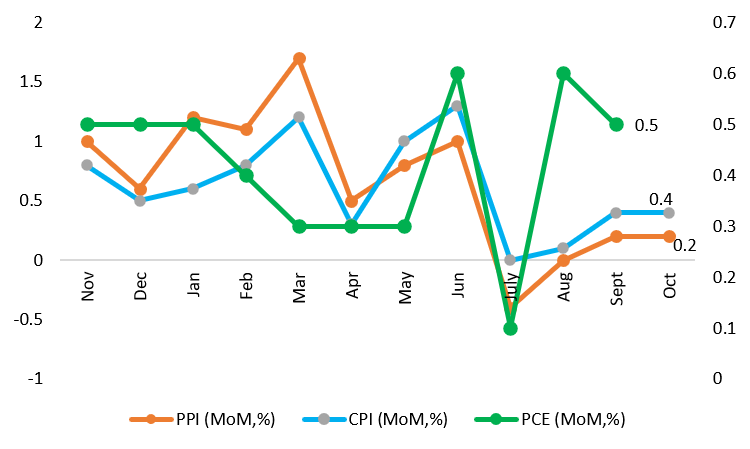

The Producer Price Index (PPI) is a leading measure of the Consumer price index (CPI), and captures price rises at a wholesale level.

On a monthly basis, the PPI registered a rise of 0.2%, below market estimates of approximately 0.4%. This was also the same as the September increase post revision, and was driven largely by slowing final demand energy prices.

Are you looking for fast-news, hot-tips and market analysis? Sign-up for the Invezz newsletter, today.

Amid historic levels of inflation, the fall in producer prices is encouraging for Fed officials, as back-to-back data releases suggest that prices may finally be shifting lower.

However, it is too early to determine if this is just a blip or a more permanent move.

Realistically, much of inflation is fueled by supply factors and will remain elevated for some months yet. Supply chains are yet to recover, geopolitical conditions are volatile which is keeps energy prices vulnerable, economic activity in China remains low, and the US jobs market is still relatively intact (which I wrote about here on Invezz).

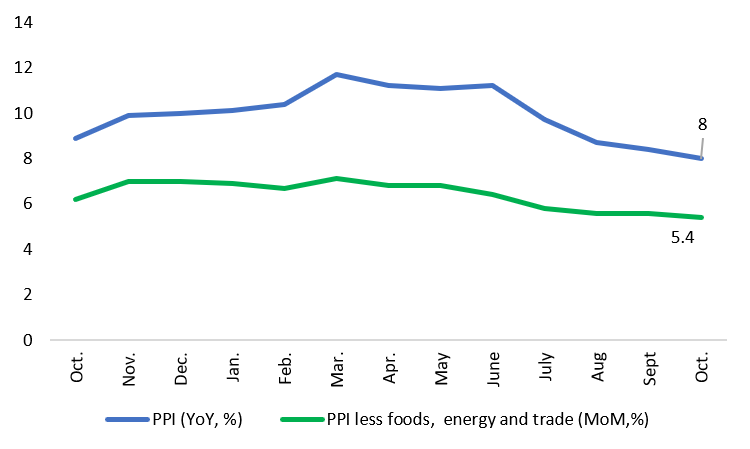

On an annual basis, the PPI was up by 8%, which in this day and age is considered to be good news, having eased from 8.4% in the preceding month.

By removing volatile components such as food and energy, and adjusting for trade, the PPI index fell to 5.4% for the year, moderating slightly over the past 3 months.

On a monthly basis, this indicator rose 0.2% versus a 0.3% increase in the previous month.

For goods, the October prices for final demand were driven by the increase in the index of gasoline, which was up 5.7%. Diesel, which is facing a supply crunch, also drove prices higher.

Among services, the decline of 7.7% in the index for fuels and lubricants, was a sizeable contributor to easing in the index by 0.1%.

Manufacturing data

The latest report was not as rosy as it may appear at first glance.

