[ad_1]

One of the tools that the Federal Reserve has to manage the money supply is the reserve requirement. Importantly, the reserve requirement is also a potent tool to manage systemic risk of the banking system. The Federal Reserve has recently abolished the reserve requirement. This article examines several possible impacts of this action.

The reserve requirement is essentially the percentage of deposits that a bank must hold. As defined by Investopedia:

Reserve requirements are the amount of cash that banks must have, in their vaults or at the closest Federal Reserve bank, in line with deposits made by their customers. Set by the Fed’s board of governors, reserve requirements are one of the three main tools of monetary policy—the other two tools are open market operations and the discount rate.

The reserve requirements are historically important in the U.S. and implemented in response to a banking crisis:

The fractional banking system came into place as a solution to problems encountered during the Great Depression when depositors made many withdrawals, leading to bank runs.

corporatefinanceinstitute.com/resources/knowledge/finance/fractional-banking/

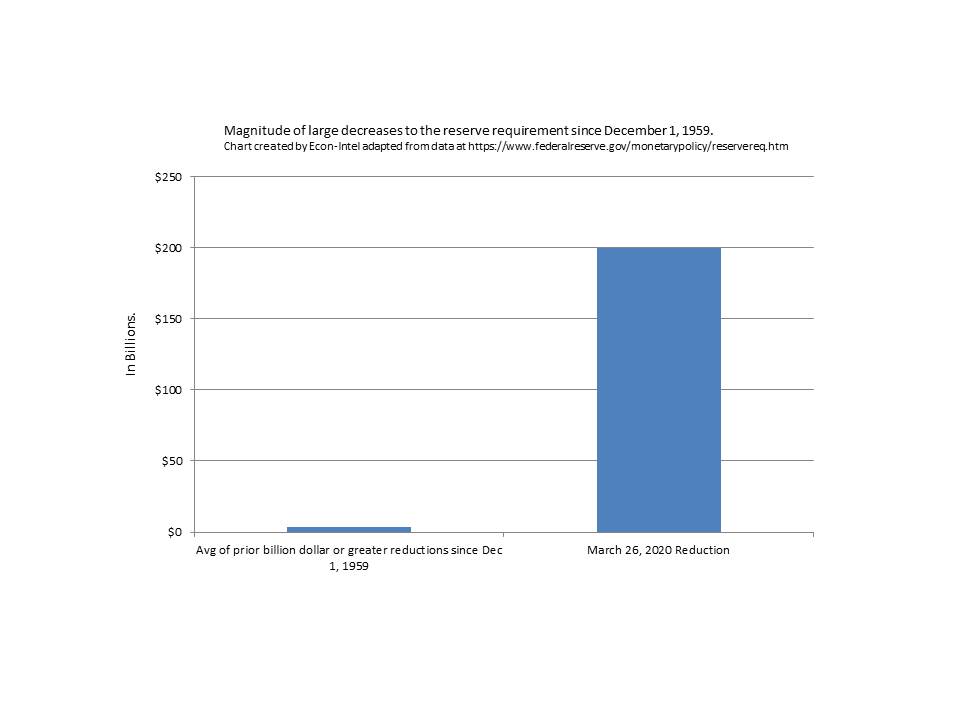

Since December 1, 1959, the Federal Reserve has adjusted the reserve requirements 105 times prior to the most recent time. At which point, the reserve requirement was abolished. The vast majority (80.9%) of those adjustments, the reserve requirements affected the banking system by less than $1.0 Billion. Of those times that the Federal Reserve did change the reserve requirement, such that it affected the banking reserves by more than $1.0 Billion, 6 increased the reserve requirement and 14 decreased the reserve requirement. The chart below compares the scale of those prior large decreases in the required banking reserves to the current change in the banking reserves.

As you can see, this change is unprecedented in scale. No other reductions in reserve requirements have come anywhere close. The reserve requirement had never been abolished prior! The prior record for reducing the reserve requirement was approximately $8.9 billion on April 2, 1992. This time it was approximately $200 billion. This fundamentally changes the entire U.S. banking system. It is no longer a fractional reserve system. Now, there is no legal requirement for banks to maintain reserve balances.

The Fed’s Reasoning For Abolishing the Reserve Requirement:

On March 15, 2020, the Federal Reserve issued three press releases taking a series of actions. One action abolished the reserve requirement. Selected text from each is cited below, then examined:

Federal Reserve issues FOMC statement:

The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States. Global financial conditions have also been significantly affected….On a 12‑month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation have declined; survey-based measures of longer-term inflation expectations are little changed.

The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook. In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals. This action will help support economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2 percent objective.To support the smooth functioning of markets for Treasury securities and agency mortgage-backed securities that are central to the flow of credit to households and businesses, over coming months the Committee will increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion. The Committee will also reinvest all principal payments from the Federal Reserve’s holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. In addition, the Open Market Desk has recently expanded its overnight and term repurchase agreement operations.

www.federalreserve.gov/newsevents/pressreleases/monetary20200315a.htm

Federal Reserve Actions to Support the Flow of Credit to Households and Businesses

The Federal Reserve encourages depository institutions to turn to the discount window to help meet demands for credit from households and businesses at this time. In support of this goal, the Board today announced that it will lower the primary credit rate by 150 basis points to 0.25 percent, effective March 16, 2020.

The Federal Reserve is encouraging banks to use their capital and liquidity buffers as they lend to households and businesses who are affected by the coronavirus.

For many years, reserve requirements played a central role in the implementation of monetary policy by creating a stable demand for reserves. In January 2019, the FOMC announced its intention to implement monetary policy in an ample reserves regime. Reserve requirements do not play a significant role in this operating framework.

