[ad_1]

One of the main events of this trading week is the Bank of Japan’s (BOJ) ‘s monetary policy decision expected in the next Asian session. The Japanese yen’s weakness was the main theme in 2022, but since the BOJ intervened in the currency market, it rallied hard from the lows.

As such, the USD/JPY pair corrected from above 150 to below 130. Similar moves were also seen on other JPY pairs, as the BOJ’s recent moves have created confusion in the FX market.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

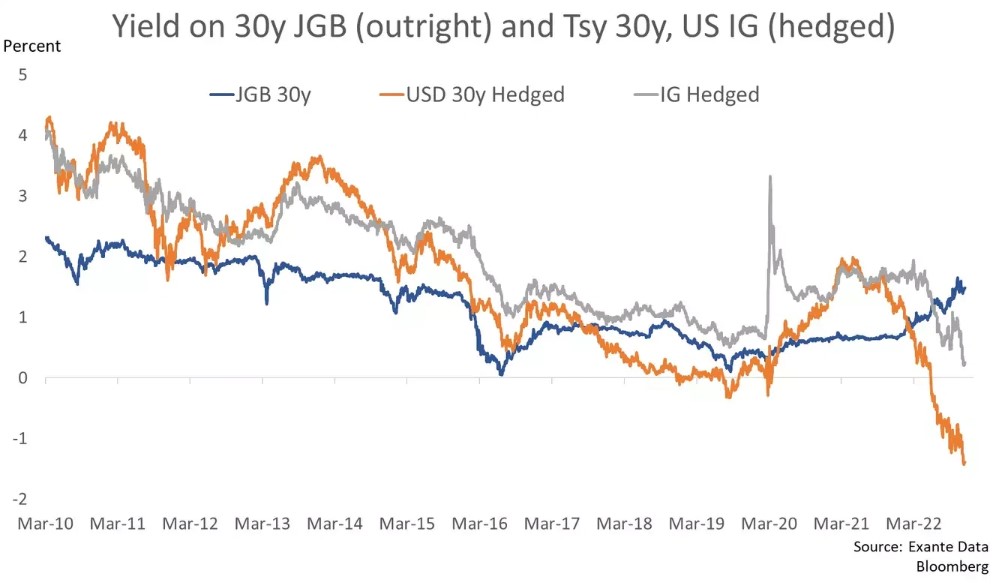

It is all about institutional investors and their appetite for foreign bonds. For years, the JGBs (i.e., Japanese Government Bonds) were unattractive due to the low yields.

In search for positive yields, local pension funds, commercial banks, or the publicly owned Post Bank have invested abroad as long as yields were down. Most of these investors typically hedge their currency bond exposure, with perhaps only the pensions fund, represented by GPIF (i.e., Government Pension Investment Fund), remaining unhedged.

But recently, the appetite for global bonds from Japanese institutional investors disappeared. Why does it matter? It does so because whenever this happens, it signals a change in the BOJ’s policy.

And yields have already moved, as seen below.

Japan’s 10-year JGB yield is already pressuring the upper edge

The BOJ took the market by surprise when in late 2022 announced a change in its yield curve control policy. It said it is willing to let the yields rise up to 0.5%, a major shift from the previous policy.

Sure enough, yields moved sharply, and the yen rose as well.

But what makes tomorrow’s meeting really important is the fact that Kuroda’s term ends in April. Kuroda is the head of the BOJ and was one of the promoters of easy monetary policy for years.

Now that he’s on his way out, who will follow? More importantly, is the recent change in the yield curve control policy the start of something big?

All in all, it looks like volatility in the Japanese yen pairs will remain elevated in 2023, just like it was in 2022. Those willing to take a chance and trade the JPY pairs would better listen to what the central bank has to say about the changes in its yield curve control policy.

[ad_2]

Image and article originally from invezz.com. Read the original article here.