[ad_1]

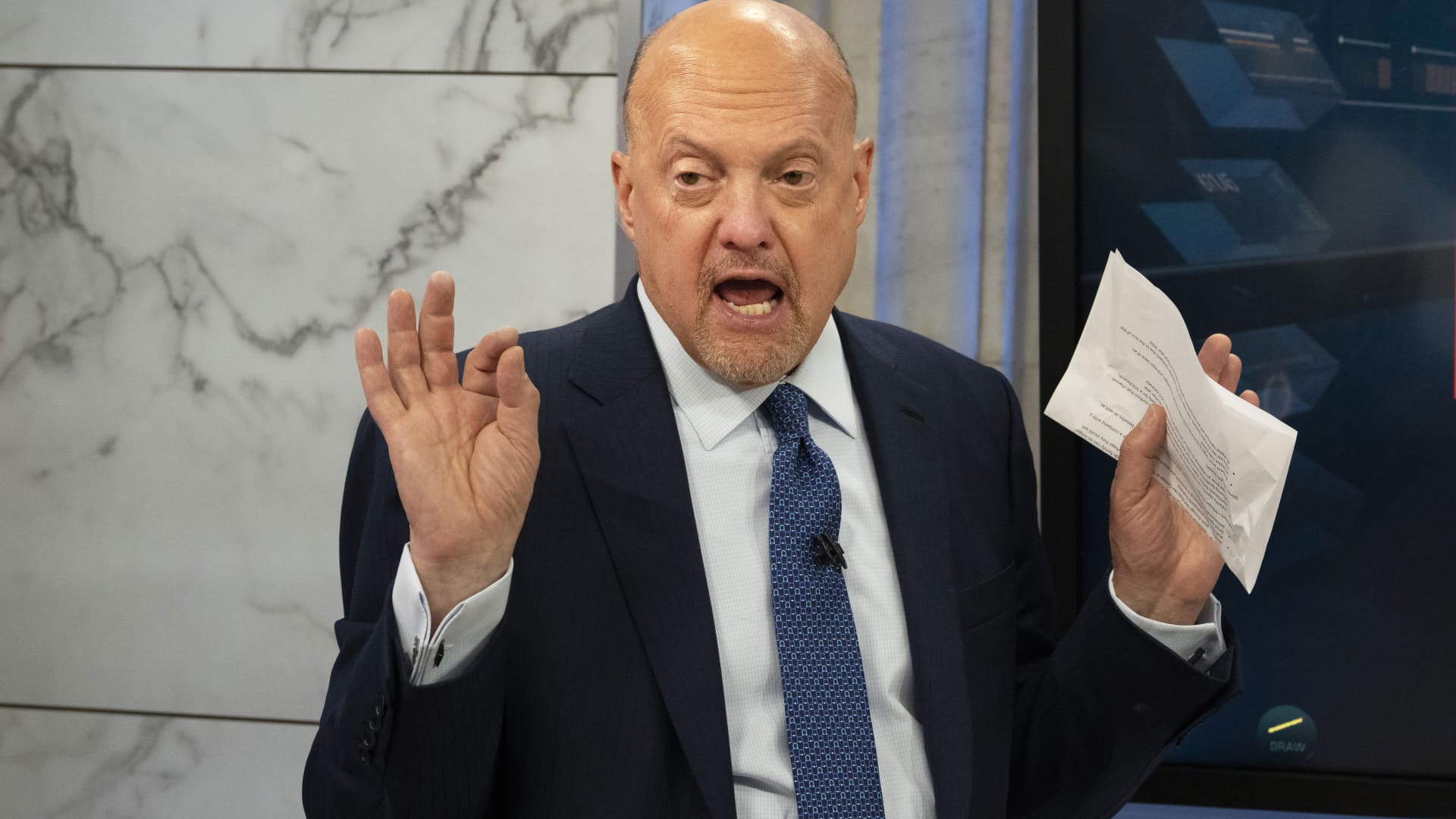

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Wednesday’s key moments. Hold onto recession-proof stocks Quick mentions: PG, HAL, PXD, DIS 1. Hold onto recession-proof stocks Amid ongoing market volatility, the Club remains focused on companies that can withstand an impending recession and have solid balance sheets. Namely, we like stocks in the healthcare, financial and energy sectors. Healthcare and energy are still necessities in an economic slowdown, while banks are benefiting from higher interest rates. “We’re focused uniquely on…companies that do well in a recession and urge you not to sell them, particularly ones with a great balance sheet,” Jim Cramer said Wednesday. Stocks were mostly lower, with the S & P 500 down 0.38%, following two consecutive days of gains. We believe that the market simply doesn’t have what it takes to maintain a sustained rally, given persistent headwinds like rising interest rates, a strong U.S. dollar and stubborn inflation. 2. Quick Club mentions: PG, HAL, PXD, DIS Procter & Gamble (PG) beat Wall Street estimates on earnings and revenue in its latest quarter reported Wednesday, aided by higher pricing that helped offset a decline in sales volumes and the strong U.S. dollar. We believe the company’s performance demonstrates consumer willingness to pay for quality products despite price hikes, and remain bullish on the stock. Shares of PG were up around 2% in mid-morning trading, at roughly $131 a share. Jeffries initiated coverage on Halliburton (HAL) with a $40 price target and buy rating. We like HAL, particularly due to its strong free cash flow growth, and stand by the oil services company. Shares of HAL were up more than 3.5% Wednesday, at roughly $31.5 a share. Morgan Stanley downgraded Pioneer Natural Resources (PXD) to underweight. However, we have faith that CEO Scott Sheffield is steering the company in the right direction, and recommend investors buy the stock into any weakness. “In the oil business, you go with the operator,” Jim said. Netflix (NFLX) on Wednesday said it added 2.41 million net global subscribers in the third quarter, more than double the growth the company projected a quarter prior, while beating earnings and sales estimates. The stock soared more than 14% on the news. While we don’t own Netflix, we believe this is a positive readthrough for club holding Disney (DIS), and urge investors to buy the stock. Shares of Disney were up more than 2% in mid-morning trading, at roughly $100.55 a share. (Jim Cramer’s Charitable Trust is long DIS, HAL, PG, PXD. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

[ad_2]

Image and article originally from www.cnbc.com. Read the original article here.