[ad_1]

The consumer is tapping “out.”

Ever since inflation entered the financial system is early 2021, there has been a debate as to when the higher cost of living would hit consumer spending to the point of inducing a recession.

Sure, consumers can rely on savings or credit to make ends meet in the near-term. However, if inflation remains elevated for a prolonged period, eventually it becomes too much to bear, and the consumer is forced to “tap out” and cut discretionary expenses. That’s when a recession hits.

I mention all of this because the stock market is telling us that the recession has arrived.

One of the best means of analyzing intra-market developments is ratio work. This consists of comparing the performance of one asset or stock relative to the performance of another.

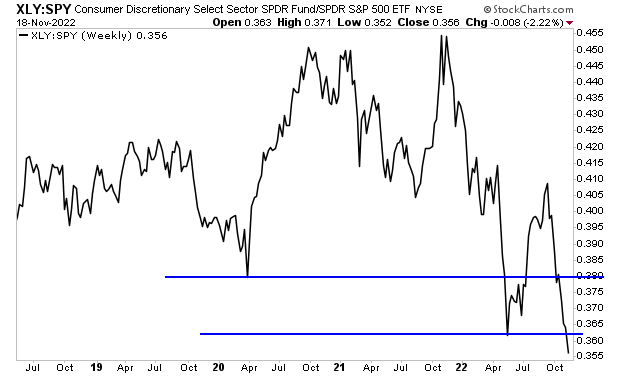

For example, let’s look at the ratio between the Consumer Discretionary ETF (XLY) and the S&P 500 (SPY). During periods of consumer spending strength, this line rises. And during periods of consumer spending weakness this line falls.

Below is a chart of the ratio over the last four years. As you can see, this ratio is dropping like a stone. It is actually lower today than it was at the lows of the March 2020 Crash!

This suggests the consumer is “tapping out” right here and now. The question now is if this is just a slight downturn or the start of a major recession. To answer that, let’s step back and look at a longer-term chart.

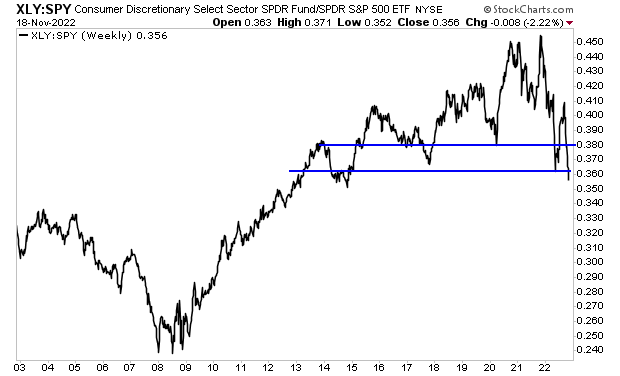

From an economics perspective, this is the most disturbing thing I’ve seen in years. It suggests the U.S. is entering its first major recession since the Great Financial Crisis of 2007-2009.

I think we all remember what happened to stocks during that time: an extraordinary crash in which stocks lost over 50% of their value.

A crash is coming. And it’s going to make 2008 look like a joke.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.