Article content

(Bloomberg) — Already suffering from the war in nearby Ukraine, eastern Europe’s main currencies are about to take another blow from a looming euro-area recession.

[ad_1]

Already suffering from the war in nearby Ukraine, eastern Europe’s main currencies are about to take another blow from a looming euro-area recession.

Author of the article:

Bloomberg News

Netty Ismail and Maciej Onoszko

(Bloomberg) — Already suffering from the war in nearby Ukraine, eastern Europe’s main currencies are about to take another blow from a looming euro-area recession.

This advertisement has not loaded yet, but your article continues below.

Traders are more bearish on the Hungarian forint, Polish zloty and Czech koruna than any other developing-nation currency except for Russia’s ruble and the Turkish lira, according to data collected by Bloomberg. And Goldman Sachs Group Inc., Fidelity International and InTouch Capital Markets all see eastern Europe suffering more than other emerging markets if the euro weakens.

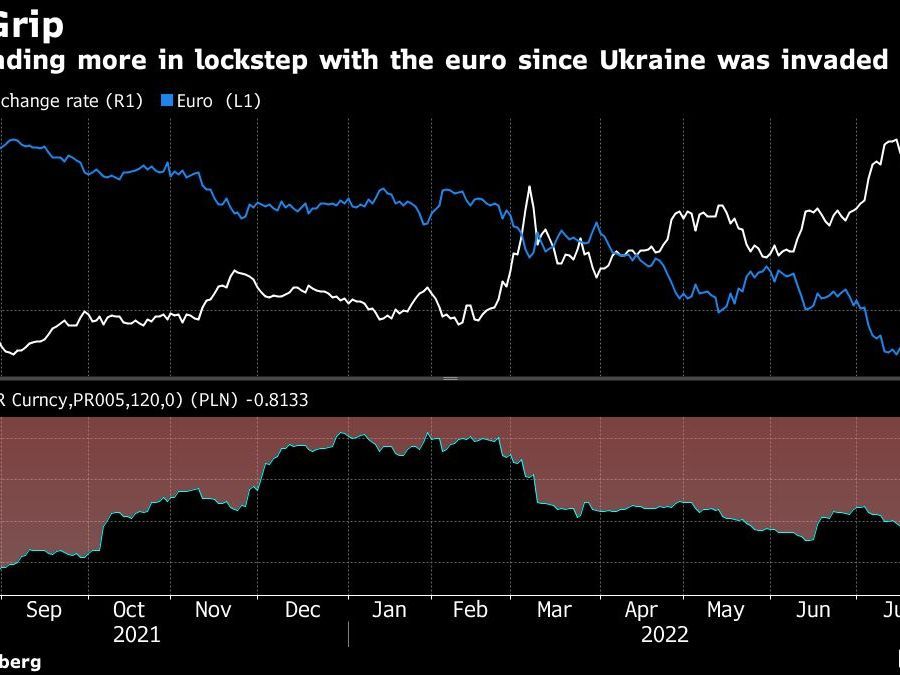

The three currencies are seen as especially vulnerable to wavering demand from the 19-nation single-currency area, which buys about 60% of each country’s exports. Since Russia’s invasion of Ukraine in February, they have also been trading increasingly in lockstep with the euro.

“We are cautious and negative on eastern European currencies,” said Paul Greer, a money manager at Fidelity International in London who is betting on further declines in the zloty and koruna versus the dollar. The region “is the most vulnerable bloc within emerging markets in the currency space,” he said.

This advertisement has not loaded yet, but your article continues below.

While the International Monetary Fund warned in July that the world economy may soon be on the cusp of a recession, the euro region’s prospects look particularly dire. Record-breaking inflation and the heightened likelihood of a Russian energy cutoff threaten to inflict a slump in the single-currency club.

Eastern European currencies will likely see the biggest declines in emerging markets if the euro drops below dollar parity for a sustained period, given their exposure to euro-bloc demand and gas disruptions, Goldman Sachs strategists said. In late July, the US bank cut its three-month euro target to $0.99 from $1.05.

“Europe is far more vulnerable at this stage, so it’s reasonable to assume that the central and eastern currencies will underperform, especially if euro-dollar falls,” said Piotr Matys, a senior currency analyst at InTouch Capital Markets.

This advertisement has not loaded yet, but your article continues below.

Double-Digit Declines

The region’s currencies have been among the hardest hit by the fallout from Russia’s invasion of Ukraine in February. Since the war started, the forint weakened 17% against the dollar and 8.2% to the euro. The zloty has lost 12% versus the US currency in the period, while the koruna slumped 9.6%.

The currencies’ growing connection to the euro underscores the potential for further impact from any weakening of the common currency. When paired against the dollar, all three have an inverse correlation with the euro of around minus 0.8, where minus 1 would indicate they would move in lockstep with the euro.

For now, rapid monetary tightening in Hungary has helped to stabilize the forint after it plunged to a record low against the euro in July. The fact that Prime Minister Viktor Orban’s government hasn’t yet secured access to the European Union’s pandemic recovery fund is also weighing on the currency.

This advertisement has not loaded yet, but your article continues below.

In Poland, authorities have made more progress in talks with the EU’s executive to access recovery funds. Meanwhile, the country’s central bank is close to the end of its monetary tightening cycle, which took it’s key rate to 6.5% compared with 10.75% in Hungary.

The Czech koruna has been the most stable, largely due to the central bank’s currency interventions. The monetary authority kept its key interest rate unchanged at 7% last week, making good on new Governor Ales Michl’s plan to halt aggressive monetary tightening.

The outlook for the region is mixed, said Oliver Harvey, who heads currency research for central and eastern Europe, the Middle East, Africa and Latin America at Deutsche Bank AG. Concerns about Hungary’s economy have been priced in while the koruna will likely begin trailing its regional peers as the Czech Republic loses its competitiveness and the pace of intervention eases, he said.

This advertisement has not loaded yet, but your article continues below.

But a euro slide below parity could seal the three currencies’ fate.

“If the move below parity is being driven by euro specific factors — i.e. a further worsening in the Russia/Ukraine conflict and spillovers into the euro-zone economy — CE3 would underperform,” Harvey said.

What to watch this week:

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.