[ad_1]

Is 2020 the watershed year when the world begins to understand the concept of systemic risk in our interactions with the natural environment? What explains the recent drumbeat of headlines in the financial press and the accompanying fund flows?

COVID-19 is one reason. The pandemic has accelerated interest in environmental, social, and governance (ESG) investing and influenced government policy, economic activity, and markets in a dramatic, swift, and entirely global way. This is in marked contrast to climate change–associated systemic risk, the awareness of which has developed over a much longer time frame.

While pandemics tend to be rare, seasonal weather events seem to have become more frequent and more intense in the United States in recent years. Hurricanes have ravaged our coasts, floods have deluged the Midwest, and wildfires have scorched the West. This year, the word “derecho” entered our vocabulary as winds approaching 150 miles per hour devastated Iowa, ripping off roofs and bringing down trees and powerlines.

Western Fires

If California were a sovereign nation, it would be the world’s fifth largest economy. Its annual gross domestic product (GDP) of $3.2 trillion would place it just behind Germany and ahead of India in the global rankings. Such success is owed to its many natural and human endowments, in particular, its role as a world technology and entertainment hub.

But as of this writing, more than 4% of California has burned in 2020. There have been well over 8,000 reported fires in the state this year alone. Five of these rank among the six largest conflagrations in the state since records first began being kept in 1932. Oregon has battled its own severe wildfire season as have a number of other Western states

In the Bay Area, after locking down at home with shelter-in-place orders due to the pandemic, residents had to shelter in place a second time because of the horrible air quality from the fires. And rolling blackouts affected millions of residents for the first time in 19 years.

In testimony to the US Congress earlier this year, John MacWilliams of the Center on Global Energy Policy at Columbia University observed:

“Although the magnitude of the forecasts varies, the scientific literature almost universally projects significant climate change–driven increases in wildfire activity and intensity across the United States by the end of the century. The United States government’s Fourth National Climate Assessment, released in November 2018, notes that ‘by the middle of this century, the annual area burned in the western United States could increase from two to six times from the present, depending on the geographic area, ecosystem, and local climate’

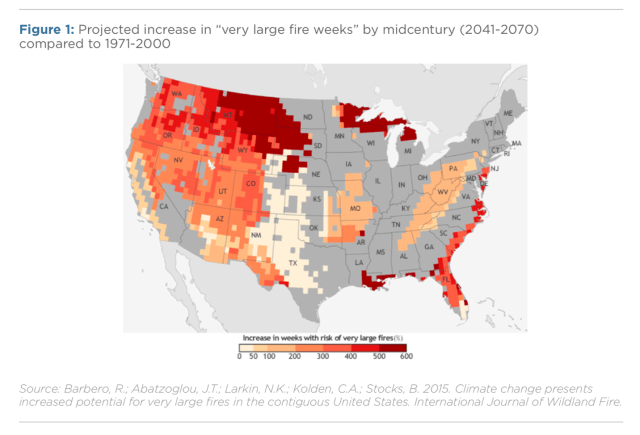

“Importantly, while current wildfire activity in California is of national concern given its population, the size of its economy, and its climate leadership, the largest increases in wildfire activity are expected in other states. The map below, taken from a 2015 study in the International Journal of Wildland Fire, shows how different regions across the US are likely to be affected. As is painfully evident in the map, many regions are likely to face growing danger, notably the Southeast and Northwest parts of the country.”

A review of California-related data is instructive. It illuminates the trends that have led to this year’s record-breaking wildfires.

For example, in 2018, the devastating Campfire fire destroyed the city of Paradise. That set in motion the eventual bankruptcy of the energy provider PG&E the following year.

California Wildfires: Total Acres Burned by Year

But as the above graphic illustrates, 2018 was a modest year for wildfires compared to 2020. Many more acres have burned this year. Wildfires perversely increase the carbon dioxide released into the atmosphere. According to one study, the climate feedback from fires amounts to 5% to 10% of global CO2 emissions each year on average.

