[ad_1]

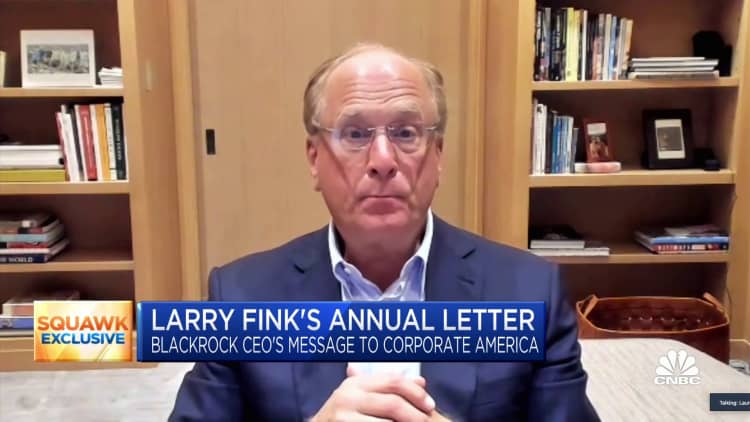

Larry Fink, chief executive officer of BlackRock Inc.

Christopher Goodney | Bloomberg | Getty Images

Billionaire businessman and former New York Mayor Michael Bloomberg and the investing behemoth BlackRock have both recently issued their own strongly worded missives defending investments in climate solutions and clean energy and saying that requesting climate-related risk disclosures from companies is smart capitalism.

The letters come as political pressure mounts against the idea of environmental, social and governance (ESG) funds, which purport to give people an easy way to invest in companies acting responsibly in those areas. Critics, particularly on the Republican side, have said ESG is a cover for a political agenda and is partly aimed against fossil fuel producers.

related investing news

Bloomberg, who is currently worth almost $77 billion according to Forbes, published an op-ed in his namesake media publication on Tuesday deriding the Republican-led efforts to politicize investment decisions in climate solutions and clean energy.

“In a world rapidly moving to clean energy, companies that are dependent on fossil fuels put investors at greater risk,” Bloomberg wrote.

“The fact is: Climate risk is financial risk. Costs from climate-related weather events now exceed $100 billion annually — and that is only counting insured losses,” Bloomberg wrote. “Accounting for these and other losses isn’t social policy. It’s smart investing. And refusing to allow firms to do it comes with a big cost to taxpayers.”

On Wednesday, BlackRock sent a letter to a collection of attorney generals which defended its engagement in measuring the climate risk of companies and investing in clean energy as responsibly carrying out its fiduciary duty to clients.

“Our commitment to our clients’ financial interests is unwavering and undivided,” wrote BlackRock’s senior managing director and head of external affairs, Dalia Blass.

“Governments representing over 90 percent of global GDP have committed to move to net-zero in the coming decades. We believe investors and companies that take a forward-looking position with respect to climate risk and its implications for the energy transition will generate better long-term financial outcomes,” Blass wrote. “These opportunities cut across the political spectrum.”

Former mayor of New York Michael Bloomberg speaks during a meeting with Earthshot prize winners and finalists at the Glasgow Science Center during the UN Climate Change Conference (COP26) in Glasgow, Scotland, Britain, November 2, 2021.

Alastair Grant | Reuters

BlackRock’s letter was specifically responding to an Aug. 4 letter from 19 state attorneys general to BlackRock CEO Larry Fink, in which they objected to what they called a bias against fossil fuels.

“BlackRock’s past public commitments indicate that it has used citizens’ assets to pressure companies to comply with international agreements such as the Paris Agreement that force the phase-out of fossil fuels, increase energy prices, drive inflation, and weaken the national security of the United States,” the attorney generals state.

Specific state lawmakers have adopted legislation for their own states “prohibiting energy boycotts,” the letter from attorney generals states. For example, later in August, Texas comptroller Glenn Hegar accused ten financial companies, including BlackRock, and 350 investment funds of taking steps to “boycott energy companies.”

BlackRock objected to the idea that it is boycotting energy companies or operating with a political agenda.

BlackRock is “among the largest investors in public energy companies,” and has $170 billion invested in United States energy companies. Recent investments include natural gas, renewables and “decarbonization technology that needs capital to scale,” BlackRock said in its letter.

BlackRock also said that it requests climate-related financial disclosures from companies in order to improve transparency and be able to make quality investment decisions for clients.

Bloomberg, meanwhile, said that measuring climate risk is just basic investing.

“Any responsible money manager, especially one with a fiduciary duty to taxpayers, seeks to build a diversified portfolio (including on energy); identifies and mitigates risk (including the risks associated with climate change); and considers macro trends that are shaping industries and markets (such as the steadily declining price of clean power),” Bloomberg wrote.

“That’s investing 101, and either Republican critics of ESG don’t understand it, or they are catering to the interests of fossil fuel companies. It may well be both.”

[ad_2]

Image and article originally from www.cnbc.com. Read the original article here.