[ad_1]

Across all economic sectors, disruptions resulting from the global pandemic have forced businesses around the world to adapt and create new models of work. Although some industries may eventually return to a more normal operating model, the investment industry has already crossed a threshold, according to Kunal Kapoor, CFA, CEO of Morningstar.

“The longer this [disruption] is drawing out, the more it’s not about navigating a period,” Kapoor said in a recent CFA Institute panel discussion about the future of work. “It’s about permanently changing the style in which you run your team.”

In other words, the future of work has already arrived for investment professionals.

Kapoor’s observation came as part of the interactive CFA Institute webinar “The War for Talent and the Return to Work,” held on 16 September, which drew investment industry leaders together to share their insights about the emerging model of work for firms and professionals. Joining Kapoor in the discussion were Carol Geremia, president of MFS Investment Management and head of global distribution, and Lori Heinel, CFA, executive vice president and global chief investment officer at State Street Global Advisors. Rebecca Fender, CFA, chief of staff for Research, Advocacy, and Standards at CFA Institute, served as moderator.

During the webinar, audience members were invited to participate by responding to survey questions and by submitting their own questions for the panelists to address. Adding the diverse perspectives of participants to the expertise of the panelists provided an illuminating snapshot of an industry culture in transition for organizations as well as for individual professionals and their careers. Everyone seemed to agree on one thing: As Geremia put it, the investment industry as a whole has arrived at “an enormous opportunity.”

A New Paradigm for Productivity

The panelists agreed that firms will need to adopt a hybrid model that combines flexibility and virtual work with the need for in-person interaction. Stressing the need for a forward-looking approach to leadership, Heinel said, “It’s not about return to the office. It’s the future of work.”

Even though the focus is on the emergence of a new model, some roles may not change much at all. Client-facing professionals who tend to travel and be out of the office a lot, for example, have long had their own hybrid model of work, while certain other functions need to be done on-site in an office most of the time. For example, the latency of technology is a critical factor for traders, who may need to work in an office environment to have access to the right platform.

The need to combine conventional working arrangements with alternative approaches is why investment firms will have to adopt a hybrid model that can incorporate the best of both worlds and produce better outcomes for all participants, including clients. For Heinel, the conversation should start with a fundamental question: How can people get work done most effectively? Because different functions will have different answers, a model based on flexibility and adaptability will lead to greater complexity for firms to manage.

In what might be a counterintuitive outcome, many firms, including those of the panelists, have reported an increase in employee engagement during the pandemic, but the situations that correlated with higher engagement may also come with tradeoffs. Regardless of how motivated and engaged employees are, a hybrid model will pose challenges for connecting individual professionals within and across teams and fostering the development of meaningful relationships.

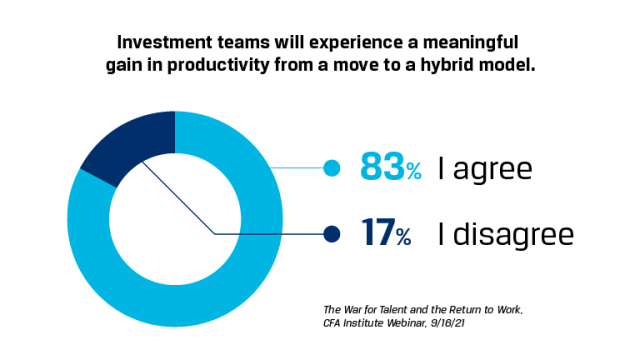

Ultimately, any model of work will be measured by productivity, which is turning out to be an area with a significant perception gap between management and employees. When webinar audience members were asked to agree or disagree with the statement “Investment teams will experience a meaningful gain in productivity from a move to a hybrid model,” there was an overwhelming consensus, with 83% expecting a productivity boost.

The strong positive response did not surprise the panelists. In general, employees appear to perceive themselves as having been more productive during the pandemic, but from the perspective of management, these professionals may have been getting more accomplished simply because they have been working more hours rather than being more productive or efficient with their time.

“I’m not sure that if you actually looked at the amount of time they spend doing things versus the output, it would actually translate through,” said Heinel. “I think it’s just been that the work/life balance has gotten a little bit out of whack.”

The question of productivity also raises what Geremia called “the biggest challenge of the hybrid model” for management. Performance can vary widely among different types of employees, and Geremia described a scenario in which more autonomous employees may thrive with less supervision while those who need more managerial support may not get enough direction or help. Heinel pointed out that personality differences are another important factor to consider. For example, the constant demand for virtual meetings can be exhausting for introverts, which can leave them with less energy to form and strengthen connections with other team members.

From Geremia’s point of view, the overall challenge for leadership can be framed as another type of inclusiveness — how to manage firms in a way that includes and integrates a wider variety of workers with different characteristics and circumstances.

Impact on Careers

If a hybrid work model increases complexity for firms, it also will add new considerations for the career planning of individual investment professionals. A hybrid model may offer some advantages, but there will be tradeoffs too.

One benefit of a hybrid model based on flexibility is that reducing geographic barriers will expand opportunities. Heinel noted that her firm recently filled a position that in the past had always been placed in one of two locations; in this case, however, the best candidate was not based in either location. Given the greater flexibility of a hybrid model, the firm was able to hire the preferred candidate without requiring relocation. The robust job fit may be one reason why the new employee has been able to succeed in forming strong relationships despite the greater distance.

