Shares of Tesla Inc. gained Thursday, after Needham backed away from its bearish view on the electric vehicle giant, saying there are now several potential catalysts that could boost the price, and none that might knock it down near term.

Needham said it transferred analyst coverage of Tesla, from Raji Gill to Vikram Bagri, and Bagri subsequently raised the rating to hold from underperform.

“We believe the stock is fairly priced, and we do not see a catalyst for underperformance in the near-term,” Bagri wrote in a note to clients, with “Catch me if you can” in the title. “In fact, we see several potential catalysts that could drive the stock higher.”

Tesla’s stock

TSLA,

climbed 1.0% in afternoon trading toward a one-month high. It has run up 13.1% amid an eight-day stretch in which in has gained seven days.

Here are Bagri’s potential positive stock catalysts:

- Renewal of federal tax credit eligibility, under the Inflation Reduction Act, which offers tax rebates for buying new and used electric vehicles.

- A potential upgrade of Tesla’s credit rating to investment grade status by the end of the year. S&P Global Ratings currently rates Tesla credit at BB+, which is the highest speculative grade, or “junk” rating, and just one notch below investment grade.

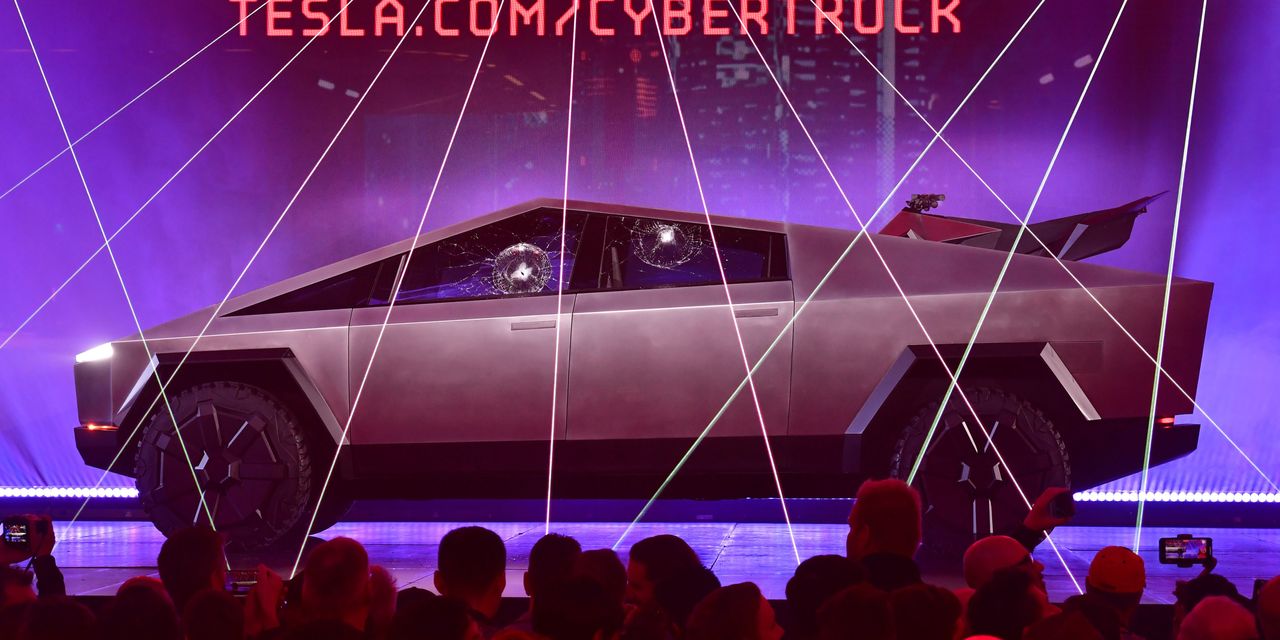

- The first deliveries of the Cybertruck in 2023.

- Expansion of the EV charging network and improved utilization.

- Gross margin improvement, driven by 4680 cells.

Bagri said he believes Tesla could achieve about 10% global market share of passenger vehicles, as global battery electric vehicle (BEV) adoption is expected to reach 40% by the end of 2023. His market share estimate assumes the company can maintain a market share in China in the “high-single digit” percentage range.

Of the 42 analysts surveyed by FactSet who cover Tesla, only four are now bearish after Needham’s upgrade, while 27 are bullish and 11 are neutral.

The upgrade comes after a report showing that after more than two years, Tesla no longer holds the title of the most bearish bets on the stock. Short interest in Tesla was $17.4 billion as of Wednesday, according to S3 Partners, while Apple Inc.’s stock

AAPL,

became the most shorted with short interest of $18.4 billion.

Don’t miss: Tesla spent 864 days as Wall Street’s biggest short bet. Now it’s

Apple.

Separately, Tesla was hit with a new lawsuit, that alleges the EV maker “deceptively and misleadingly” overstated the abilities of its Autopilot and Full Self Driving features.

Tesla’s stock has dropped 13.2% year to date, while the S&P 500 index

SPX,

has shed 17.8%.