In light of the shift to an ample reserves regime, the Board has reduced reserve requirement ratios to zero percent effective on March 26, the beginning of the next reserve maintenance period. This action eliminates reserve requirements for thousands of depository institutions and will help to support lending to households and businesses.

www.federalreserve.gov/newsevents/pressreleases/monetary20200315b.htm

Coordinated Central Bank Action to Enhance the Provision of U.S. Dollar Liquidity

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.The swap lines are available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses, both domestically and abroad.

www.federalreserve.gov/newsevents/pressreleases/monetary20200315c.htm

Summarized, the Federal Reserve stated that due to the coronavirus there was economic harm. Because inflation was low, they were going to provide monetary stimulus via lower interest rates. As well as treasury and agency mortgage-backed securities purchases. Additionally, they announced that they were going to lend liberally through their repo facility. They further went on to encourage banks to continue to lend and abolished the reserve requirements. As well as, coordinated with several other reserve banks to maintain liquidity in the dollar swap markets.

During the panic and economic stresses surrounding the early portion of the coronavirus pandemic, these actions are defendable. Now, conditions have changed and it is apparent that the massive monetary stimulus has led to an inflationary environment. Apparently, the Federal Reserve either misjudged the optimal quantity of monetary easing or waited too long before reducing monetary stimulus.

Abolishing Reserve Requirements in an Era of Tightening Makes no Sense:

Now, the Federal Reserve has reversed course on interest rates and is now aggressively raising rates. As well as selling off treasuries and mortgage-backed securities rather than purchasing them. The logic of removing the reserve requirement temporarily to stimulate the economy was defensible during the pandemic response. However, leaving the reserve requirement at 0% and experimenting with running without any reserves is a bizarre and risky experiment. Additionally, it will limit the Fed’s ability to tighten when that is their goal.

Reserves are critical to the stability of the banking system. For depositors to be able to withdraw money from their bank, reserves must be available. Both logically and historically, when some depositors are unable to get their money out of their bank, a panic is likely. As an increased number of people fear the same happening to them and go to withdraw money from their bank. This can create a bank run. When banks that had sufficient reserves for day-to-day activities are unable to redeem deposits for their clients during the panic. The panic and economic chaos surrounding the ensuing cash crunch can spread and create economically difficult times.

Of the tools that the Federal Reserve has, the reserve requirement is the one that most directly affects bank liquidity. It also applies most directly to those banks with marginal liquidity without immediately directly affecting the more liquid banks. In other words, the reserve requirement can be a more targeted tool than the blunter interest rate tool.

Example Risk Scenario of Abolished Reserve Requirement:

Current reserve requirements are 0%, as they are now. The least liquid bank, as determined by its reserves, is 1.2%. For instance, it holds $12,000,000 of reserves in cash or at the nearest Federal Reserve branch on $1,000,0000,000 of deposits. All other banks are holding 3.0% or more in reserves in this example.

If the Federal Reserve were concerned about future economic conditions, it could choose to increase the reserve requirement from 0% to 1%. This change would ensure that the least liquid bank did not loan out all of the remaining $12,000,000 of reserves.

This would decrease the risk of the least liquid bank failing due to liquidity issues. As well as increase certainty that the bank has the reserves available when depositors wish to withdraw money. If the Federal Reserve is uncertain that the increase from 0% to 1% is sufficient to buffer against these risks in the future, the Fed can also offer forward guidance on the reserve requirement. This will encourage banks to retain additional cash in preparation for subsequent additional increases in the reserve requirement. This option would allow banks to prepare in advance for additional increases in the reserve requirement. This action will help ensure ample liquidity for the banking system to continue operating smoothly.

The Fed is responding to high inflation by raising interest rates and reducing its balance sheet by selling bonds. Both of these actions tighten the money supply to dampen demand for goods and services. This reduced demand will hopefully dampen inflation and bring it back down to a more reasonable level. Why then has the Federal Reserve left in place an unprecedented policy of extreme loosening by allowing the banks to keep literally no reserves whatsoever? When the Federal Reserve is tightening the money supply anyway, there is no cost to tightening by increasing the reserve requirement. This would achieve the goal of tightening to fight inflation and would improve the liquidity of the least liquid banks. Therefore, decreasing risk to the banking system as a whole.

Three key reasons to increase the reserve requirement without delay:

- First, when the Federal Reserve is tightening anyway, there is no negative effect of slowing the economy from having a portion of this tightening come from the increase in reserve requirements. But raising the reserve requirement at a time when the Fed is loosening monetary policy would counteract their other actions to stimulate the economy.

- Second, throughout the banking system as a whole, there are significant reserves. As of the end of 2nd quarter 2022, the banking system as a whole, has cash to cover approximately 17.9% of all customer deposits (See: banking industry data for more details). Due to the relatively high cash balances in the banking system at this time, it should be relatively easy for the less liquid banks to restructure their balance sheets to achieve higher reserve balances. Waiting longer until overall systemic liquidity decreases would jeopardize the ability of the less liquid banks to increase their own reserves and liquidity.

- Third, beginning the process of increasing reserve requirements now allows more time for banks to adapt. A rapid change in reserve requirements would be more difficult for banks to respond to and would increase the chances of negative consequences during the transition.

Conclusion:

The Federal Reserve has a tool that both increases systemic banking safety and tightens monetary policy. But, they have abandoned it. Further delays in re-establishing a reasonable reserve requirement jeopardizes the future stability of the US banking system. The current policy of tightening offers a rare opportunity. The Fed could re-implement reserve requirements to tighten the money supply and increase the stability of the banking system. The Federal Reserve Abolishing the reserve requirement elevates many potential risks. Delaying a return to utilizing reserve requirements at this time, when the Federal Reserve is tightening policy, is downright unexplainable.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.