Rising average temperatures in California have no doubt influenced the dry conditions, and the warmer temperatures have also contributed to more frequent lightning strikes. which have been blamed for recent fires.

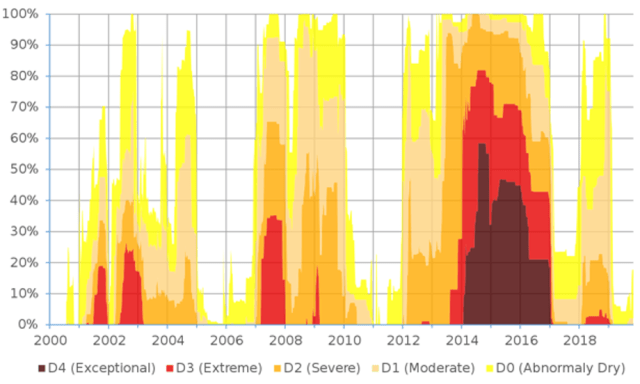

Drought Area in California

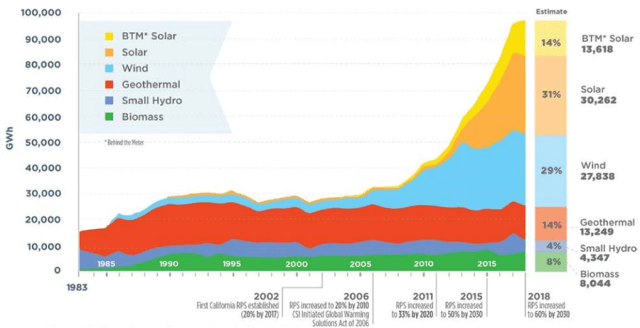

Extreme droughts have ravaged the state over the last decade and have exacerbated conditions further. But California has pushed ahead with emissions reductions through renewable energy programs, and today it leads the nation with nearly 30% of its power generated by renewables.

Total Renewable Generation Serving California Load by Resource Type

So, what does this all mean from an investment standpoint? Markets may not be pricing climate risks with respect to utilities because there is an underlying assumption that ratepayers and insurers will cover the costs, according to the Center on Energy Policy.

California responded to the 2018 fires by creating a wildfire insurance fund to help those impacted directly. But it notably failed to reform the legal framework that allows utilities to be held liable for damages they did not cause, perpetuating risks for companies and ratepayers into the future. Already Californians pay nearly twice the national average for power.

In addition to stocks, investors are also reconsidering their investments in reinsurance. This asset class is not pricing climate risk well. The insurance linked securities (ILS) sector’s underperformance since 2017 is evident, which spells regime change. The CEO of major reinsurer Zurich Re’s CEO has gone further, pointing out the need to price climate risk as a component to premiums, which is not a current practice in the insurance business.

And finally, what about the risk to municipal bonds? The risks to cities and states seems obvious when considering the potential budget impacts posed from flood, fire, and wind mitigation and reconstruction, or the permanent damage posed by rising sea-levels. But a new issue brief by the Center for American Progress points to what it sees as unprecedented risk in the municipal market due to climate change, and calls for greater disclosure of these risks:

“Much like the coronavirus pandemic, the compounding impacts of climate change will be an unprecedented event in human history. In the coming years and decades, cities and states will deal with unexpected fluctuations in both revenue and expenditures as they grapple with long-term environmental changes and an increase in catastrophic events. Federal regulations should require issuers to include comprehensive and, to the greatest extent possible, quantitative scenario-based climate risk disclosures to account for these fluctuations and to preserve the liquidity of the municipal bond market.”

Action is needed on climate. In the meantime, investors must continue to assess these risks across a broad range of asset classes. While California continues to grapple with its crisis, it is clear a range of contributing factors has built up over many years.

So investors must prepare now. Systemic risk from climate change will spread to other states and geographies in the all-too-near future.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Max Geller

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.