[ad_1]

A global pandemic, a rapid spike in market volatility, and a renewed push for social reform, among other events, have acted as catalysts for change in the United States this year.

Individuals, businesses, and institutions are stretched thin as they combat the fallout from COVID-19 and the resulting economic crisis.

As a result, investors must think strategically about their financial assets. Can they continue to generate the necessary cash flow to meet their budget needs? Or should they:

- Make special distributions from long-term asset pools?

- Borrow from existing lines of credit?

- Participate in government relief programs?

- Some combination of the above?

Here the focus is on special distributions from longer-term asset pools. Specifically, if such moves are necessary to meet ongoing expenses and obligations, what are their costs and advantages?

The Cost of a Dollar

Cost of capital is among the most important concepts in finance. Simply put, it refers to how much it costs an organization to have money available.

Part of this price can be tangibly measured. For example, if the money is borrowed as debt, what is its interest rate? But other contributors to the cost of capital aren’t so easily gauged. For example, if the money is borrowed, what is the potential for financial distress associated with that debt and generating the ongoing cash flow to support the debt payments? Costs like these are not quite so tangible.

Every dollar has a cost, whether from earning it, the interest owed on it as debt, or even its lost investment return potential were it to remain invested, say, as part of a long-term asset pool.

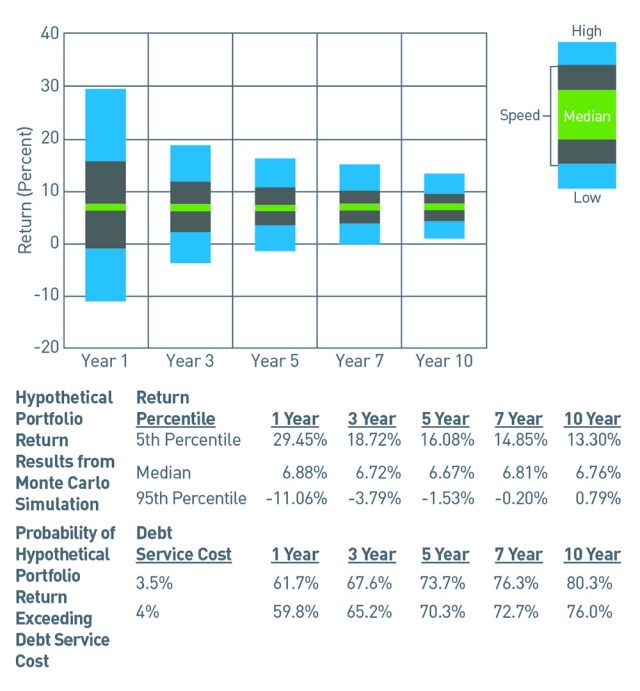

The following chart illustrates a hypothetical example of this analysis. A combination of historical endowment returns and recent borrowing costs shows how an institutional investor might compare a dollar’s earning potential in an endowment to another source of funds, such as borrowing money through a debt instrument.

Comparing Costs of Capital: Endowment Distribution vs. Debt Instruments

The analysis is not quite this simple in practice, of course. Time horizons and future return expectations, among other financial objectives and constraints, are relevant to the decision-making process and may result in a range of different outcomes. (For example, the cost of capital could be higher or lower than forecast.) Moreover, past performance is not indicative of future returns, so the long-term asset pool performance might not always be higher than the cost of debt, as depicted in the chart above.

Before making a decision based on potential investment returns, investors should conduct a forward-looking analysis using a Monte Carlo simulation, or similar modeling tool. The results of a hypothetical simulation we ran is depicted in the graphic below. It is just one example of how investors can evaluate various sources of capital.

Range of Returns for Hypothetical Long-Term Investment Portfolio

This chart is for illustrative purposes only and should not be relied upon for any reason. Actual account results may vary significantly.

To be sure, none of the analytical methods available are perfect, but developing a logical framework for financing decisions is critical. Having a sense of what a dollar costs encourages better decisions about the source of capital and how that capital is used.

Long-Term Asset Pools as Emergency Funding Mechanisms

The environment for individuals, businesses, and other institutional investors remains a volatile one. The challenges today are legion and all investors need a strategy to ensure they survive the extreme financial turmoil with the assets they need intact.

How can they respond to potential budget and revenue shortfalls from the ordinary — say, a temporary lag in cash flows — to the extreme — a daily struggle to keep the lights on?

Some potential strategies create and preserve cash on the balance sheet by raising capital or minimizing expenses. For businesses or institutions, that might mean salary cuts, furloughs, suspending retirement plan contributions, drawing on credit lines, or issuing new debt. Individuals might reduce or suspend their retirement plan contributions, run up their credit cards, or draw on home equity or other lines of credit.

