[ad_1]

“Most innovations fail. And companies that don’t innovate die.” — Henry Chesbrough

Innovation prevails during times of adversity. Organizations can treat the current coronavirus crisis as an existential threat or as an opportunity to help effectively navigate rough terrain now and in the future.

Responsible innovation might just be a transformative solution.

The traditional, shareholder-value centered asset management business model is under financial and social pressure. A more balanced approach that considers all stakeholders — clients, employees, communities, the environment, and, yes, shareholders — is possible.

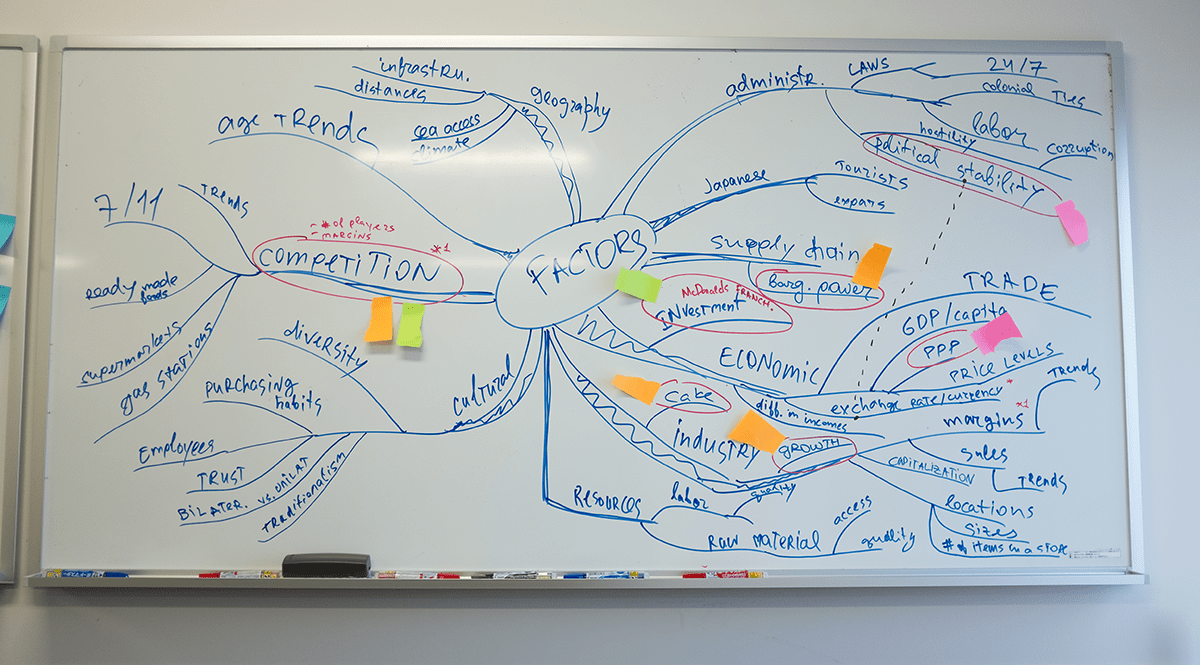

Twenty-five senior industry practitioners gathered in London in early March, prior to the lockdown, for the second installment in a European series of Asset Management Innovation (AMI) Initiative Responsible Innovation1 roundtables. Our objective: to discover how the asset management industry can innovate responsibly through the lens of business models.

Our previous roundtable demonstrated that the current asset manager business model has not significantly evolved over the years and is in urgent need of a reset. Since the 2007–2008 financial crisis, the industry has scrambled to regain investor trust.

But new catalysts for change are emerging: The generational shift in the

customer base, the pressure on margins from low rates, the prevalence of passive

investments, the democratization of investment knowledge, the threat posed by

new entrants, and the regulatory mandate to mitigate climate change are all

reshaping the landscape.

The coronavirus pandemic may be a new and unexpected catalyst but it has sparked a sudden change across the financial world. Banks and corporates are canceling dividends and buybacks, in some cases to explicitly protect jobs. Could this crisis herald a move towards that new balance, a shift away from a shareholder-centric to a stakeholder-centric focus?

Roundtable participants shared their experiences and discussed the challenges

they face when trying to change their business models. A change in how a

company operates requires a shift in its culture and mission. That new mission should

cascade down and permeate all aspects of the organization, from the way

business is conducted, products constructed, managed, and priced, and, finally,

customers served. So how can a business model be shifted in a way that nurtures

responsible innovation?

We believe responsibly innovative business models offer at least three distinct ways to develop.

Roundtable Participants

| Alex Hiniesto, CFA | Elisabeth Vishnevskaja, CFA | Monika Machon |

| Alexandra Haggard, CFA | Eliza Dungworth | Niral Parekh, CFA |

| Amin Rajan | Fabrizio Palmucci, CFA | Olivier Lebleu, CFA |

| Andreas Utermann, CFA | Gemma Steel | Rhodri Preece, CFA |

| Aoifinn Devitt, CFA | George Latham | Roberto Silvestri |

| Armarjit Singh | James King | Sam Livingstone, CFA |

| Arvind Sabharwal, CFA | James Larkman | Will Goodhart |

| David Sheasby | Julia Susanne Orlich | |

| David Wahi | Massimiliano Saccone, CFA |

At best, innovation is a long and difficult process.

Shifting an established asset manager’s mission or culture is not an easy task. It requires time, and usually more than is contained in any single CEO’s tenure. Compounding the problem, new CEOs tend to bring different philosophies and often dial back the changes made by their predecessors. Another issue: Medium to large asset managers may have a different P&L for different teams. In practice, this means teams often compete rather than work together toward a common goal.

