[ad_1]

Interesting story on Alignable.

Due to high inflation, reduced consumer spending, higher rents and other economic pressures, U.S.-based small business owners’ rent problems just escalated to new heights nationally this month, based on Alignable’s November Rent Poll of 6,326 small business owners taken from 11/19/22 to 11/22/22.

Unfortunately, 41% of U.S.-based small business owners report that they could not pay their rent in full and on time in November, a new record for 2022. Making matters worse, this occurred during a quarter when more money should be coming in and rent delinquency rates should be decreasing. But so far this quarter, the opposite has been true.

Last month, rent delinquency rates increased seven percentage points from 30% in September to 37% in October. And now, in November, that rate is another four percentage points higher, reaching a new high across a variety of industries.

All told in Q4 so far, the rent delinquency rate continues to increase at a significant pace, up 11 percentage points from where it was just two months ago.

Well, this is not good.

And on the mortgage front, not all is quiet.

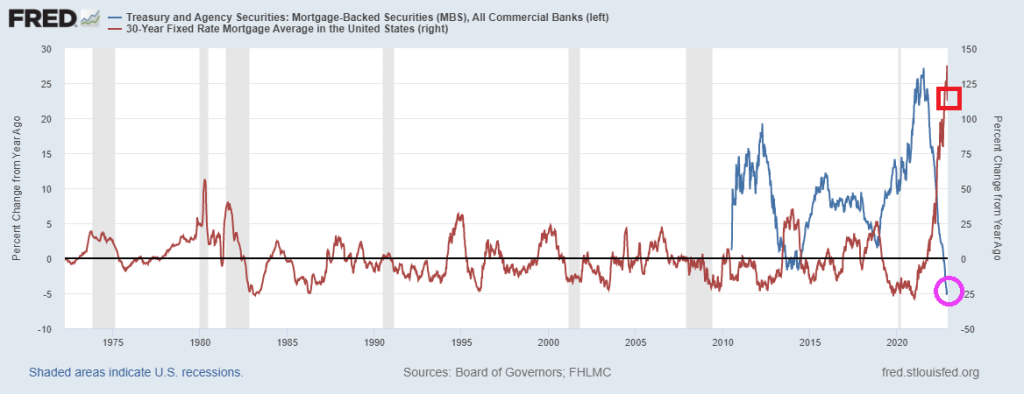

Commercial bank holding of Agency mortgage-backed securities (MBS) has collapsed with Fed tightening and mortgage rate increases.

Ain’t that a lot of bad news for real estate and the mortgage market.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.