[ad_1]

“We know less than we are willing to believe, while applying less than we know.” — Markus Schuller

Buzzwords vs. Innovative Specialization

Professional investors face the same challenges across asset classes, strategies, and geographies:

They all must consider how to meet their investment and career objectives as digitization-driven margin pressure, the asset management industry’s oligopolistic tendencies, and regulatory requirements that encourage standardized services push asset managers and asset owners in a direction they have thus far avoided: developing a comparative advantage through innovative specialization.

Board rooms, media publications, and consulting pitches are thus full of VUCA buzzwords like change management, agile organizations, self-optimization, mindfulness, and artificial intelligence. These popular phrases might appeal to venture capitalists (VCs) during elevator pitches and are easy to cite, but do they make investment professionals truly walk the walk of innovative specialization?

Innovative specialization requires going beyond lip-service, fee reduction, and digitized me-too products. Individual decision makers must be empowered through directed change in order to resiliently focus on most evidence-based decisions. Such change is effortful and thus difficult and painful at times, but it is the best way to achieve innovative specialization.

Finance professionals have no shortcut to innovative specialization other than empowering their individual decision making. Why? Because of the half-life of financial knowledge.

The Half-Life of Financial Knowledge

Derived from nuclear physics, the half-life of knowledge concept describes the time it takes for half of the knowledge in a certain field to decay or become obsolete. This means that engineers, medical doctors, and finance professionals need to keep up with the state of knowledge in their discipline to stay relevant in their work. To accomplish that, they need to study a certain number of hours per week.

Since interest in this subject is relatively recent, content on the half-life of knowledge, especially in finance, must be considered carefully. Indeed, much of the available literature is composed of web articles. Nevertheless, almost all point to one main source: The Half-Life of Facts by Samuel Arbesman.

Arbesman compares scientific publications to uranium atoms. A single uranium atom’s rate of decay isn’t predictable, but that of a mass of such atoms is. Arbesman conducts his analysis through the prism of scientometrics, which studies scientific publications, or the “science of science.” That discipline has produced the most reliable material on determining the half-life of knowledge and researchers have calculated the half-life of certain fields. Their methodologies tend to differ, but the results all speak the same language.

Rong Tang studied the citation distributions of monographs in religion, history, psychology, economics, math, and physics. She finds the half-lives for psychology and economics were 7.5 and 9.38 years, respectively.

Another team of researchers analyzed the half-lives of 14 professional psychology specialties. These range from 7.58 years for clinical health psychology, to 9.6 for cognitive and behavioral psychology, to 18.37 for psychoanalysis.

In “Journal Usage Half-Life,” Phil Davis focuses on article downloads from various academic and professional journals. He computes the half-life as the median age of articles in the sample. According to his results, the half-lives for all studied fields range from two to five years.

Using the above data, we carried out a proxy computation by analyzing papers’ citation life cycles. We compared the different sciences as well as the different fields within economics, from the most theoretical research areas to the most applied ones. We took the average citation peak and calculated the time for that figure to halve.

We observed half-lives of eight to nine years for psychology, eight to 10 years for economics, five to six years for finance, and eight years for applied theory.

By comparing our results with those from the literature, we calculated the half-life of financial knowledge as follows: For applied research and theory, we determined half-lives of five and 10 years, respectively.

Finally, we broke down the annual figures to determine how many hours per week of study was required for practitioners to stay up to date. Using the methodology developed by T. F. Jones, we derived a formula: N/(2*h*w) when N is the number of hours invested in a degree, w the number of weeks per year dedicated to training, and h the half-life of knowledge in years.

If we use the European Credit Transfer System (ECTS) as a proxy, earning a master’s degree requires between 7,500 to 9,000 hours of study, or 1,500 to 1,800 hours per year, according to the ECTS Users’ Guide. So a half-life of 10 years and 7,500 hours of study requires 7.8 hours of study per week. A half-life of five years and 9,000 hours of study would require 19 hours a week.

Based on these calculations we found finance professionals must study between eight and 19 hours per week to keep up with the state of knowledge in the field.

Our results are unequivocal. The knowledge base of every finance professional is aging fast and directed change towards empowered decision makers is essential. The question is how can that directed change be accomplished.

The Case against Passive Forms of Learning

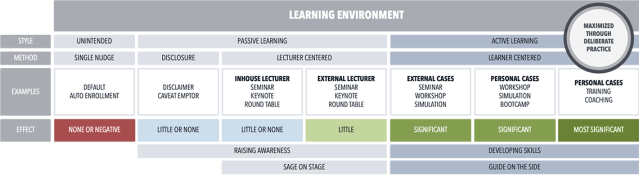

The learning environment for directed change is divided between passive and active forms. The illustration below summarizes the relevant realm of literature.

The more tailored an individual’s active learning environment, the better the directed change that can be facilitated. Passive forms of learning generate little to no impact: They raise awareness. They don’t develop skills.

Therefore, we can largely discount the directed change capabilities of the following forms of learning:

| Seminars | Keynotes |

| Roundtables | Webinars |

| Podcasts | Video lectures |

| Online courses | Panel discussions |

| Pattern recognition software | Cultural change interventions |

| Virtual, augmented, and mixed reality learning technologies |

Indeed, it would mark a naïve understanding of life, the complexity of cognitive processes, and the ambiguity of human civilization to think that seminars, webinars, online courses, and the like achieve directed behavioral change.

The academic evidence is clear: They do not.

The Case for Tailored Active Forms of Learning

Empirically, the more tailored an individual’s active learning environment, the better directed change towards empowerment can be facilitated and the most evidence-based investment decisions achieved.

So how can that environment be created?

