[ad_1]

Introduction

One of the more peculiar transactions I worked on as an investment banker at Citigroup was the initial public offering (IPO) of a Kuwaiti property company. This was during the 2007 real estate boom when almost every Middle Eastern nation was competing to build the tallest skyscrapers. As was often the case, the money from the IPO was needed to start construction. The plot of land was essentially a patch of desert close to Kuwait City. It required a rather vivid imagination to grasp its potential.

My job as an M&A analyst was to create a discounted cash flow (DCF) model to value the company. Given that real estate development takes time, the IPO proceeds were supposed to be invested in real estate stocks in the meanwhile. These were forecast to compound by 15% per annum. This was the key assumption in the model that impacted the valuation. As an analyst, you don’t get paid to ask critical questions, but it seemed an odd business model.

The IPO never happened. The global real estate market collapsed shortly thereafter, which given such projects was hardly surprising. But I learned how sensitive DCF models are to key assumptions, which are typically the growth rates for forecasting revenues and expenses as well as the cost of capital for discounting future cash flows back to the present.

Interest rates exert a big influence on such company valuations and the lower the discount rate, the higher the valuation should be. Since interest rates have been declining across the globe and have reached all-time lows, we should expect a new regime with record-high equity multiples for stocks across markets.

Of course, relationships in finance are rarely linear and we have good data sets at hand to evaluate this theory.

Interest Rates and P/E Multiples in the US Stock Market

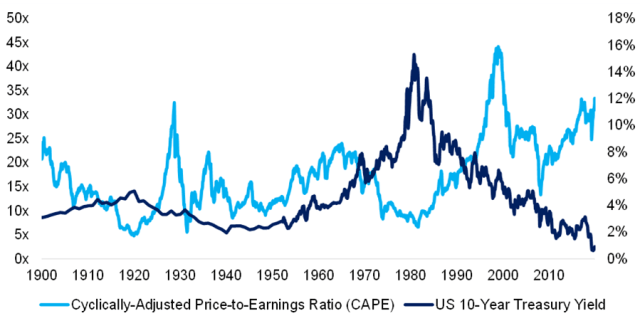

Interest rates moved in a relatively narrow range between 3% and 5% from 1900 to 1970, according to data from Robert J. Shiller. This was a turbulent period encompassing the Great Depression and two world wars. When inflation picked up in the 1970s, interest rates spiked to 15% before they began their long descent to almost zero today.

In contrast, equity multiples, as measured by the cyclically-adjusted price-earnings (CAPE) multiple, exhibited much shorter cycles of peaks and troughs. The following chart implies, however, that when interest rates peaked in 1980, equity multiples were very low. This may offer some visual support to the theory that rising bond yields lead to lower company valuations.

Interest Rates and P/E Ratios in the US Stock Market

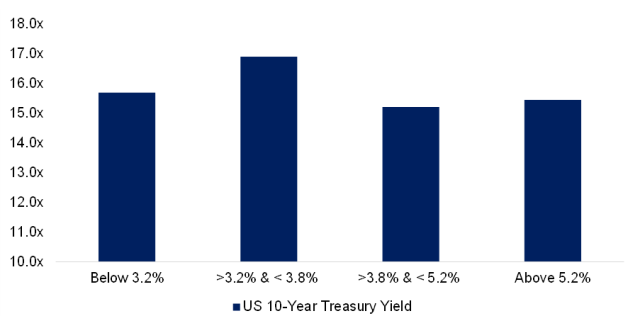

Yet frequent chart eye-balling often steers the mind to the wrong conclusions. We are not as good at pattern recognition as we believe. So what if we calculate the average price-to-earnings ratios of US stocks for the period from 1871 to 2020 and separate them into quartiles based on 10-year US Treasury yields?

The average P/E ratio was 15.8x and there were only minor differences in equity multiples between periods of high- and low-interest rates. There certainly was no linear relationship between low yields and high P/E ratios.

