[ad_1]

The most important portfolio manager skill metric is often overlooked.

I often hear fund managers say, “I only need to get it right slightly more than 50% of the time.” What they are referring to is the hit rate. It’s similar to batting average in baseball: It represents the percentage of their decisions that makes money, in absolute or relative terms. And yes, the ideal is to achieve a hit rate on decision making that is higher than 50% — whether you are a fund manager or a regular person in everyday life, right?

Yet the fact is that most fund managers have a hit rate on their overall decision making of less than 50%. Our recent study, The Behavioral Alpha Benchmark, found that only 18% of portfolio managers make more value-additive decisions than value-destroying ones. We examined trading behavior in 76 portfolios over three years and isolated the outcome of investment decisions in seven key areas: stock picking, entry timing, sizing, scaling in, size adjusting, scaling out, and exit timing.

Among our findings: While hit rate captures a lot of attention, it is often less consequential than payoff. A good payoff ratio can more than compensate for a sub-50% hit rate, and a poor payoff ratio can completely nullify the effect of a strong hit rate.

Here’s why: Payoff measures whether a manager’s good decisions have typically made more than their bad decisions have lost. It is expressed as a percentage: Over 100% is good; under 100% is bad. A few decisions with payoffs well in excess of 100% can more than compensate for several that fall below the 100% mark.

He didn’t use the term, but the legendary Peter Lynch emphasized payoff as a key theme: In 1990, he told Wall Street Week’s Louis Rukeyser that “You only need one or two good stocks a decade.” Those would need to be VERY good stocks, of course, but the point is that payoff is one of the most critical factors in successful professional investing. Successful managers need to make sure their winners win more in aggregate than their losers lose.

Perhaps it’s ironic, then, that asset owners and allocators examine a wide variety of manager statistics in an effort to separate luck from skill but tend to overlook payoff. In fact, payoff is one of the purest skill metrics out there. Managers who consistently achieve a payoff over 100% exhibit true investment skill: They know when to hold ‘em, and when to fold ‘em.

Essential Behavioral Alpha Frontier

The ability to cut losers — and, indeed, to cut winners before they become losers — is what the best investors are good at. And that manifests in a high payoff.

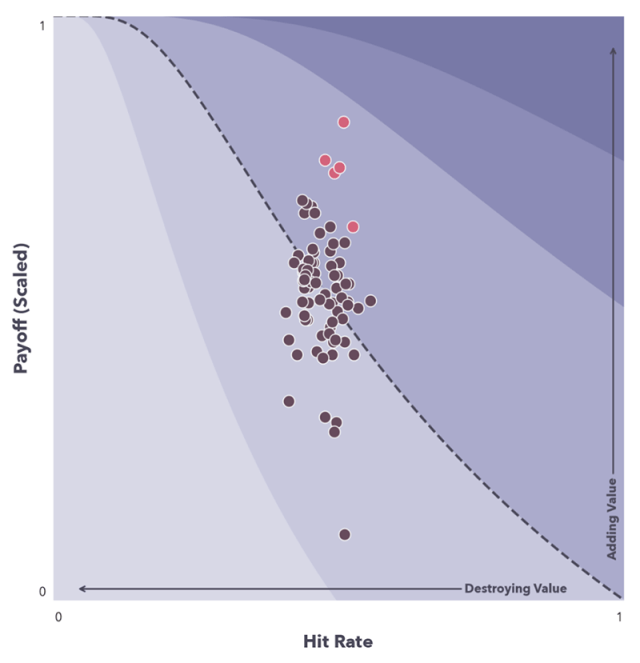

The diagram above comes from The Behavioral Alpha Benchmark. It looks at all of the trading decisions made by our sample of 76 active equity portfolios over the last three years and plots their hit rate against their payoff. The dashed line represents what would be achieved by chance: If the manager is correct half the time with a 50% hit rate and their average winner makes exactly as much as their average loser loses for a 100% payoff.

While the managers’ hit rates fall in a pretty tight band along the X axis, their payoffs vary dramatically on the Y axis. The top five managers, colored in magenta, have both high hit rates and high payoffs.

This diagram, and its use of payoff as a key comparative metric for portfolio managers, represents an important next step in the evolution of manager assessment methodology. It enables us to look beyond traditional evaluative metrics based on past performance — which are highly subject to the random effects of luck and thus limited in their utility — and focus instead on the quality of a manager’s decision making. And that’s a far more accurate assessment of their skill.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Wachiwit

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.

[ad_2]

Image and article originally from blogs.cfainstitute.org. Read the original article here.