[ad_1]

The average analyst does not add value.

This is something all investors know for a fact: Following analyst buy or sell recommendations isn’t going to lead to outperformance in the long run.

Or is it?

A new study may cast some doubt on the conventional wisdom.

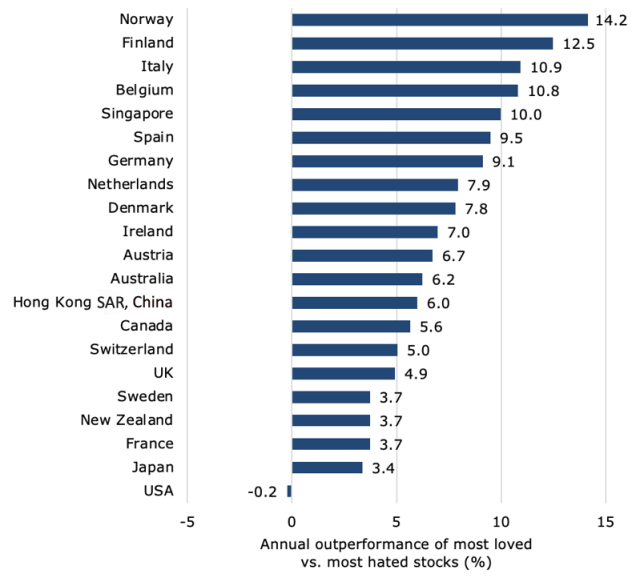

In “Analyst Recommendations and Anomalies Across the Globe,” Vitor Azevedo and Sebastian Müller, CFA, examine 3.8 million analyst forecasts in 45 countries and regions from 1994 to 2019. While the paper has many interesting findings that I will have to come back to some day, its most compelling data points concern analysts’ most-loved and most-hated stocks. Azevedo and Müller compare the top and bottom 20% of equities by consensus analyst recommendations and find that on an equal-weighted basis, US analysts failed to outperform on average. To be sure, this hardly qualifies as a surprise: These findings merely confirm the popular perception. As for why such recommendations don’t work in practice, it may have something to do with the preference among US analysts for growth and glamour stocks.

But these are just US analyst recommendations. What about those from analysts in other markets? It turns out that quite a different picture emerges as soon as the focus shifts outside the United States. In every developed market — and almost all emerging markets — following analyst recommendations actually did lead to meaningful outperformance over time.

In the chart below, I collected the results for only the developed markets included in the study. The United States is a significant outlier.

Analyst Consensus Stock Recommendations: Performance by Market

So what distinguishes this study from the earlier research that established the common perception that analyst consensus recommendations are useless? Why are the findings so divergent? A key differentiator is that Azevedo and Müller’s data cover two major bear markets: the dot-com crash of the early 2000s and the global financial crisis (GFC) later in the decade. Thus, the study was able to parse whether analyst recommendations work better in bull or bear markets. And as we might have expected, in a low sentiment phase like that of a bear market or financial crisis, analyst recommendations add more performance than in periods of bullish high sentiment.

Cause and effect are hard to differentiate here. Do analysts have deeper insights than most investors and thus are better able to sift through the rubble of a crisis and select the truly good stocks? Or do investors look to analysts for guidance and follow their recommendations more closely during a crisis, and thus turn their buy-and-sell recommendations into something like self-fulfilling prophecies?

Whatever the answer, the study suggests that investors may want to rethink the conventional wisdom on analyst recommendations. They may add some value after all.

For more from Joachim Klement, CFA, don’t miss 7 Mistakes Every Investor Makes (And How to Avoid Them) and Risk Profiling and Tolerance, and sign up for his Klement on Investing commentary.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Maksim Rumiantsev

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.