[ad_1]

by BoatSurfer600

Anyone else feel like the US is slowly collapsing?

‘There is no more retirement’: Runaway prices are pushing seniors back to work

Recent data shows about 3.2% of workers who were retired a year ago have rejoined the workforce — about 1.7 million people.

That means the number of retirees heading back into the labor force is returning to pre-pandemic levels, says a spring report from the Indeed Hiring Lab.

Yet John Tarnoff, a reinvention career coach based in L.A., says unretirement has been an underreported phenomenon for years.

“The costs of living were going up even before the current inflationary cycle that we’re in now — costs were rising, fixed incomes were no longer good for people, Social Security as an institution is under threat,” says Tarnoff.

Difficult times ahead for the global economy. In the second quarter growth was negative while core inflation continues to rise. pic.twitter.com/vv8Oj3xEug

— Gita Gopinath (@GitaGopinath) September 2, 2022

World Bank President is warning that the global economy may be stuck in a stagflation quagmire for a while

Many fragile nations have already burned through the extra IMF reserves they got last year.

Stagflation and potentially a major debt crisis…

Quite a moment in history.

— Gold Telegraph ⚡ (@GoldTelegraph_) August 26, 2022

His bill went from £2,928 a year, to a staggering £22,516.34 … Europe is toast

Food producer warns of ‘price shock’ as carbon dioxide price quadruples

Poultry processor Ranjit Singh Boparan says increase will add £1m a week to his business costs

One of the UK’s biggest chicken producers has warned food security could be under threat and shoppers exposed to a “price shock” after a more than threefold surge in the price of carbon dioxide (CO2).

Pig farmers, soft drink producers, brewers and bakeries are also being hit by the increase in the cost of the gas, which is used to stun animals before slaughter, as well as in packaging and as an ingredient.

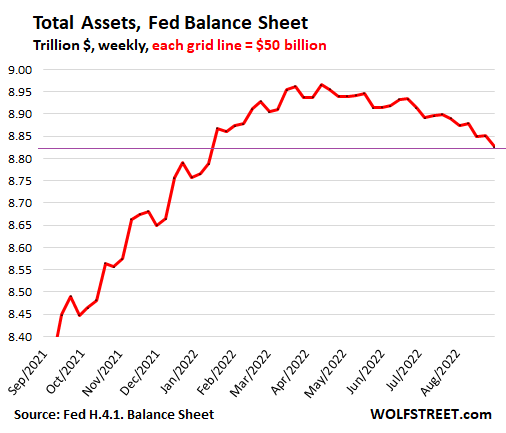

Fed’s QT: Total Assets Drop by $139 Billion from Peak (pace of QT is supposed to double in September…who else thinks Jerome Powell will go wobbly if the Fed’s Ponzi markets & asset bubbles start to crater?)

wolfstreet.com/2022/09/01/feds-qt-total-assets-drop-by-139-billion-from-peak/

60% of UK manufacturing is facing bankruptcy risk due to soaring energy bills…

“Exorbitant Rise In Energy Prices” Forces Europe’s Top Steelmaker ArcelorMittal To Close Plants

Even though European power and natural gas prices have subsided this week, Germany, the largest economy in the bloc, still faces historically high energy costs that have forced cuts in industrial output.

The latest example is the world’s largest steelmaker, ArcelorMittal, which released a statement Friday about shutting down two plants and idling one.

Europe’s top steelmaker said two plants in Germany (one in Bremen and the other in Hamburg) would be partially closed at the end of September. A plant in Asturias, Spain, will also be idled.

March against insecurity and crime in Cayenne, Guyana. The inhabitants denounce the abandonment of the department by the State. Shops and gas stations have lowered the curtain in a sign of solidarity with the demonstrators.#Cayenne #Guyana #Protest #news pic.twitter.com/3uPLovrYiW

— We Are Protestors (@WeAreProtestors) September 3, 2022

BREAKING: Massive demonstration in Prague in the Czech Republic against the government, soaring prices and the energy crisis.

Protesters threaten strike and coercive action if government doesn’t resign by September 25 🚨

— Wall Street Silver (@WallStreetSilv) September 3, 2022

Energy & food prices sky-rocketing, mortgages have more than doubled, stock portfolios soon to have drawdowns of 60-70%.

In 2023 we will also likely have a 10-20% unemployment rate.

Shit is about to get bad.

Good times are over.

— HOZ (@MFHoz) September 2, 2022

🇺🇸 Amazon Closes, Abandons Plans for Dozens of US Warehouses – Bloombergt.co/jQXSz8QmCm

— Christophe Barraud🛢🐳 (@C_Barraud) September 3, 2022

“Citigroup makes small cuts in mortgage workforce as housing market cools”

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.