[ad_1]

The Fed will end its two-day Federal Open Market Committee (FOMC) meeting today at 2PM East Standard Time.

The known universe expects the Fed to raise rates by 0.5%. And the current consensus is that by this time next year, inflation will be down near 2%.

It’d be hilarious if it didn’t involve so much suffering.

To understand what I mean by this, let’s wind the clocks back a year to the Fed’s December 15th 2021, FOMC meeting. At that time, the Fed had only just decided that inflation was NOT “transitory.”

Bear in mind, inflation has measured by the Consumer Price Index (CPI) had cleared 5% in June of 2021. It had since increased to over 7% as of December 2021.

Despite this, the Fed had yet to raise rates or end its Quantitative Easing (QE) program: the Fed Funds Rate was at 0.25% and QE was around $105 billion per month.

Again, inflation was over 7%, the Fed Funds rate was 0.25% and QE was still over $100 billion per month. So, what did the Fed, with its army of economics PhDs and analysts predict would happen once the Fed started tightening monetary conditions in 2022?

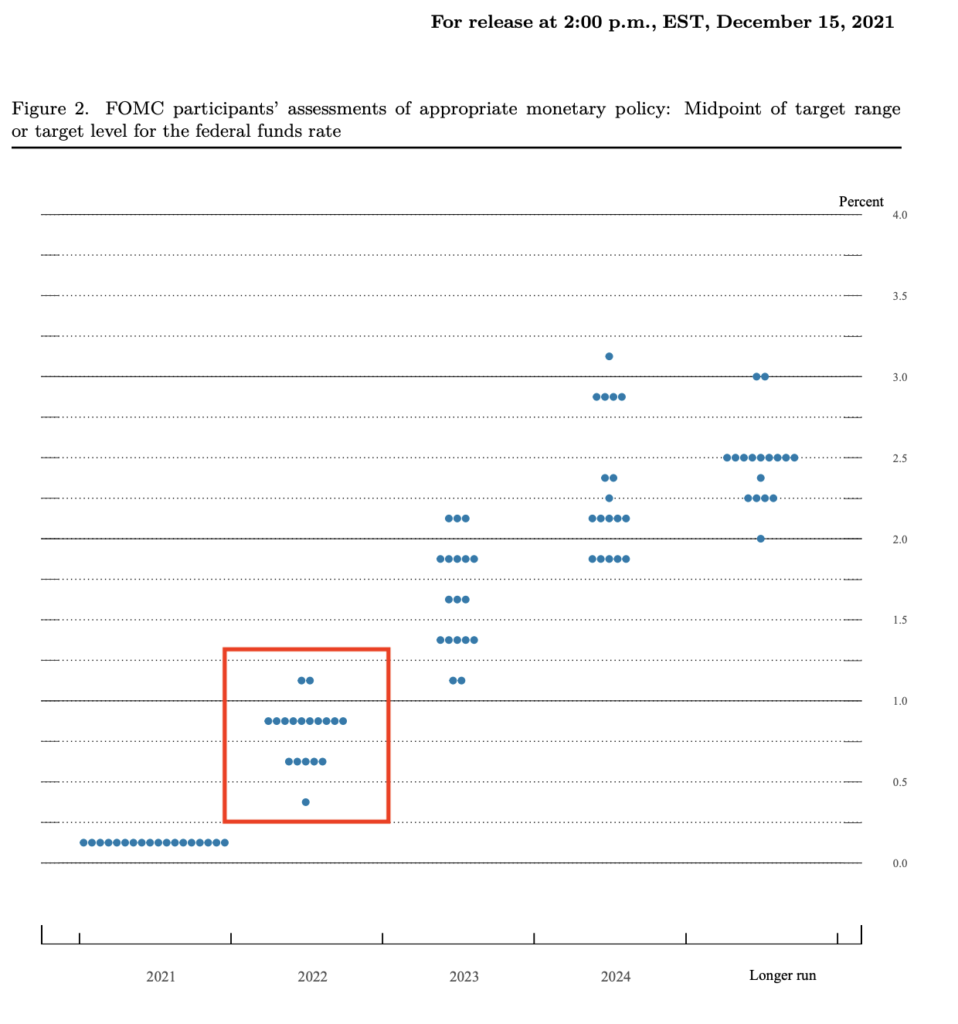

The Fed’s official forecast for 2022 was that rates would be somewhere between 0.5% and 1%.

