[ad_1]

Once again, the bean counters at the Bureau of Labor Statistics (BLS) made the economy look better than reality.

According to the BLS, the economy added 261,000 jobs in October. This was significantly higher than the 200,000 that was expected. The investing world was ecstatic to see this and bought stocks hand over fist on Friday.

The only problem with this is that none of those “jobs” were real.

As Bill King notes in the King Report, the BLS tweaked its seasonal adjustments in 2022 to boost the NFP numbers.

In 2021, for the month of October, the BLS reduced the total number of jobs in America from 149.31 million jobs down to 148.005 million jobs, an adjustment of -1.305 million.

For some reason, this year (2022) the BLS only adjusted the total number of jobs by -1.061 million.

That’s a difference of +244,000 from the 2021 adjustment.

So, right off the bat, 244,000 of the 261,000 jobs the economy “created” in October of 2022 were imaginary, created via a seasonal adjustment in a spreadsheet by the BLS.

For those of you keeping track this means that over 93% of the jobs created in October 2022 were fake or made up.

Actually, in reality, things were even worse than this.

Another gimmick the BLS used was to create “jobs” was its Birth-Death Model.

You see, in the real world, jobs are not created consistently throughout the year. Some months see a lot of jobs created and others don’t, depending on how many businesses are created or go bust in a given month.

The BLS tries to “smooth” over this by using a Birth-Death Model. It too, is a gimmick, nothing more. And for some reason, this gimmick boosted the number of jobs crated in October 2022.

In 2021, the Birth-Death model added 363,000 jobs in October. In 2022, this same model added 455,000 jobs. That’s a difference of 92,000 jobs.

So, there’s another 92,000 FAKE jobs created in a spreadsheet instead of in the economy.

And people were BUYING stocks based on this?!?!

The reality is that stripped of gimmicks, the economy LOST more jobs than it created in October. This only adds to the evidence that the U.S. economy is in fact in recession.

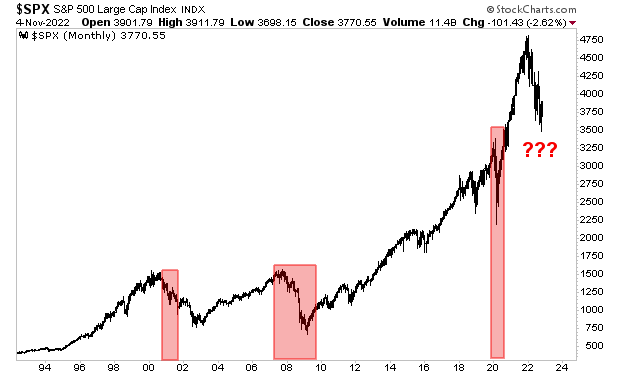

And what happens to stocks during recessions?

A crash is coming. And it’s going to make 2008 look like a joke. I coined the term the “Everything Bubble” in 2014. I warned about it for the better part of 10 years.

And it has officially burst.

On that note, we are putting together an Executive Summary outlining how to invest now that the Everything Bubble has burst.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.