Interest Rates and P/E Ratios in the US Stock Market by Quartiles, 1872–2020

Interest Rates and Equity Multiples across the World

While there’s little evidence of correlation between the two metrics, the 150-year observation period is quite long. In addition to the two world wars and the Great Depression, it included the Cold War, the gold standard, and all sorts of financial and economic crises. Perhaps it bears little resemblance to today. The current period is an era of comparative peace, with a globally connected economy and highly efficient capital markets that are carefully managed by central bankers.

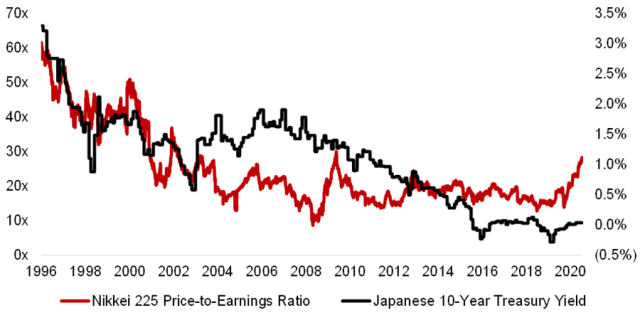

Here Japan may offer some insight. From a monetary standpoint, it has a head start on the rest of the world, having been in a low-interest rate environment since approximately 2000. Maybe it can provide a more timely perspective. Japan experienced stock and real estate bubbles that imploded in the early 1990s. The aftereffects — exceptionally high P/E ratios — lasted up to the turn of the century.

But the Japanese capital markets show declining bond yields as well as declining equity multiples. Interest rates have been at zero since 2016 and P/E ratios are anything but extreme.

Interest Rates and P/E Ratios in the Japanese Stock Market

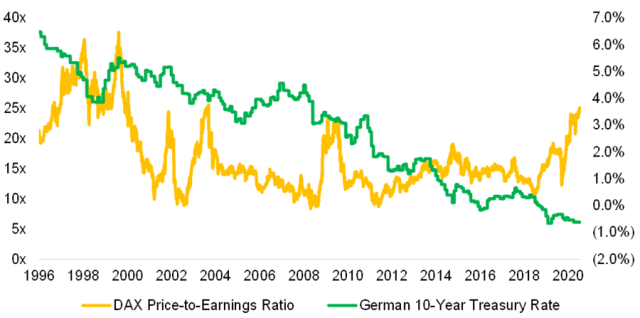

Looking to Europe and the German stock market, the average P/E ratio of the DAX Index was elevated around 2000 due to the boom in technology stocks, but thereafter traded largely in a range between 10x to 20x.

In the same time period, the German 10-year bund yield fell steadily from around 6% to almost -1% currently. As with the data from the United States and Japan, there seems to be no relationship between interest rates and equity multiples.

Interest Rates and P/E Ratios in the German Stock Market

Further Thoughts

Although applying a lower discount rate in a DCF raises the valuation, it assumes that cash flows are unchanged. Naturally, this is a flawed assumption and explains why there is no strong negative relationship between interest rates and equity multiples.

Lower interest rates tend to be a symptom of lower economic growth, which implies a less attractive outlook for the economy and its constituents. The benefit of discounting cash flows with a lower cost of capital is mitigated by reduced expected cash flows.

However, P/E ratios have risen across stock markets since 2018. Doesn’t this indicate that low rates justify high valuations?

The short answer is no. It is not statistically meaningful and might simply be explained by animal spirits. Elon Musk’s Tesla is a prime example. The company has a market capitalization larger than most of its peers combined, yet produces only a fraction as many cars. Such euphoria tends to evaporate eventually and valuations to mean-revert.

Yet lower interest rates could indeed lead to higher equity multiples, but only beyond a certain point. When rates fall to at or below 0%, bonds serve no purpose in asset allocation, and so investors must rethink traditional allocation models.

All that capital invested in fixed income needs to be reallocated, and there is plenty of room for equities and other asset classes to be rerated. The high valuations of start-ups and the strong asset flows to private equity reflect this. Heck, it might even be time to dust off plans for the IPO of that Kuwaiti real estate company.

For more insights from Nicolas Rabener and the FactorResearch team, sign up for their email newsletter.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: Getty Images / wonry

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.