American CEO confidence has plunged to its lowest levels since the so-called Great Recession of 2007–09 as central banks scramble to tame decades-high inflation, according to the results of a survey.

A whopping 98% of U.S.-based CEOs say they are preparing for an economic recession over the next 12 to 18 months, according to the quarterly survey of business leaders conducted by the Conference Board released Thursday. The number rose even higher, to 99%, for CEOs based in Europe.

“CEOs are now preparing for near-inevitable recessions in both the U.S. and Europe,” said Roger W. Ferguson Jr., a Conference Board trustee and former Fed vice chair. “While the vast majority still expect the U.S. recession to be short and shallow, nearly 7 in 10 believe the EU will enter a deep recession with serious global spillovers.”

Corporate bosses received more bad news this week after the latest U.S. consumer price index showed annual inflation running higher than expected at 8.2% in September. The reading affirmed a view that the Federal Reserve will continue sharply tightening monetary policy despite fears that its actions will trigger a recession.

Of the CEOs polled, just 5% felt economic conditions would improve over the next six months. Meanwhile, 81% said the economic outlook is worse for the fourth quarter than it was in the previous quarter.

Some 85% of CEOs expect the U.S. recession to enter a recession that is brief and shallow, while 13% expect a deeper downturn with a “material global spillover.”

When asked to name the biggest global challenge their businesses currently face, 34% of CEOs pointed to political and government instability, while 17% cited energy access and security, and 15% said the ongoing Russia-Ukraine war.

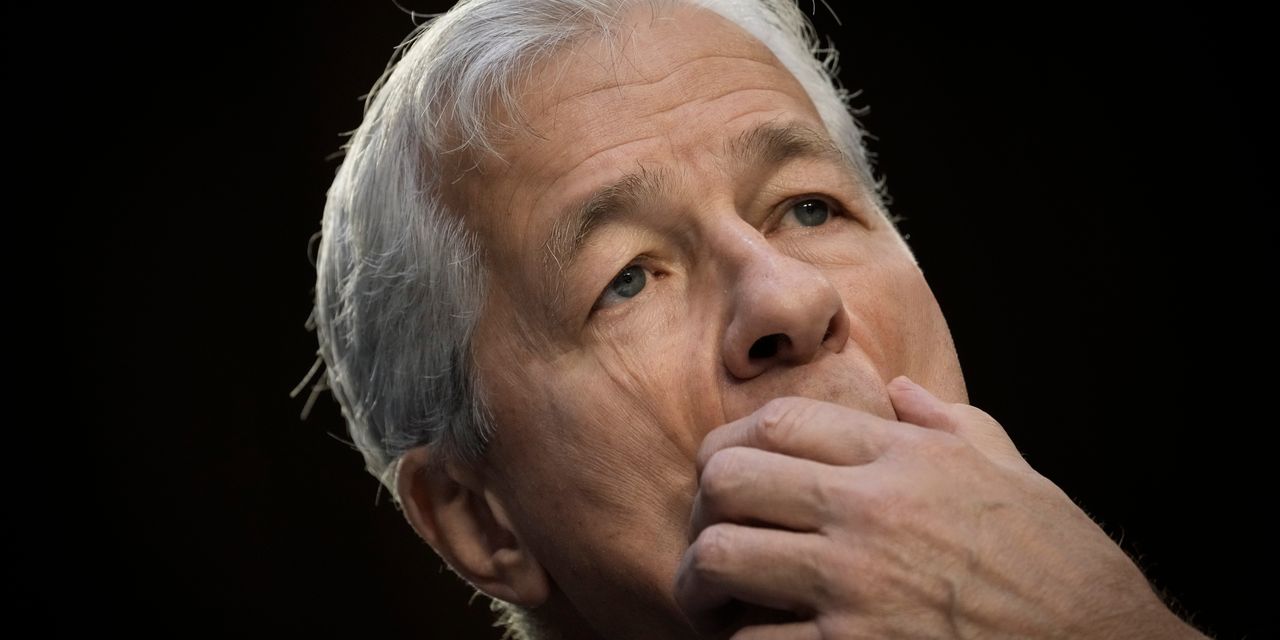

Even before the latest inflation data surfaced, JPMorgan Chase

JPM,

CEO Jamie Dimon warned the global economy faced a series of headwinds that would spark a recession next year, including higher interest rates and inflation.

“These are very, very serious things which I think are likely to push the U.S. and the world — I mean, Europe is already in recession — and they’re likely to put the U.S. in some kind of recession six to nine months from now,” Dimon told CNBC.

Last month, FedEx

FDX,

CEO Raj Subramaniam triggered a market selloff when he signaled a worldwide recession was already underway.

Executives and investors will gain a better sense of the Fed’s policy path when officials conduct their next two-day meeting on Nov. 1-2. The Fed is widely expected to hike its benchmark rate by three-quarters of a percentage point for a fourth straight meeting.