Article content

(Bloomberg) —

[ad_1]

(Bloomberg) —

Author of the article:

Bloomberg News

Libby Cherry and David Goodman

Publishing date:

Jul 24, 2022 • 43 minutes ago • 4 minute read • Join the conversation

(Bloomberg) —

This advertisement has not loaded yet, but your article continues below.

Whoever becomes 10 Downing Street’s newest resident will inherit a maelstrom of economic problems.

UK inflation running at the fastest pace since the early 80s. The Bank of England’s tip-toeing on rate hikes relative to its peer across the Atlantic. Festering labor and supply-chain wounds left by Brexit.

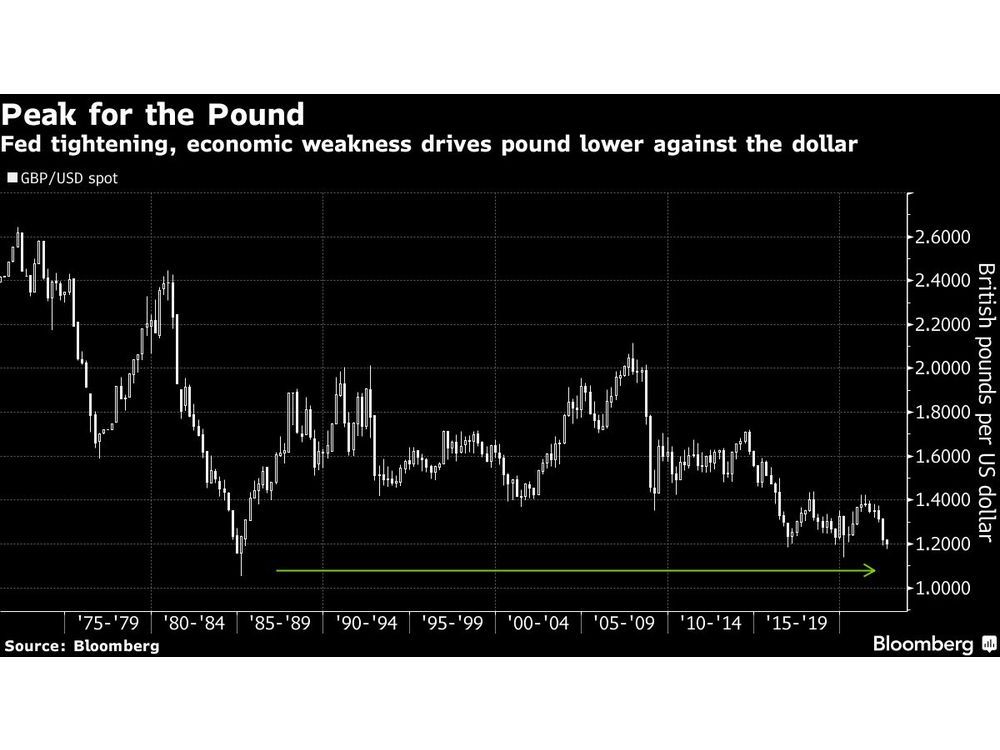

All of that has sterling languishing near levels last seen when the Covid-19 panic and lockdowns were at full force.

Add in the UK’s long-term bugbear of falling productivity, and “the new UK government is taking over in a difficult situation,” said Ulrich Leuchtmann, head of currency strategy at Commerzbank AG. “There is always the risk of a nasty spiral of higher inflation and a weaker currency.”

Investors and strategists agree: regardless of whether it’s Foreign Secretary Liz Truss or former Chancellor of the Exchequer Rishi Sunak who prevails in the leadership race, the forces behind the pound’s slide may prove beyond their powers to address.

This advertisement has not loaded yet, but your article continues below.

Volatile energy prices and a tight labor market have already left BOE policy makers teetering between aggressive interest-rate hikes and the need to cushion the economy from surging prices. With its open economy and huge current-account deficit, the UK is vulnerable to global strife. Inflation will top the pace in any of its major European peers over the next two years, according to economists surveyed by Bloomberg.

Since Brexit, sterling has become a more “peripheral” component of investors’ currency holdings, according to Bank of America strategist Kamal Sharma. That leaves it particularly exposed to souring investor sentiment globally as Russia’s invasion of Ukraine grinds on and China’s Covid fight hurts the domestic economy.

This advertisement has not loaded yet, but your article continues below.

Using world equity markets as proxy, the pound has become steadily more sensitive to global risk appetite.

As Britons feel the pinch of a feebler pound when shopping for goods shipped from overseas, the nation’s central bankers watch the impact on price growth as costly imports fan inflationary pressure. A slump in Bank of England’s preferred gauge of pound strength this year has added about 0.5 percentage points to the pace of inflation, according to Bloomberg Economic’s SHOK model.

“Even if the economy scrapes by in the positive column for GDP growth for now, things will feel very recessionary,” wrote Standard Bank G-10 strategist Steven Barrow in a note to clients this week. Barrow envisages a surge in strike action amid the kind of “union militancy” last seen in the 1970s and 1980s.

This advertisement has not loaded yet, but your article continues below.

BofA Sees UK Recession in 2023 on Higher Inflation and Rates

More expansive fiscal support from the government might seem the obvious solution to buoy struggling households, but there’s a risk it could fan inflation and make the BOE’s job harder. Tax-cut pledges by candidates could pour fuel on rising prices and require extra central bank tightening.

Barrow sees the pound sinking further to $1.15 against the greenback in the coming months. Sterling’s more than 11% drop against the dollar this year has forced BOE policymakers to take note: Catherine Mann has said she backed a 50-basis-point hike to help support the currency, double the size of the BOE’s most recent moves.

Rates Chasm

That may go some way to narrowing the central bank’s rate gap with the US Federal Reserve. The BOE has increased rates by 115 basis points over six months, compared with 150 basis points by the Fed in half the time. Bloomberg’s gauge of dollar strength is around the highest level in at least 18 years.

This advertisement has not loaded yet, but your article continues below.

To be sure, the pound’s not the only one facing a surging US currency. Nor are the factors plaguing sterling unique to the UK. The euro fell to parity against the dollar for the first time in 20 years this month, while the ECB has only now deployed its first rate hike since 2011.

“A large deficit, high inflation and political turbulence is the fate of many countries,” particularly in Europe and the Eurozone, said Amundi Asset Management portfolio manager Philippe Jauer, alluding to the resignation of Italian premier Mario Draghi, which plunged the nation’s politics into chaos.

Those ructions may win the pound some ground against the common currency, but over six to nine months Bank of Montreal’s Stephen Gallo predicts the euro-sterling pair will move higher to 0.91 from around 0.85 now.

“There’s limited rally potential regardless of who wins,” he said.

This Week

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.