[ad_1]

Climate crises disproportionately affect women and girls across all demographics, but especially in developing economies. Subject to persistently higher poverty (and extreme poverty) than men, women and girls are also more likely to be impacted by climate disasters. In fact, 80% of those displaced by climate change are women, according to UN statistics.

Due to ongoing worldwide gender gaps, climate events exact a toll on women’s job security and education as well as their access to health care, potable water, and food resources, among other necessities. Yet, research shows that with their local knowledge, women have much to contribute to climate change adaptation even if gender gaps in legal resources and economic participation hamper their involvement.

As environmental, social, and governance (ESG) investing continues its rapid growth, applying a gender lens to public funds focused on climate solutions is critical. Why? Because higher levels of women in leadership (WIL) benefit corporate performance, operations, and risk management. Indeed, gender diverse ACWI Index companies are better at reducing carbon emissions, according to a 2021 MSCI report, while 2020 research found that gender diversity on the boards of US companies correlated with higher renewable energy consumption, which in turn, boosted financial performance.

Gender Lens Equity Funds: Steady Growth

Gender lens investing directs resources to women-focused initiatives, women-owned businesses, and firms that demonstrate a commitment to gender and broad-based equality internally and through their external relationships, products, and services.

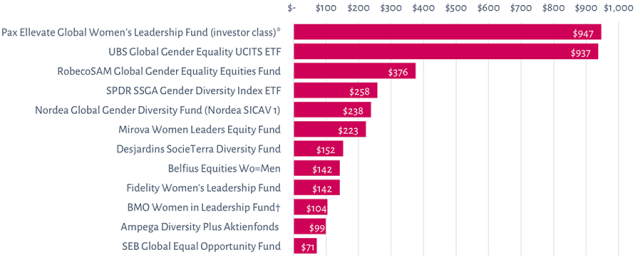

Thirty-two gender lens equity funds are available to individual investors. There are 14 global and 18 regional funds in the Parallelle Finance coverage universe with mandates to invest in higher WIL and related gender metrics. These funds hold anywhere from 30 to more than 400 stocks. As of 31 March 2022, their assets under management (AUM) totaled $4.1 billion, having grown by 51% in 2021.

The 12 Largest Gender Lens Equity Funds, in US Millions, as of 31 March 2022

Are Climate Funds Investing with a Gender Lens?

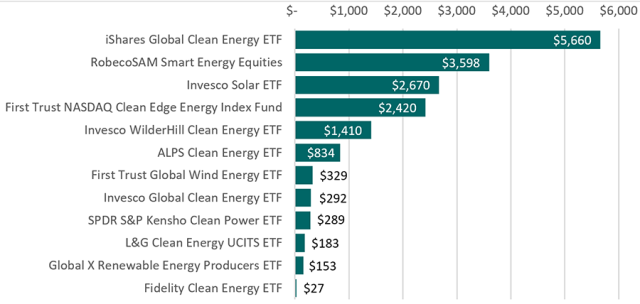

Renewable energy is a cornerstone of global efforts to address climate change. Renewable energy funds invest in solar, wind, and other clean energy producers as well as related technology and services providers. The 17 US-listed and three European- or UK-listed funds in our dataset have AUMs ranging from $5.6 billion, for the iShares Global Clean Energy exchange-traded fund (ETF), to less than $5 million, as of 31 March 2022. The average track record for the funds is six years.

The 12 Largest Renewable Energy Funds in the Dataset, in US Millions, as of 31 March 2022

These funds are not capturing the benefits of diverse leadership and wider corporate equality.

Only 11% of US portfolio managers are women. That figure hasn’t notably improved in 20 years. According to the available data, only 13% of the portfolio managers at renewable energy funds are women, and 14 of the 20 funds have no women on their portfolio management teams. In contrast, our research found that over 50% of gender lens equity fund portfolio managers are women.

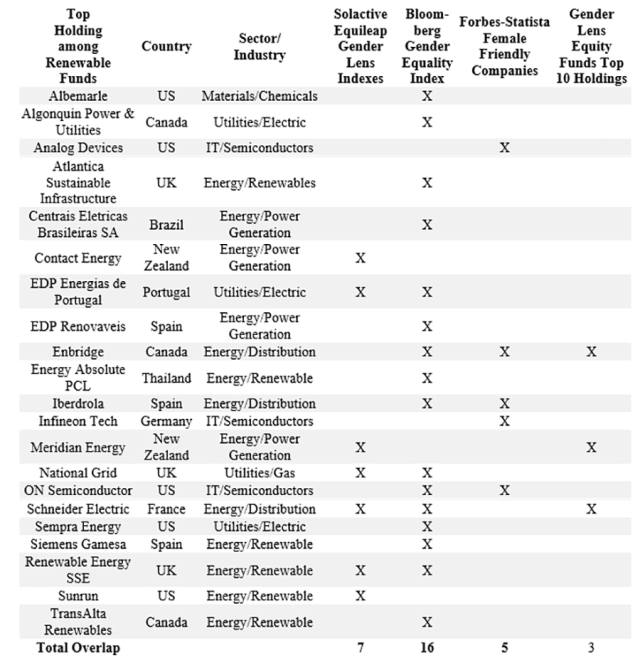

There are 110 unique top 10 holdings among the 20 renewable energy funds. The chart below lists the 21 firms that overlap with the leading gender lens equity indexes and datasets. Only seven appear on any of the Solactive Equileap gender lens equity indexes, which are constructed from Equileap analysis of leadership and workforce equality metrics, pay equity and transparency, and workplace benefits and policies at public companies. Among the top clean energy holdings of the 400 companies on the Bloomberg Gender Equality Index, only 16 appear on both lists and only 5 among the Forbes-Statista list of female-friendly companies.

Top Holdings Overlaps: Renewable Funds and Gender Lens Indexes, Datasets, and Equity Funds

Of the top renewable energy holdings, only three — Enbridge, Meridian Energy, and Schneider Electric — appear among the 164 unique top 10 holdings of gender lens equity funds. These three are also on at least one of the index and dataset lists.

The results are clear: Unless renewable energy companies improve their WIL and other equality metrics, the sector will miss out on the related performance and operational benefits.

The Way Forward: Incorporate Equality Criteria

Climate change will set gender equality back 20 years, according to BCG forecasts. Why? Because climate change disproportionately affects women and because women are underrepresented in the global economy. Indeed, women are being left out of the industries emerging in response to climate change, and with forecasts of global net-zero investments ranging from $100 to $150 trillion by 2050, according to BCG, that is bad news for both women and net zero.

The data doesn’t lie: WIL is material to all sectors and industries. Climate-focused equity and fixed-income funds must apply WIL and broad-based equality criteria. That should include:

- Investing in women-led clean energy innovators, producers, and product and services providers.

- Seeking greater gender equality in leadership, workforce, pay, and workplace policies across all demographics in all their funds and encouraging fund holdings to develop supplier diversity programs.

- Investing in innovations to reduce climate-related displacement.

- Applying shareholder advocacy tools to advance corporate gender equality.

For more analysis from Marypat Smucker, CFA, visit Parallelle Finance.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / SDI Productions

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.