[ad_1]

So much for the Fed pivot!

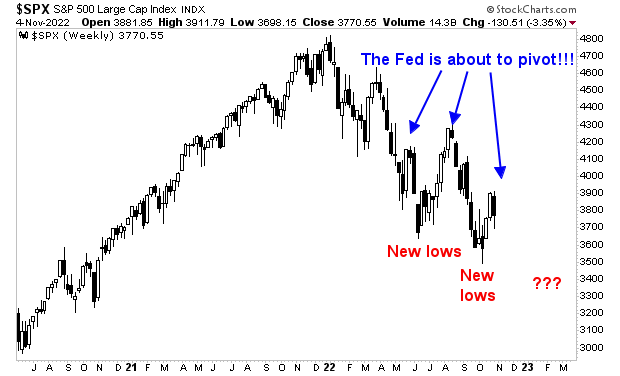

Ever since the Fed began tightening monetary policy in March of 2022, numerous pundits, social media personalities, and financial media types have been pushing the notion that the Fed will “pivot” or stop tightening monetary policy soon which will ignite a new bull market in stocks.

This narrative is both ignorant and deceptive.

It is ignorant in that history has shown us that stocks usually don’t bottom for another 14 months once the Fed starts easing monetary conditions following a cycle of tightening. This was the case during the Tech Crash and the Housing Crash.

I’ve received questions from several of you as to why this was not the case during the COVID-19 crash. In that particular instance the market was imploding due to an exogenous issue (the pandemic) triggering an economic shutdown, as opposed an organic bear market triggered by Fed tightening.

Moreover, during COVID-19, the Fed effectively backstopped the entire financial system, spending over $3 trillion buying municipal bonds, corporate bonds, corporate bond ETFs, student loans, auto loans, and more in the span of three months. Were the Fed to abandon its current monetary tightening and begin easing financial conditions, it would NOT implement similar schemes; rather it would likely simply cut rates.

So again, history is very clear here: barring an exogenous issue (another pandemic, nuclear war, etc.) if the Fed were to abandon its tightening and begin easing conditions, stocks would continue to fall and likely not bottom for another year.

However, the “Fed is about to pivot” narrative is not only ignorant… it is also deceptive in that there is practically ZERO evidence that the Fed has even begun considering it.

Looking over the statements made by Fed officials since March 2022, I’m struck by the fact that even the most formerly dovish Fed officials have become inflationary hawks.

Neel Kashkari is the President of the Federal Reserve Bank of Minneapolis. Prior to the Fed’s current monetary tightening it is quite difficult to find any instances in which he wasn’t a fan of money printing/ QE/ maintaining easy monetary conditions.

However, since the Fed embarked on its crusade to end inflation, Mr. Kashkari has been extremely hawkish. Some notable headlines from the last six months…

Fed’s Kashkari: We may have to push long-term real rates into restrictive territory.

~May 2022

Fed’s Kashkari says officials are ‘a long way’ from backing off inflation fight.

~July 2022

Kashkari stakes out the most aggressive stance on lifting interest rates

~August 2022.

Kashkari Says Bar for Fed Policy Pivot on Rates Is ‘Very High’

~October 2022.

Again, this is Neel Kashkari, the man who was arguing that the Fed shouldn’t “overreact” to “temporary inflation” throughout 2021. And now he is adamant that the Fed needs to be aggressive in raising rates to end inflation. Nowhere do you see him even hinting at the Fed pausing rate hikes let alone easing.

Another example of a formerly dovish Fed official turning inflation hawk is John Williams.

Mr. Williams is the current President of the Federal Reserve Bank of New York: the branch of the Fed responsible for market operations. In September of 2021, when inflation cleared 5% for the first time in 13 years, Mr. Williams commented that it might be “appropriate” for the Fed to ends its emergency level Quantitative Easing Program sometime in “mid-2022.”

Yes, he wanted the Fed to run QE for another eight months despite inflation clearing 5%. This was insanely dovish and negligent.

Fast forward to the middle 0f 2022, and Mr. Williams is making the following statements:

NY Fed president urges big interest-rate hike but believes ‘economy is strong’

~June 2022.

Fed’s Williams pushes back on market expectations of a rate cut next year.

~August 2022.

Fed’s Williams says more rate hikes needed to bring down inflation

~ September 2022.

My point with the above examples is anyone who pushes the narrative that the Fed will soon pivot isn’t actually paying attention to what the Fed (and Fed officials) are saying. In this sense, the people who keep finding excuses to push this narrative are being highly deceptive.

But that hasn’t stopped them from trying…leading investors to the slaughter time and again!

I’ll detail what’s really driving stocks higher in tomorrow’s article.

A crash is coming. And it’s going to make 2008 look like a joke. I coined the term the “Everything Bubble” in 2014. I warned about it for the better part of 10 years.

And it has officially burst.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.