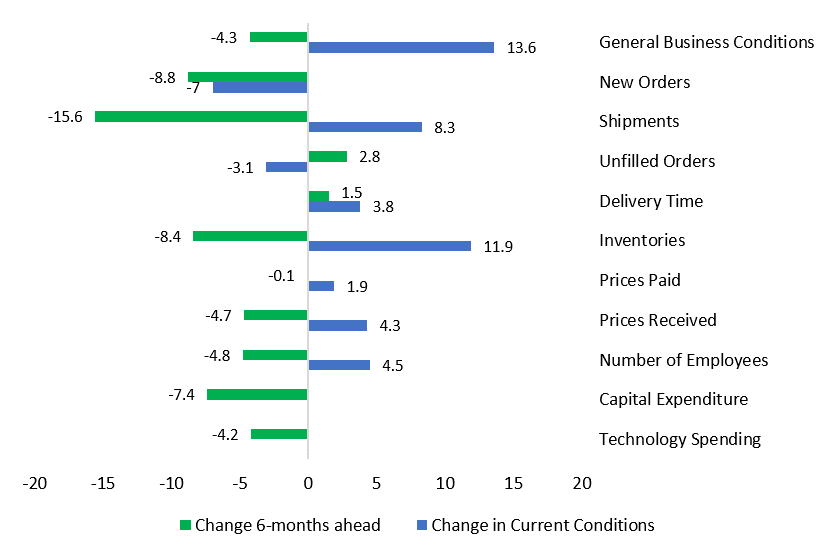

It is true that the NY Fed’s Empire State Manufacturing Survey rose to 4.5, the first expansion since July 2022, which included a disastrous decline to negative 31.3.

Coming on the back of such a downturn, the slight improvement in numbers, should not be given too much weight just yet.

Although shipments improved somewhat in the month, inventories, an ongoing threat to the US recovery and employment situation, seems to have worsened once more, rising sharply by 11.9 points to 16.5.

New orders retreated from +3.7 in October to -3.3 in November.

I covered some of the issues related to rising inventories in an earlier article.

What stood out was the confusion that economic actors seem to be in which is rarely a good sign,

Thirty-three percent of respondents reported that conditions had improved over the month, and twenty-nine percent reported that conditions had worsened.

Overall, six-month ahead expectations are quite pessimistic, with general business conditions, new orders, shipments, unfilled orders, employment and both capital and technology expenditure taking a hit.

The one source of relief is that inventories are expected to decline significantly.

However, to achieve this in a lower demand environment, current economic activity will likely suffer gravely, further hurting job prospects.

Moreover, the inventory situation could be harder to correct with 17% of survey respondents polled by Morning Consult saying they would be reducing their holiday spend this year in light of high interest rates and potential for job losses.

Interest rate outlook

The Fed has raised rates for six consecutive meetings, reaching the 4% mark earlier in November, the highest in a decade and a half (which I reported on here).

In the run up to the FOMC’s last meeting of the year, a decelerating CPI and PPI is certainly good news.

Lael Baird, Vice-chair of the Federal Reserve mentioned that rate rises may begin to slow, giving time to monetary authorities to better assess the situation going forward.

Unfortunately, with interest rates operating with lags of up to a year and a half, and rate hikes being pushed at 3x the pace for four consecutive meetings, a controlled slowdown may be difficult to execute now.

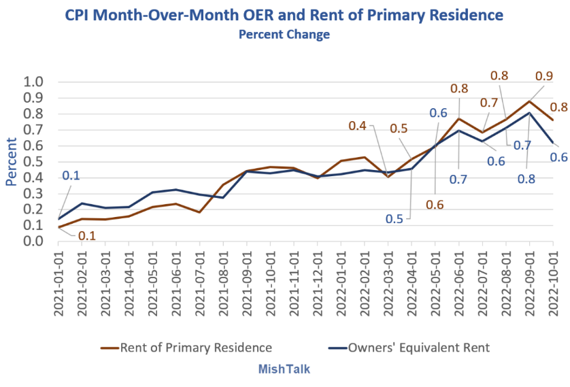

Moreover, even though the CPI has eased this month, not only is it still at a massive 7.7% above the comparable period last year, but much of the monthly increase of 0.4%, is driven by persistent housing and shelter costs.

