[ad_1]

Now that September has begun, markets seem to be just reeling from the Federal Reserve’s more hawkish stance than they expected.

In sync with the stock market, the crypto market tumbled after the Federal Reserve expressed its hawkish views on Friday, August 26. During the Jackson Hole economic symposium in Wyoming, Fed Chairman Jerome Powell said the Fed will keep raising interest rates until inflation is contained. He pointed out that history cautions against prematurely easing policy, citing the June FOMC projections for a federal funds rate slightly below 4 percent by 2023.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

The Federal Reserve learns three lessons

According to Powel, the Fed learned three lessons from inflation in the 1970s and 1980s. To begin with, the central bank must take responsibility for ensuring low and stable inflation. Next is an interesting one – if consumers expect inflation to be low and stable, it will be. In plain English, if you convince people that everything will be alright, it will be alright. Here’s some evidence to support this theory – consumer confidence in the US rose for the first time in four months in August, according to the latest Conference Board report.

The third lesson is to keep going no matter how long it takes – stay focused on your chosen path.

Powel continued by explaining that the pain associated with rate hikes, a slowdown in economic growth (probably a carefully chosen phrase for describing a recession) and a softer labor market would all be better than the pain if the Fed had not taken such an aggressive approach.

“These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain,” he said. Well, that does make sense. There’s no pleasure without pain, after all.

The Dow slumped 3% following Powell’s path of pain scenario, while the S&P 500 and Nasdaq Composite dropped even more. Bitcoin also dropped 6% for the day, following the trail of its traditional market counterparts.

There was some hope for investors in the data out prior to the Fed’s decision, when consumer spending edged up slightly and inflation eased, suggesting the central bank may consider easing its monetary policy. However, those hopes were dashed, and the markets reacted accordingly.

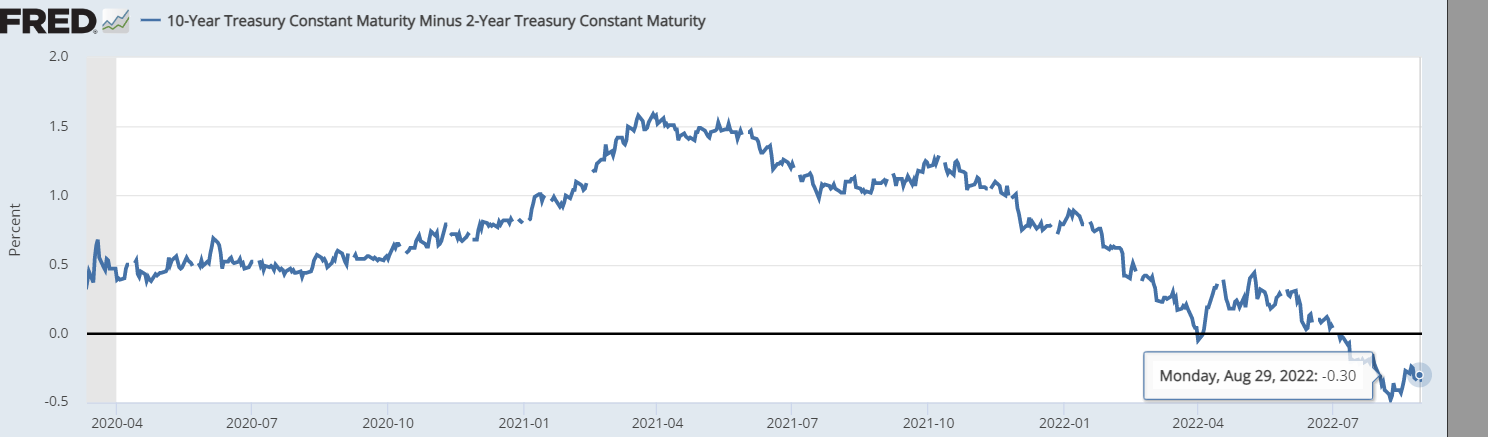

Recessions usually begin with some of the most typical preludes such as macroeconomic uncertainty, geopolitical instability, inverted yield curves, and a perception of impending recession – they are all intensifying at the moment.

