[ad_1]

The SEC made the first move on Wednesday toward the broadest overhaul of the stock market in more than 10 years, which the agency claims will result in better prices for investors and drive more trades to conventional exchanges.

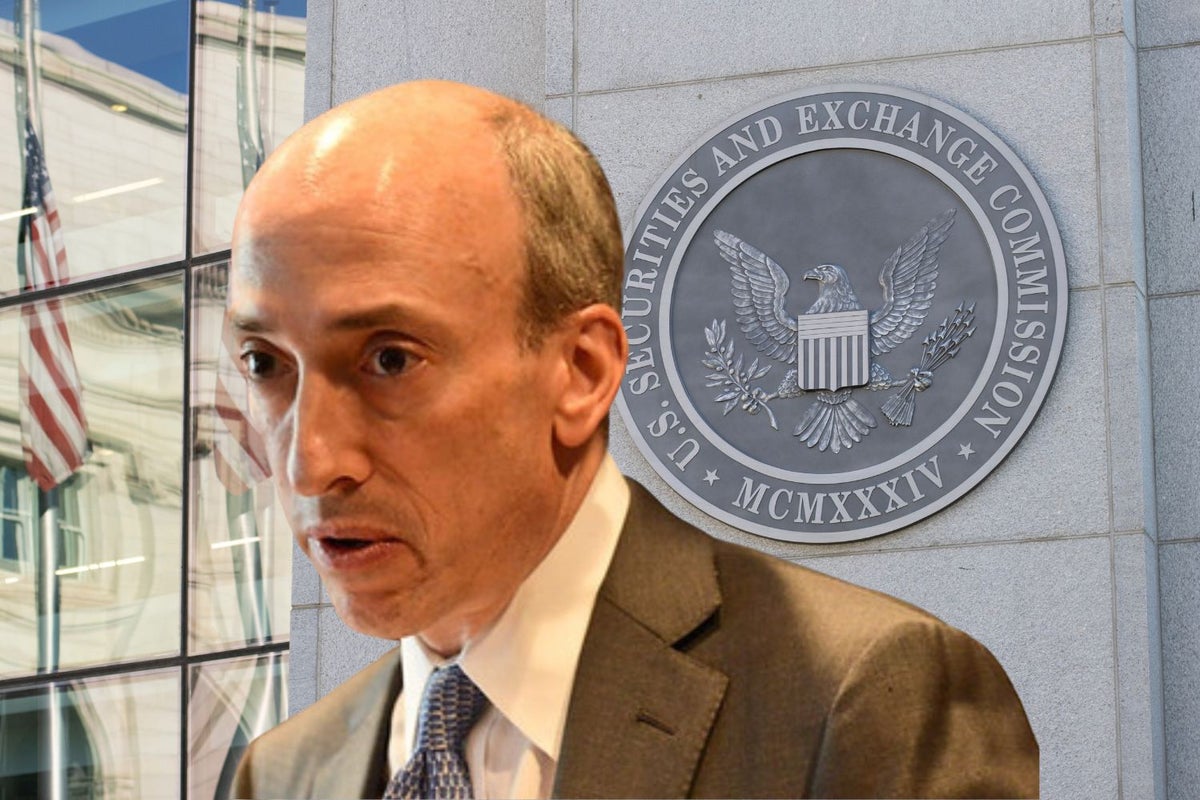

What Happened: On Wednesday, the SEC presented a number of ideas that, according to Chair Gary Gensler, would increase openness and competitiveness.

Notably, Gensler has regularly criticized Payment-For-Order-Flow (also known as PFOF), saying it produces conflicts of interest for brokers. He’s also previously said that abolishing the practice was “on the table.”

The proposal would require market participants to take part in auctions for the ability to process numerous orders in milliseconds, according to the SEC, which stated that it does not intend to outlaw PFOF. Major stock exchanges and the majority of market-making companies would be subject to that regulation.

Read Also: SEC Goes After ‘MrZackMorris,’ ‘Stock Sniper’ For Alleged Fraud

The regulator also intends to decrease the rebates that exchanges may provide brokers in an effort to encourage more trades to take place on those platforms. Platform operators would have to start disclosing their fees upfront rather than basing them on volume over the course of a month.

According to the SEC’s estimation, the auctions could save retail investors $1.5 billion per year.

“Today’s markets are not as fair and competitive as possible for individual investors — everyday retail investors,” Gensler said in his opening remarks.

The market-making firms that have developed algorithms and software to process trades swiftly and offer what they claim to be the best bargain for customers may be directly impacted by the auctions if they are put into place.

The adjustments would also modify the current business structures of exchange venues.

Stocks will be able to trade at smaller price increments both on and off exchanges, according to the proposals. The SEC says that the action would promote competition for order fulfillment and drive down prices.

The SEC will accept feedback on the ideas through March, consider suggestions, and then draft the final version that the commissioners must approve before the regulations can be implemented.

Currently, wholesale brokerages like Virtu Financial Inc. VIRT and Citadel Securities pay companies like Charles Schwab SCHW and Robinhood Markets Inc. HOOD to handle a sizable portion of their retail trades.

Shares of Virtu were down 7.18% at $19.98 on Wednesday afternoon, the highest intraday drop since Sept. 6; Robinhood fell as much as 4.4% before recovering, trading down 1.67% at $9.19 at the time of publication, according to Benzinga Pro.

Read Next: FTX Founder Sam Bankman-Fried Charged By SEC For Defrauding Investors

Photo: Created with an image from Shutterstock and Third Way Think Tank on flickr

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.