions to support compliance requirements. However, these disconnected tools remain distributed across different systems. If employees don’t know how or where to complete compliance tasks right away, there’s little incentive to adopt the software.

How can compliance teams drive software adoption in light of these challenges? It boils down to creating a culture of compliance by making compliance tasks easy and by highlighting the importance of each task for the firm at large.

The following tips can help compliance teams earn employee buy-in, encourage adoption, and lower their firm’s risk:

1. Involve First-Line Managers

The responsibility to lead software adoption and the consequences of a failed software implementation often fall only on compliance teams. Compliance team members, however, tend to sit in entirely different sections of the organization from the employees who must use the software in their day-to-day roles.

When first-line managers take some of that responsibility, it can foster greater adoption and accountability. By ensuring their direct reports execute on compliance expectations, managers can help create a stronger culture of compliance across an organization. So keep managers up to date on employees’ compliance activity so they can focus on those who might need an extra push. Compliance software can aid this effort through dashboards, automated alerts, or even prescheduled reports — all of which together can lessen the need for one-to-one communication from the compliance officer and ensure that the right people have what they need to help support a culture of compliance.

2. Distribute Compliance Updates and Information Effectively

If an employee has a compliance-related question and can’t find an easy solution, they may be discouraged from or delay using compliance software. So give them a simple way to find answers when they’re stuck and no compliance officer is available to offer direct help.

Create a document library or database within (or easily accessible from) your compliance software that employees can search and use. Include material that answers common compliance questions. For example, what’s the firm’s policy around gifts and entertainment? At what point should employees submit approval requests for those items? Will these and other policies change if an employee works in a different country?

The most common questions will vary from firm to firm, but answering them — and making those answers easy to find — is a good place to start.

3. Automate Manual Tasks Where Possible

Highlighting how software can automate manual tasks — and therefore free up capacity for higher-value work — will incentivize its adoption among the compliance team. Manual tasks always create extra headaches. Take brokerage statements, for example: Whether it’s the employees themselves or the compliance team members who are responsible for entering these into the system, it takes time. And then there’s the additional administrative task of making sure everything is done correctly and people are held accountable.

Instead, rely on a platform that can automatically ingest executed trades via electronic broker feeds each day or rely on a company that provides a service for processing paper broker statements. This saves both employees and compliance officers time while increasing the compliance team’s chances of catching, investigating, and defusing any suspicious activity.

Compliance software offers a promising solution for aligning with regulations, but only if compliance teams can address some of the common causes of organizational pushback. To cultivate buy-in and promote software adoption, teams must distribute compliance information well, automate compliance demands whenever possible, and involve first-line managers. These solutions can help manage organizational risk, avoid costly regulatory fines, and prevent reputational damage.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

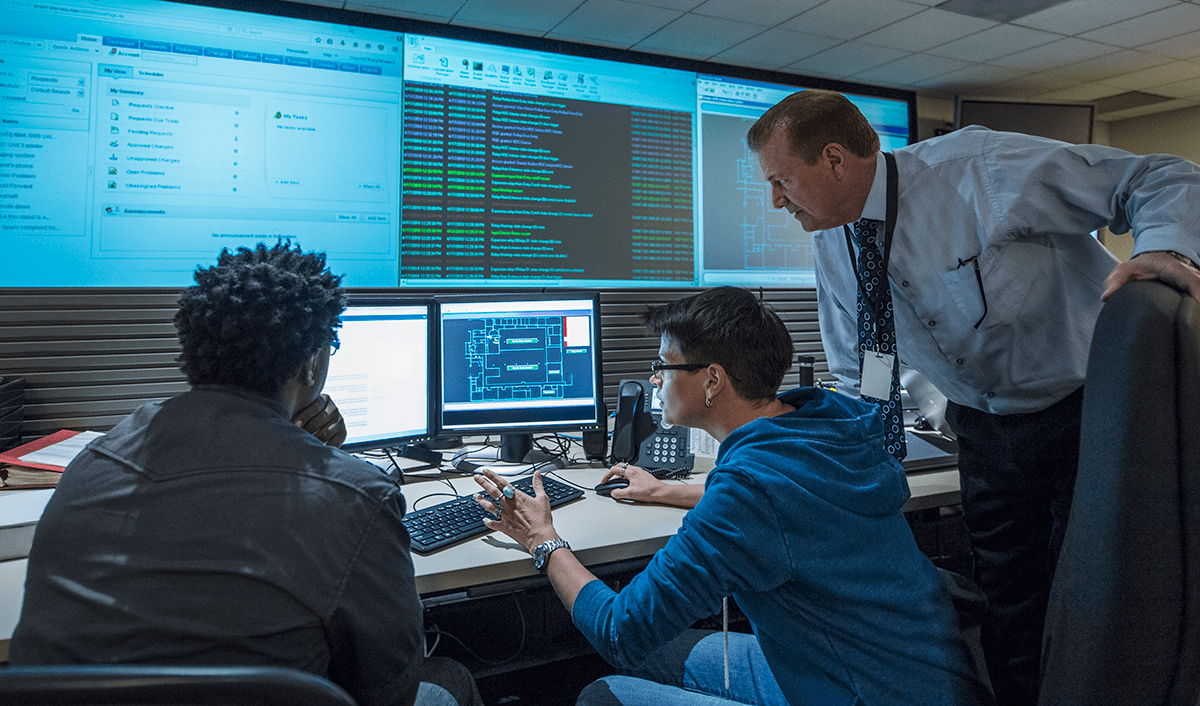

Image credit: ©Getty Images / Erik Isakson

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.