[ad_1]

“We’d expect kind of double the normal length of a recession because the Fed’s not going to be at your back for a long time, and that’s a big deal,” Jensen told Bloomberg on Friday.

fortune.com/2022/12/16/how-bad-recession-double-normal-length-china-bridgewater-associates-cio/amp/

The Bridgewater co-CIO said that the “good news” is that there is far less leverage in the financial system compared with the period before the Great Recession of 2008, which he believes will prevent a “cascading effect” in markets that causes a deep recession.

“Instead, you have this long grind that’s probably a couple years,” he said.

US consumer credit card debt is at an all time high

www.cnbc.com/select/us-credit-card-debt-hits-all-time-high/

About 270,000 homebuyers who bought during the red-hot housing market this year already owe more than their house is worth, per YahooFinance.

— unusual_whales (@unusual_whales) December 17, 2022

BlackRock, $BLK, has said to get ready for a recession unlike any other.

— unusual_whales (@unusual_whales) December 17, 2022

Deep Recession Ahead, as Central Bankers Empty the Punch Bowl

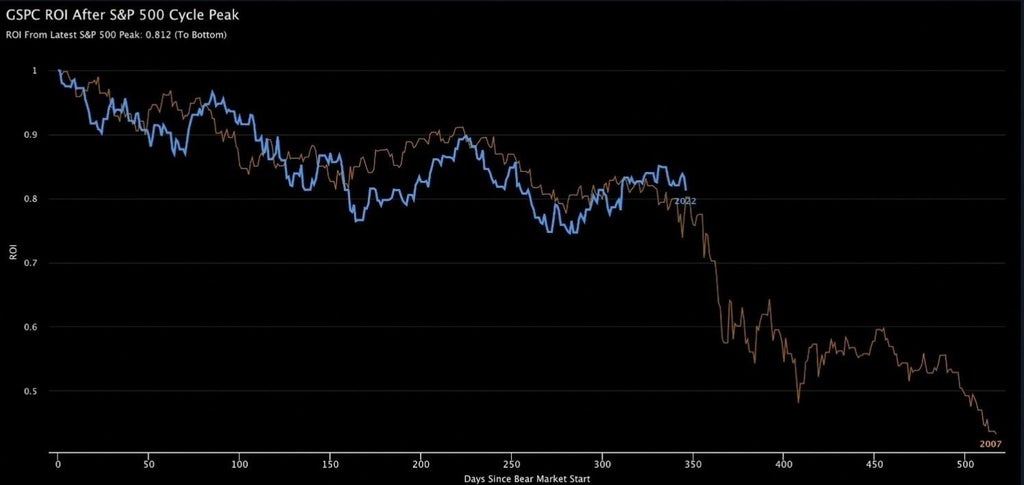

2022 vs 2008

Musk Sounds a Dire Warning About the Economy

Elon Musk is worried about the economy.

For several months now, the richest man in the world has continued to sound the alarm, warning that the economy risks a deep recession if the central bank’s monetary policy stays on course.

While the Federal Reserve is holding its last monetary meeting of the year in the coming days, the serial entrepreneur has just made a new prediction. And like his past predictions, this one is very alarming.

The Federal Reserve has raised interest rates sharply in recent months, taking the benchmark rate from almost zero during the pandemic to a range between 3.75% and 4%, in an effort to combat inflation, which is at its highest in 40 years. But many economists say that this aggressive monetary policy will plunge the economy into a recession.

www.msn.com/en-us/money/markets/elon-musk-sounds-a-dire-warning-about-the-economy/ar-AA158QxK

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.