We’re seeing a deepening inversion of the yield curve, with higher yields for 2-year government bonds and lower yields for 10-year bonds, although the latter carries higher risk.

Source: Fred.stlouisfed.org

As an example of how deep it could sink, early in the 1980s, when Paul Volcker raised interest rates to 20% to fight inflation, the yield curve fell to more than 200 basis points below zero.

Markets are now pricing in higher interest rates, so will selling pressure continue? The S&P 500 averaged a 0.6% loss in September since 1945, historically the worst month for the index. Bitcoin has also been in the red in September for most of its history.

Source: Coinglass.com

Prior to the highly anticipated US August jobs report, a number of economic reports will see the light of day, including US construction spending and vehicle sales, affecting stock markets and thus cryptos. It is therefore worthwhile to pay attention to these.

The Merge’s contribution to the crypto market

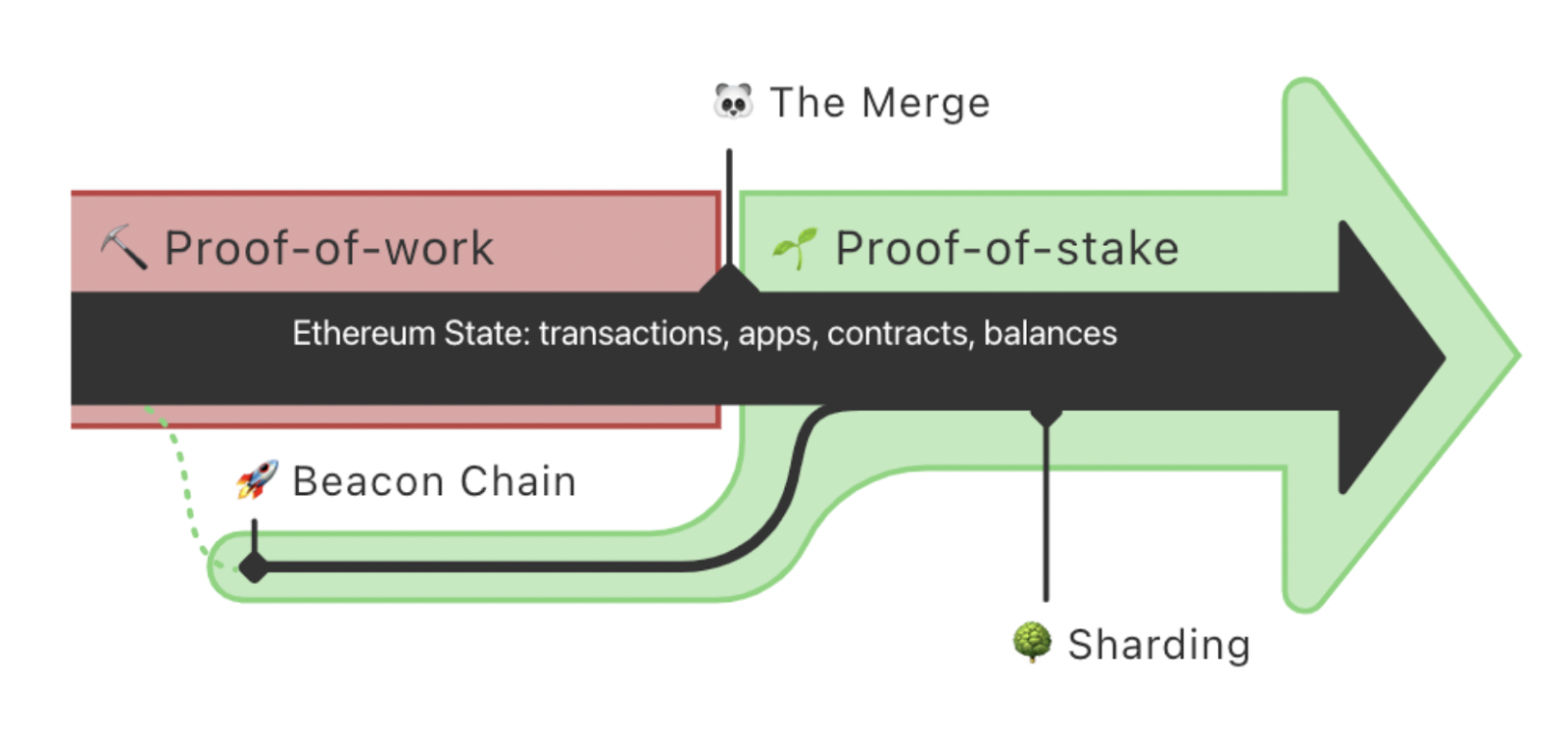

Around September 15th, Proof-of-stake (PoS) Beacon Chain (ETH2) will swallow Ethereum (ETH1). What will this mean for the crypto market?

First of all, the argument that Ethereum, DeFi, and NFTs are harmful to the environment will be put to rest. Consequently, ESG-compliant institutions will find Ether an appealing investment.

The Merge will also result in fewer ETH tokens being issued. There is currently a 4.3% increase in the supply of ETH every year, which incentivizes miners to secure the blockchain. The Merge will give the validators exclusive control over block creation, reducing the energy required for Ethereum. With a decrease of ETH issuance, supply and demand will take over, driving the ETH price up. Beacon is secured by ETH staking and users are rewarded with block rewards for staking. Staked ETH cannot be withdrawn until six months after the Merge, which reduces its circulating supply as well.

From the perspective of the average user, although Ethereum is switching from proof-of-work to proof-of-stake, its entire history remains intact – your ETH funds in your wallet before The Merge will remain accessible following The Merge. You are not required to upgrade.

In addition to this, the Merge will allow users to protect the network at home instead of having to rely on institutions and large miners to do so. It will allow the network to become more decentralized and thus more resistant to attacks.

