[ad_1]

Stocks are now in very serious trouble.

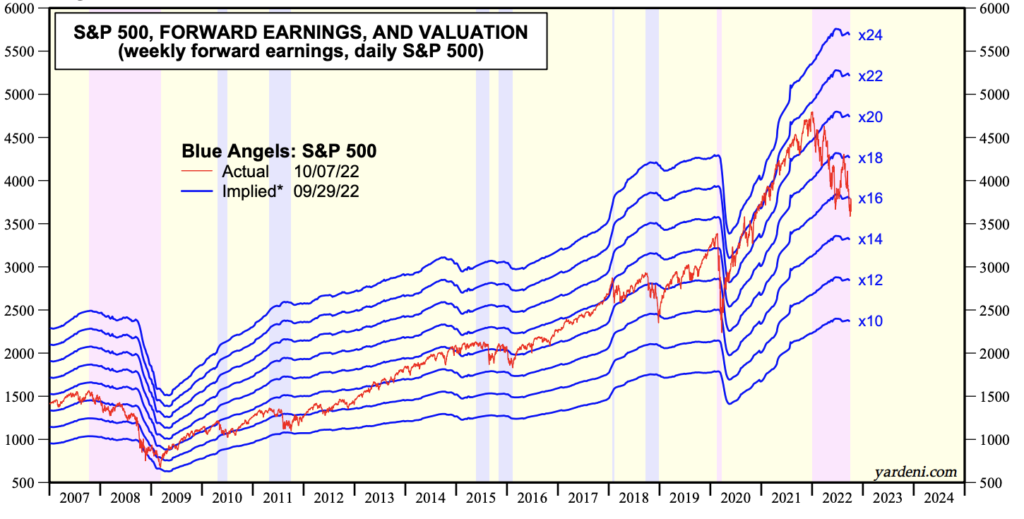

The ENTIRE collapse thus far in this bear market for stocks has been due to bond yields rising. When Treasuries were yielding 0.25%, investors were willing to pay 20-22 times forward earnings for stocks. However, once Treasury yields rose to 3%+, stocks were repriced down to 16-18 times forward earnings.

The below chart from Ed Yardeni does a great job of illustrating this.

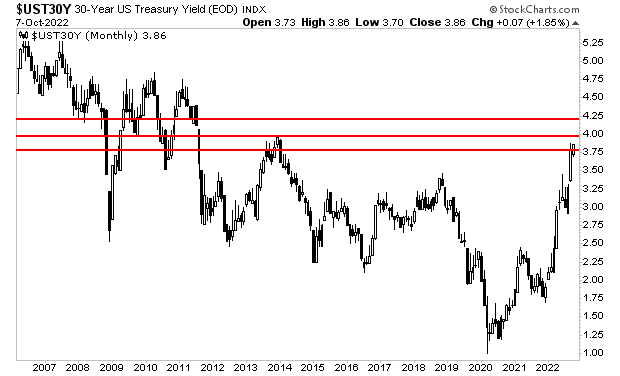

I bring this up because Treasury yields are showing NO SIGNS of stopping.

The yield on the 30-Year Treasury erupted higher last week, breaking above critical resistance at 3.75%. The door is now open to 4% if not 4.25%.

This means that stocks are about to be repriced even lower, possibly to 14 times forward earnings, or ~3,400 on the S&P 500. And if Treasury yields don’t stop soon, we might even go to 12 times forward earnings which is sub-3000 on the S&P 500.

This all ties in with what I’ve been saying for months…

Inflation blew up the Everything Bubble. And smart investors are using this to see incredible returns!

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.