Basic Assumptions

As primates, we are negentropic beings that stabilize our state through autopoietic repetition.With that context in mind, our research derived seven basic assumptions for directed change towards empowerment:

- Behavioral change can happen through endogenous and exogenous triggers.

- Empowerment seeks to target a specific form of behavioral change: directed change.

- Directed change is the exception because of our resistance to change drive by our mental immune system.

- The context for directed change is complex, ambiguous, and dynamic.

- Directed change is effortful, which is a euphemism for difficult and at times painful.

- Intervention design is decisive for how effortless directed change can be achieved.

- Cultural change and technological change are ineffective intervention points.

Framework for Directed Change

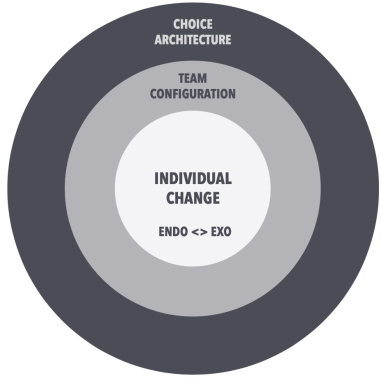

How can all these assumptions be satisfied in a single comprehensive framework? How can we intervene in the choice architecture of a professional investment process to enable empowerment towards most evidence-based decision making?

The Panthera Intervention Framework is our attempt to satisfy these assumptions. It addresses the need to overcome the described resistance to change by constructively closing the knowing–doing gap.

Our framework concentrates on an intervention design composed of three foundational layers:

- A choice architecture that incentivizes meaning creation, reduces friction, and provides a tailored active learning environment for decision makers (nudges, simple rules, etc.).

- A team configuration that encourages critical appraisal through cognitive diversity and procedural design.

- Directed behavioral change towards empowerment via

- Establishing focus through intuition-driven heuristics (i.e., internal and external distractor management through search, stop, decide routines) and debiasing techniques.

- Applying the established focus to select plausible tools, methods, and sources to build the case for most evidence-based investment decisions.

To be sure, the framework does not offer any easy answers. But achieving innovative specialization through directed change is not an easy process. Nevertheless, such approaches are a necessity for those who want to win the race against the half-life of financial knowledge.

Further Reading

Bibliography

Anauati, V., Galiani, S., and Gálvez, R. H. 2016. “Quantifying the Life Cycle of Scholarly Articles across Fields of Economic Research.” Economic Inquiry.

Angel, R. 2013. “The Impact of The Half-Life of Facts on Education.” Wired.

Bailey, R. 2012. “Half of the Facts You Know Are Probably Wrong.” Reason.

Carlson, B. 2018. “The Half-Life of Investment Strategies.” A Wealth of Common Sense.

Charette, R. N. 2013. “An Engineering Career: Only a Young Person’s Game?.” IEEE Spectrum.

Chernev, A., Böckenholt, U., and Goodman, J. 2015. “Choice Overload: A Conceptual Review and Meta-Analysis.” Journal of Consumer Psychology.

Davis, P. M. 2013. “Journal Usage Half-Life.” Phil Davis Consulting.

The Economist. 2012. “The Q&A: Samuel Arbesman. The Half-Life of Facts.”

European Higher Education Area; Bologna Process; European Commission. 2015. ECTS Users’ Guide. Publication Office of the European Union.

Galiani, S., and Gálvez, R. H. 2019. “An Empirical Approach Based on Quantile Regression for Estimating Citation Ageing.” Journal of Informetrics.

Gourville, J. T., and Soman, D. 2005. “Overchoice and Assortment Type: When and Why Variety Backfires.” Marketing Science.

Halpin, G., Halpin, G., and Arbet, S. 1994. “Effects of Number and Type of Response Choices on Internal Consistency Reliability.” Perceptual and Motor Skills.

Hertwig, R., and Erev, I. 2009. “The Description-Experience Gap in Risky Choice.” Trends in Cognitive Sciences.

Hertwig, R., and Pleskac, T. J. 2008. “The Game of Life: How Small Samples Render Choice Simpler.” In Chater and Oaksford, The Probabilistic Mind: Prospects for Bayesian Cognitive Science. New York: Oxford University Press.

Jones, T. F. 1966. “The Dollars and Sense of Continuing Education.” IEEE Transactions on Aerospace and Electronic Systems.

Neimeyer, G. J., Taylor, J. M., Rozensky, R. H., and Cox, D. R. 2014. “The Diminishing Durability of Knowledge in Professional Psychology: A Second Look at Specializations.” Professional Psychology: Research and Practice.

Schuller, Markus. 2017. “Ambiguity Tolerance Beats Artificial Intelligence.” Enterprising Investor.

Schuller, Markus. 2018. “The Knowing–Doing Gap in Behavioral Finance.” Enterprising Investor.

Schuller, M., Mousavi, S., and Gadzinski, G. 2018. “More Rational Investment Decisions through Heuristics Management.” Academy of Management, Annual Summit, Chicago. Conference Paper.

Schuller, M., Gadzinski, G., and Mousavi, S. 2019. “Intuition-Driven Heuristics for Rational Investment Decisions.” Qualitative Research in Financial Markets.

Schuller, M., Mousavi, S., and Gadzinski, G. 2019. “Intuitive Behavioral Design.” Behavioral Economics Guide 2019.

Schwartz, Barry. 2004. The Paradox of Choice, Why More is Less: How the Culture of Abundance Robs us of Satisfaction. New York: Harper Perennial.

Simon, H. A. 1956. “Rational Choice and the Structure of the Environment.” Psychological Review.

Tang, R. 2008. “Citation Characteristics and Intellectual Acceptance of Scholarly Monographs.” College & Research Libraries.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty images / Alexlky

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.