Shelter accounts for the bulk of CPI, and rents do not appear to be easing meaningfully anytime soon.

I described this dynamic in a September piece as follows,

When mortgage rates are high, as they are today, the market for renters tends to swell, usually pushing up rents and sending the shelter index higher.

Due to the high weightage of shelter in the CPI (approximately 32.4%), increasing rate hikes may actually fuel inflation by sending mortgage rates higher and leading to a rise in rental prices.

Consequently, shelter inflation has the potential to be much a more durable source of high prices, and may potentially contribute to higher inflation for the remainder of the year and well into 2023.

Many of the essential components of the CPI are stubbornly advancing and would be greatly disaffecting lower-income earners.

For instance, mortgage rates are at two-decade highs (which you can read about here), shelter inflation has continued to march forward and heating oil prices were up nearly 20% in the latest release.

At the same time, the NY Fed survey indicates that employee strength may fall, while inventories are drawn down and new orders suffer.

We already expect to see tremendous layoffs at Amazon, due to its ‘broad review of costs’ and at Meta with workers bracing for a 13% cut in headcount. Other majors such as Redfin, Salesforce and Stripe are following suit. FedEx is furloughing workers, likely driven by elevated inventories.

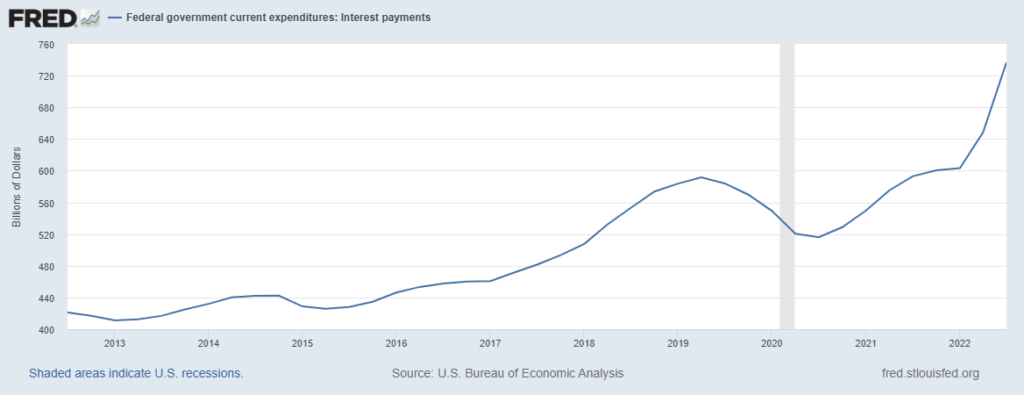

To top that off, the age-old question of sustaining interest payments on debt looms overhead.

If interest rates were to continue to rise, this would cause considerable turmoil among households and in the repayment of debt, that are already being pushed to the brink.

Pivot potential?

With the ongoing downturn in economic activity and high inflation, furnishing interest payments will become even more unsustainable, even if rate hikes were to suddenly stall.

The CPI is likely to continue to be elevated for an extended period owing to shelter costs and the unwillingness of companies to invest in much needed capital and technology.

Tension between the Fed’s goals of maximum employment and low inflation are likely colliding, and could result in mounting public pressure to ease conditions or provide more fiscal support.

With yields surging this year and with much of the banking sector having taken on too much risk, calls to support bond investors that are suffering heavy losses, will put a lot of pressure on the Fed to pivot and strengthen its bond buying programs.

Copy expert traders easily with eToro. Invest in stocks like Tesla & Apple. Instantly trade ETFs like FTSE 100 & S&P 500. Sign-up in minutes.

10/10

68% of retail CFD accounts lose money

[ad_2]

Image and article originally from invezz.com. Read the original article here.