But for some investors, such steps may not be feasible or may not be enough. They may want or need to make special, permanent distributions from long-term asset pools — for example, endowments for institutional investors and retirement accounts for individual investors — to solve budget or revenue shortfalls.

If the money is available at their discretion, barring any potential restriction outlined below, they can access capital whenever they need it. Specifically, funds in an existing endowment may be easier to access than those from debt markets or government relief programs and potentially less contentious compared to alternative funding sources or expense reduction strategies.

What Are Potential Long-Term Costs of a Special Distribution?

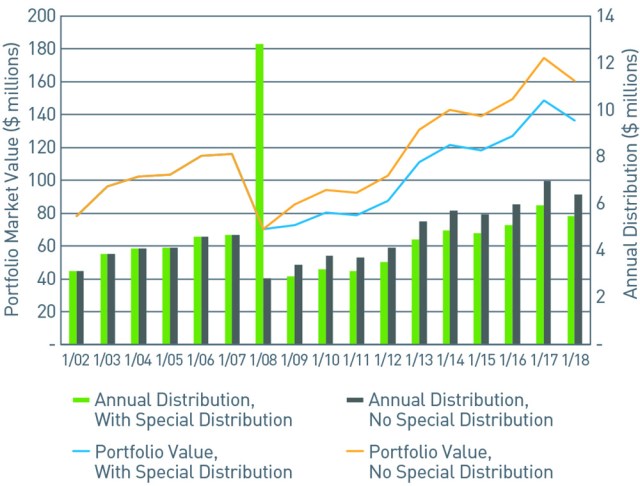

In the following chart, we plot the effect of a special distribution of $10 million, or roughly 10%–15% of the portfolio’s value at the time, on a hypothetical endowment portfolio during the global financial crisis of 2008.1 What were the implications for the portfolio over 10 years?

- Its ending value was $23.75 million, or 17%, lower than had the special distribution not been made.

- Total distributions over this 10-year period, excluding the special distribution, were roughly $7.5 million lower.

- At the end of 10 years, the portfolio’s normal annual distribution — 4% of market value — was almost $1 million less than it would have been had the special distribution not been made.

Hypothetical Scenario: Charting the 10-Year Impact of a Special Distribution1

While this is all theoretical and subject to the limitations of our assumptions, the special distribution had profound consequences on the portfolio’s value over time. Barring outside contributions to recoup the loss of principal, the endowment’s ability to support its organization over the long term was adversely impacted.

Five Consideration before Making a Special Distribution

For some investors, a special distribution might not be the best option available. For others, it might be the only reasonable course. And still for other it may be somewhere in between.

Regardless of where a person or organization falls on this spectrum, there are some common considerations that may help to frame the analysis:

- Are there any donor or organizational policy restrictions that might prevent the special distribution from being used for its intended purpose?

- Are there any legal or regulatory considerations, such as certain provisions of the Uniform Prudent Management of Institutional Funds Act (UPMIFA), that could prevent a special distribution?

- What alternatives are worth considering as part of the analysis?

- Can the long-term asset pool or pools support a special distribution?

- Is the distribution a “grant” or is it meant to be repaid?

Balancing Solvency and Financial Viability in the Future

Against all of the market challenges this year, investors will need to continue implementing tactical plans to manage their finances.

To help weather this storm and prepare for whatever comes next, all investors must find ways to balance the demands of maintaining solvency in the present with remaining financially viable in the future. And that may mean addressing the tradeoff between emergency funding and intergenerational equity.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

1 Assumes $100 million portfolio invested 100% in S&P 500® at the beginning of 2002 and follows a 4% simple spending rule of portfolio market value. The special distribution in the scenario was an additional $10 million taken in 2008. The hypothetical example is meant solely to illustrate the differences in the spending values over time. Indexes are unmanaged, are not available for direct investment, and are not subject to management fees, transaction costs, or other types of expenses that an account may incur. Index performance results do not represent, and are not necessarily indicative of, the results that may be achieved in accounts investing in the corresponding investment strategy; actual account returns may vary significantly. Back-testing has inherent limitations: it does not reflect economic and market factors that would likely affect a manager’s investment decisions; it does not account for trading that an active manager would likely undertake to modify portfolio holdings over time; and it is applied retroactively with the benefit of hindsight. Since trades have not actually been executed, hypothetical results may under or over compensate for the impact of certain economic and market factors that would affect a manager’s investment decision, all of which can adversely affect trading results.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Paul Biris

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.