[ad_1]

To mark Enterprising Investor’s 10th anniversary, we have compiled retrospectives of our coverage of the most critical themes in finance and investing over the last decade.

The past 10 years have witnessed a sharp acceleration in the trend toward sustainability in investment management and the embrace of environmental, social, and governance (ESG) factors in financial analysis.

Since its launch in 2011, Enterprising Investor has tracked this trend and provided investment professionals with critical insights into the developments shaping the sustainability of investing.

ESG investing has existed in one form or another for much of the last 75 years, yet it is only over the last decade that it has reached a critical mass.

This development reflects a confluence of factors. Chief among them is greater demand from end investors — including institutional asset owners and retail investors — for investment products and solutions that take account of ESG risks and opportunities. Investors have also expressed a desire for investments that align with certain environmental or social goals — so-called non-pecuniary objectives. Governments and regulators have also exerted pressure on the investment industry to contribute toward broader sustainability-oriented policy goals.

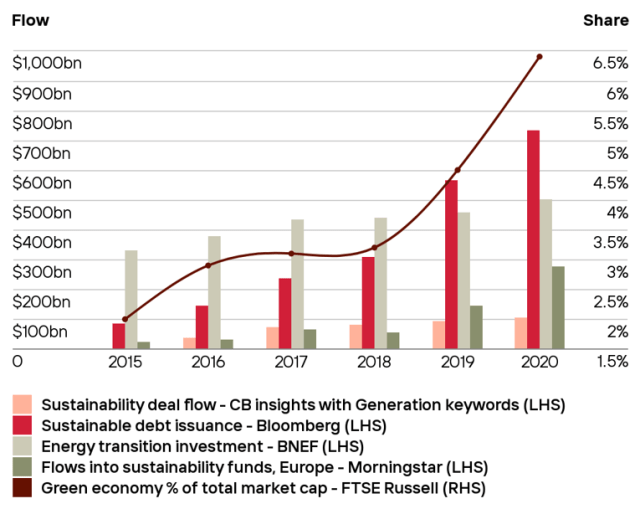

Together, these factors have led to rapid growth in the development of ESG-related financial products. The following chart from Generation Investment Management’s Sustainability Trends Report 2021 illustrates this pattern:

Trends in Sustainability-Related Finance, 2015–2020

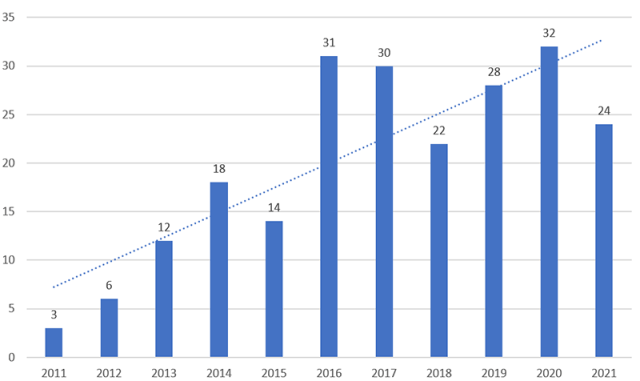

ESG coverage on Enterprising Investor largely reflects these developments. Since EI’s launch in the autumn of 2011, a total of 220 ESG-related articles have been published, three quarters of them since 2016. These posts address all manner of ESG issues, including accounting and disclosure standards, the fiduciary duty debate, the relationship between ESG and investment performance, thematic investing, water quality and human rights issues, gender lens investing, and many more.

ESG-Focused Articles from Enterprising Investor, By Year

What follows is a hand-picked selection of the most pertinent insights and thought-provoking commentary on all things ESG over this period. We showcase the key sustainability issues through the perspectives of both ESG proponents and critics. The collection provides a fascinating window into the ESG debate and orients readers towards the emergent sustainability trend and its implications for the future of investing.

A Framework to Drive ESG Financial Discipline

Kevin Prall, CFA, outlines a structural foundation for analyzing how ESG affects intangible asset value creation and discusses how a focus on intangible value creation can bring more financial discipline to ESG investments.

ESG Matters: Global Trends and Transitions

Aline Reichenberg Gustafsson, CFA, and Barbara Stewart, CFA, discuss sustainability and the growing importance of women in the investment ecosystem, with an emphasis on the Nordic perspective.

Jordan N. Boslego, CFA, states that without strong fiduciary standards, ESG may become an excuse for fund managers to underperform and charge higher fees.

Thematic Investing: Thematically Wrong?

Nicolas Rabener examines the merits of thematic investing and how its performance compares against established benchmarks. He concludes that, “ESG and similar themes are forms of investing based on personal preference. They may come at a cost, but they achieve some non-financial objectives.”

The ESG Debate Heats Up: Four More Challenges

What are the main areas of concern in the ESG world? Christopher K. Merker, PhD, CFA, examines the challenges around standards, greenwashing in investment products, and the urgency of climate change.

ESG Investing: Can You Have Your Cake and Eat It Too?

Do companies with high ESG ratings outperform their lower-ranked counterparts? Gautam Dhingra, PhD, CFA, and Christopher J. Olson, CFA, share their analysis.

ESG Investing: Too Good to Be True?

The notion that companies that care about the environment, look after their employees, and exhibit good governance outperform is likely a mirage, says Nicolas Rabener.

Beyond Carbon: Water Risks and Sustainable Investing

The water crisis in Cape Town, South Africa, demonstrates that carbon emissions and climate change are not the only sustainability threats, says Monika Freyman, CFA. Water concerns already affect investors’ bottom lines as well as future risks to their top lines.

Human Rights Issues and Your Portfolio: The Risks and Opportunities

What are the risks and opportunities associated with integrating or failing to integrate human rights issues into asset allocation considerations? Anjali Pradhan, CFA, explores the issue.

Sustainable Investing and Fiduciary Responsibility: Conflict or Confluence?

Usman Hayat, CFA, interviews David Blood, co-founder of Generation Investment Management, who surveys the sustainable investing trend and discusses why sustainability is integral to fiduciary duty.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Bloomberg Creative

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.