[ad_1]

via energyandgold:

When I spoke with 321gold founder Bob Moriarty in November he was adamant that now is the time to invest in the resource sector. Today, he thinks that investor sentiment in the resource space is worse than it was in 2008 after the Lehman crash. It is this combination of poor sentiment and beaten down share prices that offers investors an opportunity to generate outsized returns once the sector turns.

In this month’s conversation Bob and I discuss tightening financial conditions, weak investor sentiment, the cryptocurrency sector implosion, and some tax loss silly season opportunities in the junior mining sector. Without further ado, Energy & Gold’s December 2022 conversation with Bob Moriarty….

Goldfinger:

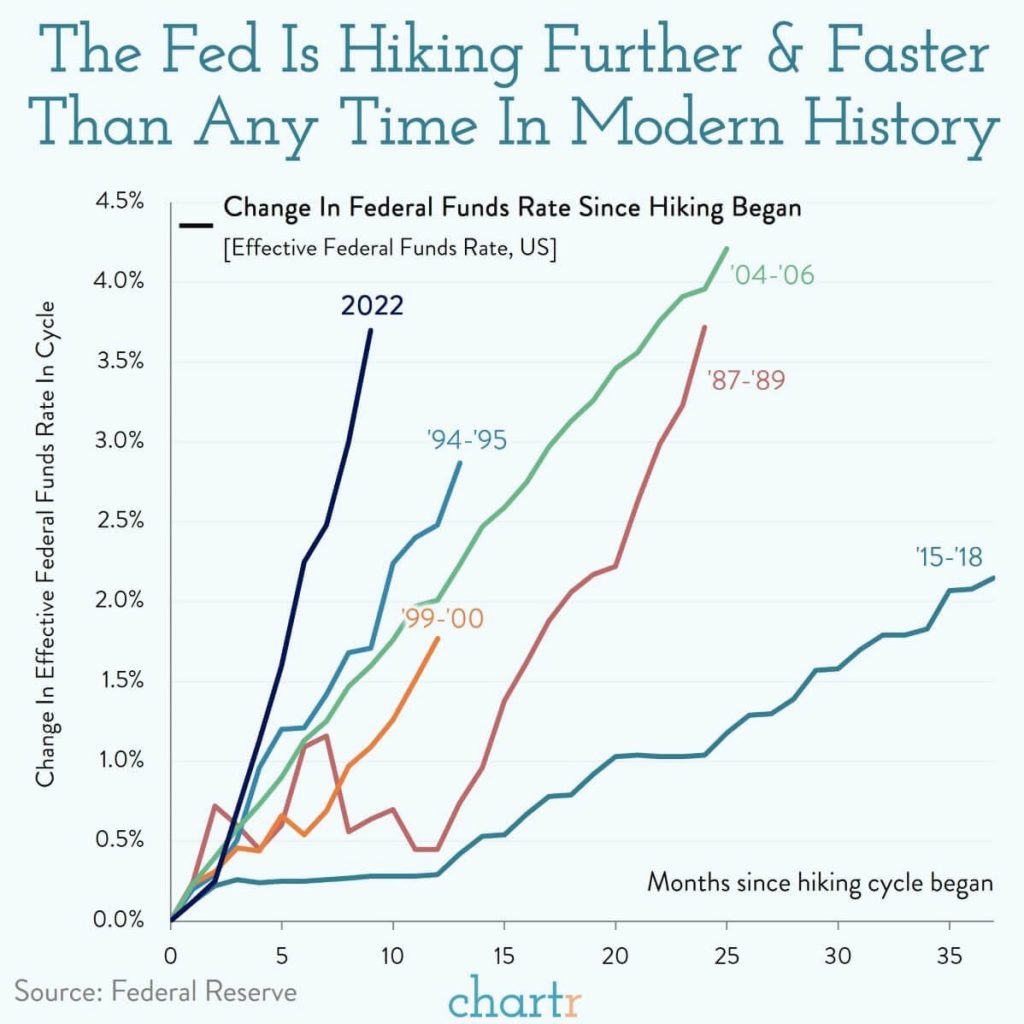

Bob, it’s good to speak with you again, what’s your take on the market action of the last week? We’ve had some impressive gyrations across equities but precious metals have remained relatively resilient. It seems the market has no memory from day to day. I know you’re not a Fed commentator or a Fed fan, but did you make anything of Powell in his press conference last week? He seemed pretty uncertain.

Bob Moriarty:

They painted themselves into a corner. They have no good options at this point. I think long term the Federal Reserve is pretty meaningless.

Goldfinger:

Painted themselves into a corner in the sense that they can’t cut rates very easily because of inflation or because of something else?

Bob Moriarty:

Well, not because of inflation, but because of hyperinflation. If they back down now, we would absolutely go into hyperinflation and the problem is jacking up the interest rates. They just killed the automobile industry and real estate. I mean, here’s the deal, and you’re young enough to know this, but you’ve been around markets long enough to know it. We’ve got an entire generation that has never faced positive real interest rates. When I was 25 or 30, you were paying 8, 9, 10% for real estate and the idea of it going down to 5 or 6%, I mean, it’s just crazy. And for the last, Jesus, 10 years it’s been utterly irrational. The purpose of interest is to give savers a return on their investment. There hasn’t been a return on investment. So there will be a return on investment now, which is good for retirees, but it’s going to kill the real estate market.

Goldfinger:

We’re definitely seeing some of these hikes. The tightening of financial conditions feeds through to the real economy. The data points that we’ve received today, the retail sales, numbers missed to the downside. The Empire State Manufacturing missed to the downside. The Philadelphia Fed Manufacturing missed the downside and the trend throughout the economy is clearly one of slowing. And the housing market is absolutely affected by the rise in mortgage rates, just tighter money. So people are less able, they’re less willing and they’re less able to make high ticket purchases.

Bob Moriarty:

Well, we’ve had free money pretty much for at least five years in reality, 10 years, and people have gotten used to it and I think that’s a new norm. But you cannot have a situation in a rational economy where interest rates, real or nominal, go negative. We still have negative interest rates. Okay, we’ve got 6, 7 to 8, 10% depending on how you want to define it and 5% interest.

Goldfinger:

That’s an interesting point. Yeah, I mean technically the CPI is 7% even according to the data we got last week. And obviously, the Fed funds is 4.5%, but you could also make an argument that inflation is falling fast now because of the Fed tightening, and interest rates could be in positive territory very soon if the economy continues to weaken.

…

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.