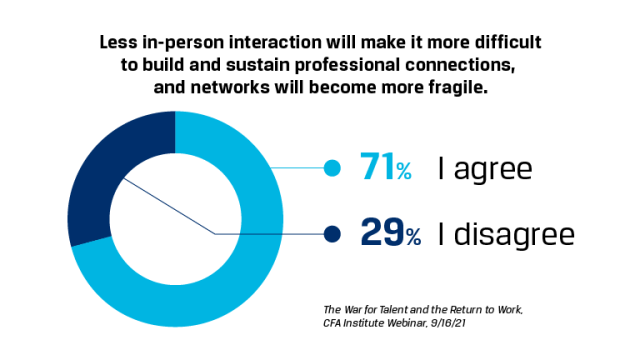

A global talent pool means global competition among professionals vying for positions. Building strong professional networks will become more important than ever, but the challenge of trying to form meaningful relationships will be more difficult. Pointing out that relationships in a virtual world can become more “transactional” and less personal, Kapoor said, “My concern is where you want the deepest relationships. How do you sustain those?”

The bottom line is that investment professionals will need to be more vigilant and active in building and maintaining effective networks. In fact, many of them already seem to understand this reality. When webinar audience members were asked for input, 71% agreed with the statement “Less in-person interaction will make it more difficult to build and sustain professional connections, and networks will become more fragile.”

A hybrid model of work will also pose challenges that vary for professionals at different stages of their careers, and some of the issues can defy stereotypes about generations. Consider the impact of technology. Although younger generations are often perceived as more comfortable with technology, the panelists have found that younger employees may be the ones who have a stronger desire to work in an office environment more often.

According to Kapoor, younger employees at Morningstar have said that they learn a lot by observing in the office “but they’re not seeing the people who are coaching them and mentoring them here as frequently.” Moreover, because Morningstar has a history of promoting internally, there may be concern about opportunities for advancement. “That’s an imbalance that we have to address,” Kapoor added.

Heinel had a similar observation. “This is an apprenticeship business, and being able to learn organically and through the personal nature of how those insights get transmitted is something that [some employees] are just starved for.”

The impact on individual professionals can go beyond the conventional notions of career planning. Highlighting the issue of mental health, Geremia noted that “the burnout level” has become a concern, and the problem is not limited to employees lower in the hierarchy who feel that they are under more pressure. “Even CEOs get burned out,” added Kapoor.

Is the stress associated with adapting to the pandemic only temporary? Because a hybrid model of work will carry forward some of the changes that began as short-term adjustments, mental health could be an ongoing concern in the industry. More than ever before, the model of work may have to account for the whole person in a qualitative way — not only in the quantifiable aspects of performance, such as productivity.

Organizational Cultures and Client Relationships

The new model of work in the investment industry will have significant implications for organizational cultures as well as cultivating client relationships. Developing trust will be key in both areas, according to the webinar panelists.

Within firms, leaders will have to find ways to develop cultures with a shared sense of purpose. A hybrid model of work will bring opportunities to increase diversity in multiple ways (not only in the conventional sense of race, gender, etc., but also in terms of working arrangements and other factors), but greater diversity will also add to the challenge of developing a cohesive, unifying firm culture.

“Managers are just going to have to figure out a whole other level of team building and new norms within their teams and throughout organizations,” said Geremia. “The foundation of all of it is trust and the willingness to share information, the willingness to believe that my job is to make somebody else better, to make somebody else smarter, to inform somebody more so that we can collectively have better conviction.”

The only choice for investment firms and professionals is to face all these challenges and overcome them. “Flexibility is here to stay,” said Kapoor. “We have to prove that we can build firms and cultures that can endure with that flexibility.”

Organizational culture will inevitably have an effect on client relationships. For investment professionals, the tendency may be to focus on what is changing within the industry, but Kapoor pointed out that clients are going through their own evolution, which will necessitate a hybrid model for cultivating those relationships. “Clients are also adapting and changing the way they want to work,” he said, “so some mix of hybrid is here to stay.”

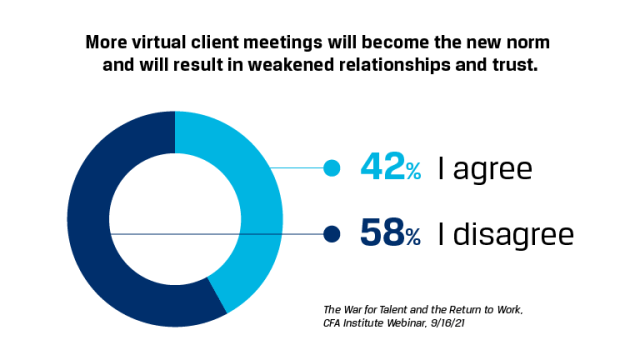

On the issue of client relationships, audience members were more divided about the future direction of change than they were about other topics. Given the statement “More virtual client meetings will become the new norm and will result in weakened relationships and trust,” 42% of audience participants agreed while 58% disagreed.

Heinel took a positive view, seeing potential for improving client relationships. “We could actually deepen the relationship with the client [by increasing interaction],” she said. Instead of flying only two people from a firm for a client meeting or presentation, a virtual meeting could include multiple team members sharing their own expertise.

Given the scale and speed of the changes under way, the investment industry will have to be agile and move quickly to find effective solutions that meet clients’ needs and expectations. “We’re going to figure it out,” said Geremia. “The most precious thing we have to protect is trust with our clients.”

What’s Next for the Future of Work?

CFA institute will dive deeper into examining the new work parameters for the investment industry in a multi-part research series that will explore what, where, and how work gets done.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Westend61

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.