From the perspective of miners, it will be very difficult for them to choose whether to continue mining the current/ then old Ethereum chain and face numerous challenges or abandon it entirely and lose their profits.

It has already been announced by some exchanges that they will list a possible ETH POW coin after the Merge. From what we know so far, Poloniex, BitMEX, MEXC Global, Gate.io, and OKX will list ETHW. There is a possibility that DEXes like Uniswap may list ETH POW tokens even before CEXes. Additionally, traders can trade ETH POW futures similar to those offered on BitMex. This is a purely speculative market – it isn’t even guaranteed that the ETH POW token will exist.

Source: Ethereum.org

It is clear from Ethereum Classic’s continued existence that old and unused chains can still be valuable. However, contrary to previous Ethereum forks, this one comes with a large ecosystem of apps and tokens. There will be ETH-backed assets in an alternate network that miners will continue to carry on their shoulders. The Merge, for example, will result in you owning twice as much USDC and twice as much Ethereum NFTs. However, there has been widespread support for the POS chain from major exchanges, so it doesn’t matter in practical terms. All POW tokens, except for Ethereum POW itself, are likely to become worthless following The Merge.

Final thoughts

Doomsayers are always predicting a collapse during major market developments like The Merge or pressuring factors such as the Fed’s aggressive monetary policy. Crypto proponents have proven these doomsayers wrong as the market doesn’t die, and even attracts new investors. With $10 trillion in assets, Blackrock, the world’s largest investment manager, has entered the Bitcoin space. It would not have done so if Bitcoin’s value was zero. Cryptocurrency closely tracks stock market movements, but they are not the same in essence – crypto is a network similar to the internet rather than a firm with earnings and assets.

As Ethereum’s development progresses, it will also contribute to the adoption of itself and other cryptocurrencies.

In addition, all of this is happening during highly uncertain times, with inflation peaking, a recession already underway or imminent, and global financial disruptions, all of which are expected to drive up the adoption and prices of Bitcoin and Ethereum in the long run.

eToro

10/10

68% of retail CFD accounts lose money

[ad_2]

Image and article originally from invezz.com. Read the original article here.