Article content

(Bloomberg) — European vacationers looking to avoid this summer’s airport chaos by renting a car can expect to pay record rates.

[ad_1]

European vacationers looking to avoid this summer’s airport chaos by renting a car can expect to pay record rates.

Author of the article:

Bloomberg News

Laura Malsch

Publishing date:

Jul 17, 2022 • 19 minutes ago • 2 minute read • Join the conversation

(Bloomberg) — European vacationers looking to avoid this summer’s airport chaos by renting a car can expect to pay record rates.

This advertisement has not loaded yet, but your article continues below.

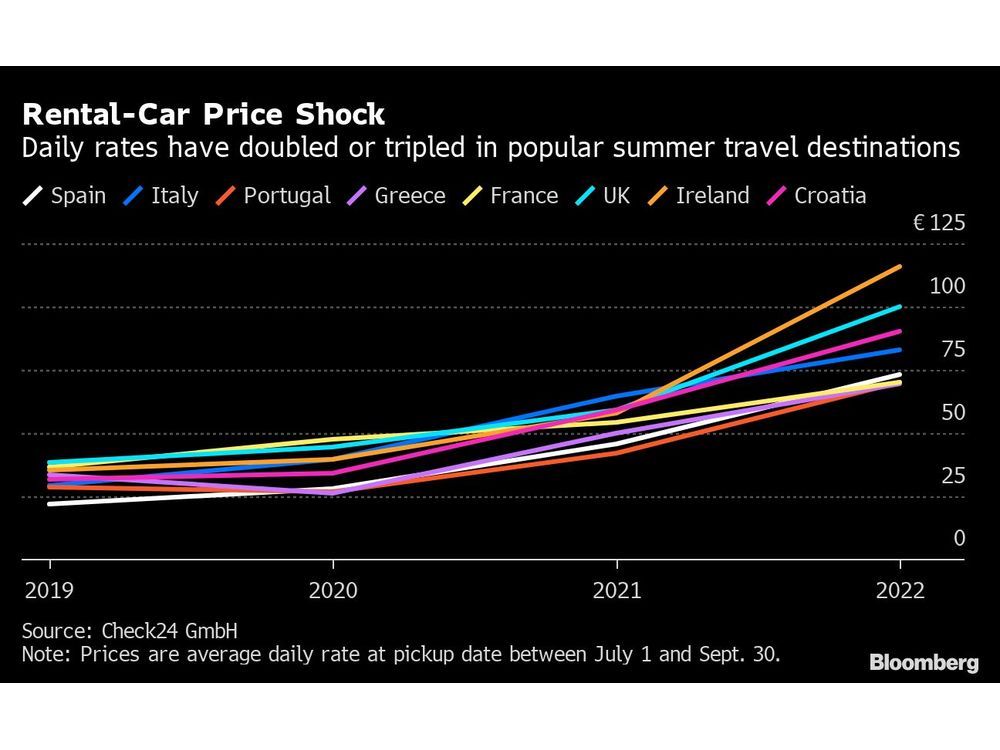

Prices that hit all-time highs in 2021 have been scaling new heights this year, with Europe’s coastal regions especially affected by inflated rates.

Travelers in Spain, who could rent a car for a little more than 20 euros ($20) per day before the pandemic, will have to pay at least three times as much this summer. Italy and Croatia saw prices jump by more than 180%, according to data compiled by Check24.

Matters could get even worse and last-minute travelers should act fast, advised Andreas Schiffelholz, the comparison sites’ rental-car managing director. “As pick-up dates get closer, prices will continue to increase.”

Spiraling prices are the product of a post-pandemic wanderlust that’s been impervious to soaring inflation, a looming energy crisis and recession fears. Overnight stays in the eurozone recovered to pre-Covid levels in May, according to Oxford Economics’ Tourism Tracker. With European school holidays just beginning, the number of vacationers is poised to keep climbing.

This advertisement has not loaded yet, but your article continues below.

The travel resurgence has already wreaked havoc at European airports. At some of the continent’s busiest hubs, more than 60% of flights are seeing delays, and as many as 8% are being canceled, according to data collected by travel agency Hopper Inc.

In response, London Heathrow put a two-month cap on daily passenger traffic and told airlines to stop selling new summer tickets. After slashing staffing at the beginning of the pandemic, airports and airlines have struggled to keep up with security and baggage handling, leading to long lines and mounting piles of misplaced luggage.

Read more: Baggage Chaos So Bad Flyers Are Turning to Tracking Devices

Rental-car firms also shrank during the pandemic, and many haven’t gotten back to pre-Covid strength even as demand rebounded. For a second straight year, a supply-chain crisis fueled by global semiconductor shortages curbed auto production and left carmakers with fewer vehicles to sell to rental companies.

This advertisement has not loaded yet, but your article continues below.

“Many car-rental firms have reduced their fleet during the pandemic and can’t just return to regular fleet sizes now that demand is on the rise,” Schiffelholz said.

Among Europe’s largest rental firms, only Avis Budget Group Inc. and Sixt SE were able to get back to their 2019 fleet levels, company reports show. Europcar Mobility Group and Hertz Global Holdings Inc., which filed for bankruptcy amid the collapse of the travel industry in 2020, have yet to return to their former size.

Some rental-car firms have turned the bounce-back in demand into a profit windfall. According to Sixt’s Co-CEO, Alexander Sixt, prices aren’t going to fall anytime soon.

“We estimate pricing to be at this level at least for the most part of 2023,” he said. Costs for tourist accommodations, air travel and new vehicles have all risen in recent years, while car-rental prices have been stagnant for a decade, Sixt said. “These recent adjustments will stay.”

Nor does he expect an imminent decline in interest from holiday-makers. Despite additional costs from rising fuel prices, “demand predictions for this summer see no significant drop,” he said.

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.