All of which brings up a critical point: To change its culture or

business model, an asset manager must commit to change over the long term. A

company must rewrite its DNA so that change is spliced into it.

Innovation requires us to embrace change and adapt to a new order. But at many asset managers, individuals and teams are inflexible and unproductive. They have become “dead wood.” Others have entrenchment strategies to maintain the status quo. The “agile” approaches that work in other industries are not embraced in asset management.

Technology is a powerful driver of change in other sectors, but most

asset managers are burdened with costly legacy systems. Many are still

struggling to implement such “basic” technological updates as efficient

websites and CRM systems. The industry has yet to deliver a game-changing

application of artificial intelligence (AI) or machine learning. These

innovations are still perceived as “frontier” and not “core” technologies for

the time being.

One last impediment: Product innovation is easily copied in the sector, so there is little first-mover advantage. This is a big deterrent to innovation, especially for businesses that are not mission driven.

We believe the following three approaches to developing responsibly innovative business models that emerged from our discussion could help surmount these obstacles.

1. Starting from Scratch

This is not an option for existing well-established businesses but is obviously

perfect for start-ups. It lays out the “ideal” attributes of a business model,

a baseline, that is responsibly innovative. As our discussion made clear, starting

from scratch is a luxury and a great way to avoid battles with legacy systems

and entrenched cultures.

The keys to ingraining responsible innovation in corporate culture are a

solid sense of purpose around clients and a positive mindset that allows for trial

and error and failure. That employees know each other well and work closely

together means they “own” the mission. Once the right culture is in place, its

principles should permeate everything, from employee conditions and client

relationships to product development.

The B corporation, or B-corp, business model might inspire some of these

new firms. Over 2,800 companies have this international certification, including

some asset managers. B corps embrace a stakeholder focus and seek to balance the

objectives of clients, society, and employees.

Roundtable participants acknowledged how an emotional connection with the customer is important to align the asset manager with the client’s end objectives. Also, if the business’s core added value is customer relationship management, then reducing or eliminating the intermediaries in the distribution value chain is critical.

Example: Dozens (banking industry)

2. “Spin Off” from a Traditional Player

New product launches have a long tradition in the asset management

industry. A new fixed-income, equity, or multi asset strategy that hits the

market and raises enough cash will soon be imitated by the whole sector. Innovation,

however, does not apply when it comes to conducting business. Whether investment

boutiques, one-stop shops, public, or privately owned companies, all asset

managers operate in essentially the same way. But what if an asset manager

instead launched a new corporate set up, that it owns but that operates independently

from the main business?

The new business’s mission? To target a specific type of client with specific needs and focus on a specific type of service, say a quant asset allocation modeling service, that doesn’t clash with the mother ship’s traditional, discretionary asset allocation service. The new structure could focus on a specific type of operational efficiency, using new non-legacy systems.

A separate structure with independent decision making gives the new business line a start-up feel, as outlined in the first approach, and enables the construction of specific cultures, values, and missions that embed responsible innovation at their core.

One banking industry example — Mettle — came up during our discussion. Mettle is an online digital bank that operates as a standalone unit within the Royal Bank of Scotland group. It targets small and mid-sized business customers and can therefore tailor its services to those customers via a specific digital platform. One example of such offerings is the digital “bookkeeping and day to day accounting” service. Mettle was launched via NatWest Ventures, which highlights the need for ample funding.

Example: Mettle (banking industry)

3. Asset Managers Alliance

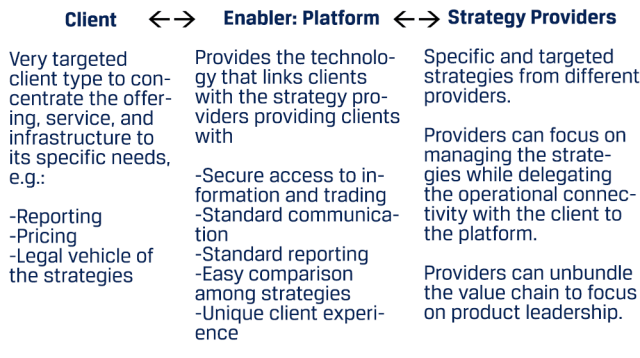

The multi-sided alliance approach is another business model that can embed responsible innovation. This could work by targeting a specific client segment, pension funds, for example. On the other side, different asset managers could bring together specific investment strategies designed for the targeted client type. What if clients could get all the products they need under one umbrella? What if these products could be customized? This could be enabled through a specific technology, a common platform, that would give access to the strategies in a seamless, user-friendly, and efficient manner. For example, reporting or legal structure could be standardized across strategies and asset managers, as demonstrated in the diagram below.

Schematics of the Multi-Sided Platform

Here the approach externalizes responsible innovation by making an outside party the enabler. That party would embed responsible innovation into its mission, culture, and values. As mentioned above, corporate governance would require some attention.

Examples: The Asset Management Exchange, The Big Exchange

Conclusion

When it comes to innovation, the right model is hard to find. There is no one-size-fits-all solution. But innovation is essential even if it might be fraught with failure. Our suggestions are just a few examples. There are certainly many more.

Open innovation is part of the answer and could help the asset management industry avoid perpetuating its inward-looking ways. Other sectors of finance, banking and insurance, among them, have also taken a more decisive stance and have created innovation labs.

1. Asset Management Innovation (AMI) is a pan-European initiative group of senior asset management leaders with the mission to help position the European asset management industry at the forefront of responsible innovation.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Morten Falch Sortland

Professional Learning for CFA Institute Members

Select articles are eligible for Professional Learning (PL) credit. Record credits easily using the CFA Institute Members App, available on iOS and Android.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.