That is correct. With inflation over 7% and rates at 0.25% in December 2021, Fed officials predicted that one year later rates would be somewhere around 0.5%-1%. In fact, even the most HAWKISH Fed officials only saw rates around 1.25% in December 2022.

Don’t believe me? Here’s the dot plot from the December 2021 meeting.

Fast forward to today… and rates are at 4.5%. The Fed was not even in the ballpark.

But wait… it gets better.

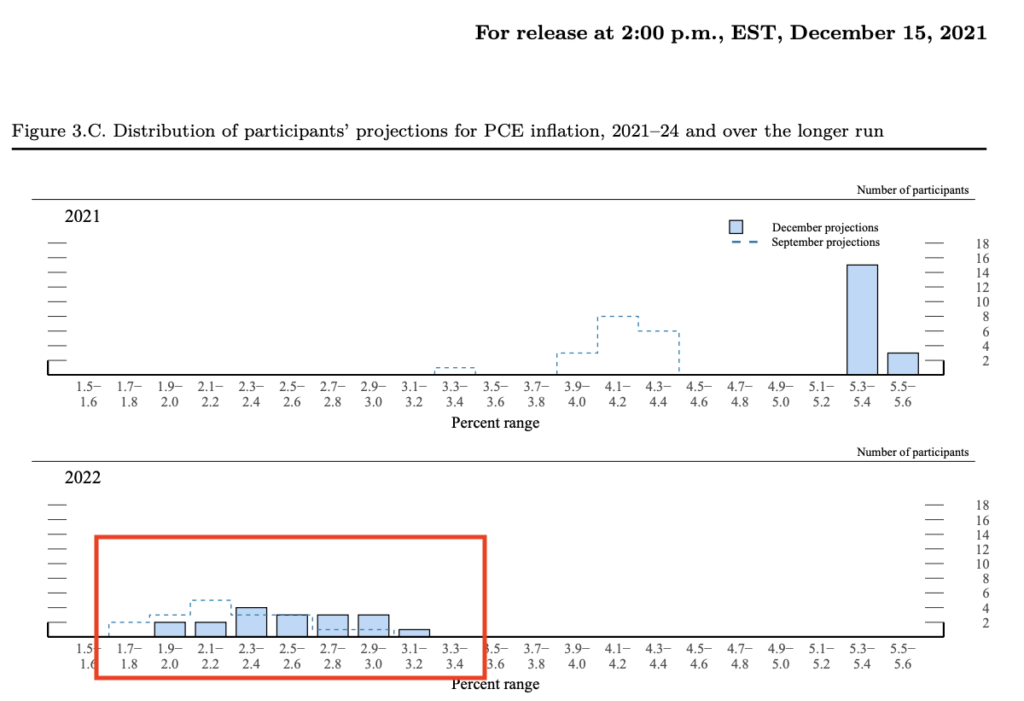

Back in December 2021, the Fed also predicted where inflation, as measured by the Personal Consumption Expenditures (PCE) index would be a year later.

That prediction?

That PCE would be somewhere between 1.9% and 3% in 2022. In fact, the absolute worst case scenario Fed officials forecast for inflation in 2022 was 3.1%-3.2%.

See for yourself.

Fast forward to today and Personal Consumption Expenditures (PCE) inflation is 6%… or roughly DOUBLE the Fed’s WORST prediction.

I bring all of this up because the current consensus is that inflation has peaked, the Fed won’t need to be much more aggressive going forward, and that this time next year, inflation will have fallen back to the Fed’s target of 2%.

Good luck with that!

Unfortunately for anyone who is buying into this narrative today, the bear market is NOT over. With a recession just around the corner, stocks will soon collapse to new lows. And that’s even assuming that inflation DOES drop to 2% next year (it won’t).

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.