[ad_1]

Bitcoin, a proof-of-work (PoW) blockchain, depends on its mining process to ensure the security and stability of its network. This involves the activities of miners that utilize special mining machines and electricity to operate Bitcoin nodes.

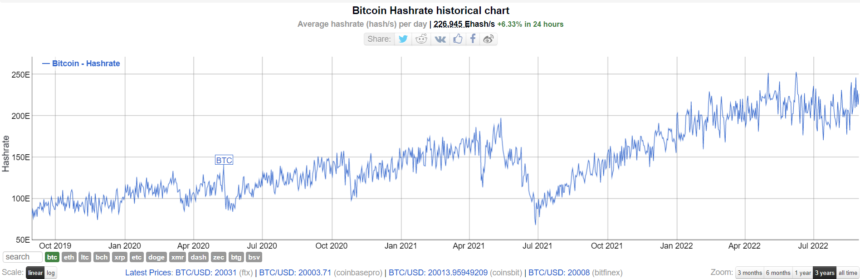

Over the years, mining attracted different miners when BTC prices were high. However, the BTC mining difficulty and the network hash rate have their role to play in block rewards.

From a recent report, the BTC mining difficulty is about to hit a new 7-month high this week. The trend of activities is creating a readjustment from the sequential information obtained over the years for the leading global cryptocurrency.

The BTC mining difficulty adjustments will occur every 2,016 blocks. But the network has witnessed a reduction in this value over the years, especially during the summer seasons. Also, banning mining in countries like Iran and China due to high energy consumption contributed to the decline.

Adjustments in Bitcoin mining difficulty are crucial for the network’s functionality as a blockchain. This is because it defines the ease or difficulty of the mining process on the network based on the number of miners working on the blockchain.

Usually, with more miners operating on the network, it becomes more difficult to receive rewards and vice-versa. The adjustment process ensures no change in new block production for Bitcoin at all times. Also, its consistency is not affected by the number of active miners on the blockchain.

The Bitcoin network has seen different twists in its mining difficulty. In 2022, BTC kept having different negative adjustments consecutively through the middle of summer. The most critical data of about -5.01% on July 21 marked its lowest level over the past year.

Bitcoin Hash Rate Pushes Up

However, there’s a shift to a positive increase as the value hits 1.74% at the beginning of August. This is closely followed by another surge of 0.63% two weeks after.

The subsequent adjustment will occur in less than two days and could depict an increase of about 7%, as per BTC.com data. If this happens, it will become the most extensive data for the blockchain over the past seven months.

Besides the Bitcoin mining difficulty doing an upward climb, the hash rate also follows the same pattern. This is due to the correlation between BTC mining difficulty and its hash rate. Usually, an increase in mining difficulty is equivalent to a rise in the hash rate and vice-versa.

Data from BitInfoChart revealed a decline in the BTC hash rate. It dropped from its ATH of 250EH/s as of the beginning of June to 170 EH/s after two months. But the hash rate has been showing slight recovery as it rose to 230EH/s, representing a surge of 30%.

Featured image from Pixabay, Charts from TradingView.com

[ad_2]

Image and article originally from www.newsbtc.com. Read the original article here.