It is difficult to explain in words what is happening in the currency market today. After last Friday closing at the lows, the British pound flash-crashed in today’s Asian trading.

The mini-budget announced on Friday sent the country’s finances in disarray. The move in the bond market was even more frightening than the currency plunge, where gilts were sold and yields spiked.

Are you looking for fast-news, hot-tips and market analysis? Sign-up for the Invezz newsletter, today.

The fear was that the currency would plunge some more once trading started on Monday. And it did.

GBP/USD traded at an all-time low of around 1.0350, GBP/CHF dived below 1.02, and EUR/GBP surged close to 0.93. By all standards, the amplitude of the moves in the GBP pairs was scary, to say the least.

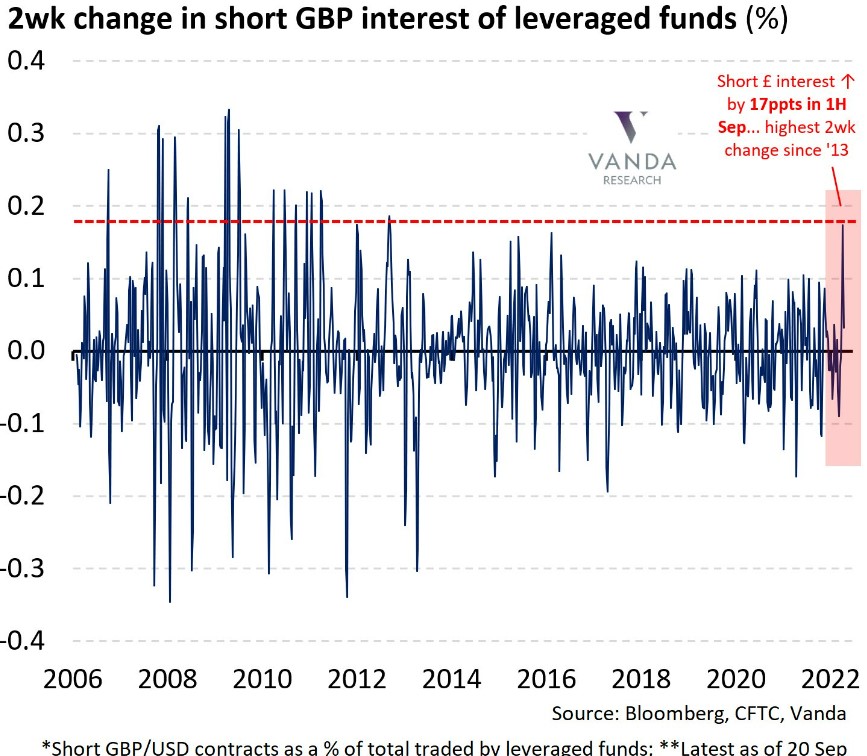

Someone did profit from the currency’s weakness. Ahead of the weakness seen in the last two trading days, the short interest in sterling recorded the highest rise in two weeks since 2013.

So everyone waited for the London market to start and see what comes next. As it turned out, the currency reversed all its losses as investors picked it up from the lows.

What caused the sterling’s selloff?

The mini budget released last Friday was the trigger. It hands out tax cuts at a time when the Bank of England is raising rates to fight rampant inflation.

More precisely, the UK will need to issue GBP194 billion in new debt, much more than the GBP62 billion planned.

But who will buy the debt, given that the Bank of England no longer does quantitative easing? It must be foreign investors, but the easy fiscal policy surely spooks them in a period of rising prices of goods and services.

Time to go long sterling?

As it is often the case in the FX market, violent moves are quickly reversed. So is the case here, as the pound reversed the losses.

However, it remains a weak currency in the middle of a financial storm. Traders should not be surprised to hear from the Bank of England, as the market now prices in more monetary tightening to offset the fiscal easing one.

From that perspective, the pound may look attractive at these levels.

Invest in crypto, stocks, ETFs & more in minutes with our preferred broker, eToro.

10/10

68% of retail CFD accounts lose money

[ad_2]

Image and article originally from invezz.com. Read the original article here.